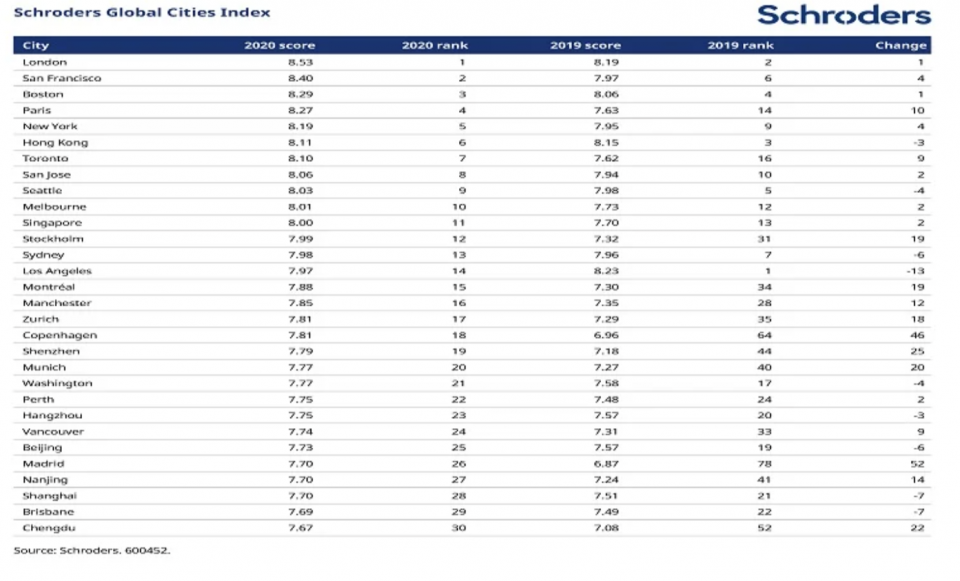

London regains top spot in Schroders’ Global Cities Index

London has returned to the top spot in the Schroders’ Global Cities Index after scoring highly in its response to climate change in comparison to other cities in the index.

This year, the index has introduced a transport score into the ranking, with a particular focus on mass transit systems. As a result, car-reliant Los Angeles fell from first place last year to 14th position.

Cities in the Schroders’ Global Cities Index are scored on four metrics: economic, environmental, innovation and transport. The ranking identifies cities with a combination of economic dynamism, excellent universities, forward-thinking environmental policies and excellent transport infrastructure.

The newly-introduced transport score has been designed to complement the environmental score, introduced at the last update in February 2020, as efficient transport is now seen as essential in providing social mobility. The index now has a heavy tilt to these two environmental and social factors. These two new scores give greater credit to cities that have sound environmental policies and good mass transit systems.

“We weren’t surprised to see London regain first place in the Index,” said Hugo Machin, a fund manager at Schroders who compiled the index. “Whilst there has been uncertainty generated by Brexit and the resulting political environment, its underlying fundamentals remain attractive to investors.”

“With an economy that continues to attract multi-national companies and highly skilled talent, a high quantity of green spaces, access to clean and reliable water, as well as reliable energy and dependable public transport, London has retained its popularity with investors.”

Discover more from Schroders:

– Learn: Why I can stomach higher equity valuations

– Read: Why lockdown winners aren’t vaccine loser

– Watch: Will 2021 be the time for investors to stop hibernating?

Who is rising and falling in the index?

The introduction of a transport score and the recent introduction of the environmental score has diluted the economic score. The result is a downgrading of cities that are simply populous.

The negative impact has been on large industrial cities in China and large cities in North America reliant on road transportation. These cities tend to be post-industrial in nature. In the US, Chicago, Houston and Atlanta all dropped out of the top 30

A city that has an efficient system for moving people, goods and data around will be more economicaly sustainable as inhabitants access more potential jobs. The transport score analyses data of five transport modes: sea, road, train, bus and air.

Los Angeles performed particularly badly due to low score for access to rail, a key transport mode for the index. The city lacks a comprehensive rail network and the average walk time to a rail terminal in the city is 61 minutes.

Medium-sized cities, particularly in Europe, now rank higher. Stockholm, Madrid, Copehagen, Munich and Manchester all benefit from good public transport systems and improving environmental policies. They have also have sufficient scale to provide good employment opportunities.

What effect has the pandemic had?

The Covid-19 crisis has had a profound impact on global cities. With many people forced to work from home during the pandemic, office owners will now have to compete even more aggressively for customers. Improved broadband speeds and communiction platforms, as well as the rise of flexible office providers, threaten traditional landlords.

“When the global pandemic subsides, cities will remain centres of innovation and entertainment,” said Hugo Machin. “The best cities will continue to evolve, encouraging the development of open space and greener buildings. Human settlement requires planning and the majority of employment requires human interaction and the sharing of ideas.

“Cities that understand this will be best placed to thrive when competing for talent and capital. The aim of the Schroders’ Global Cities Index is to quantify what makes a city successful.”

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.