London ranked third biggest crypto hub in the world behind San Francisco and New York

London has cemented its place as a global hub for the crypto industry after being named in the top three cities for FinTech with San Francisco and New York.

The UK capital does, however, claim the outright top spot as having more FinTech events and job opportunities within the sector than any other city in the world.

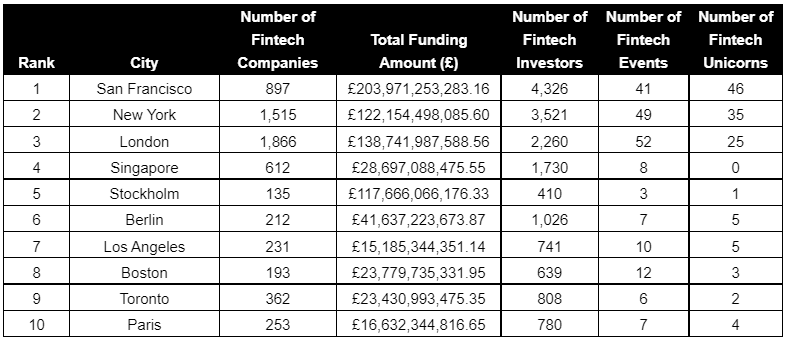

Extensive data compiled by lending firm Fluro names San Francisco as the FinTech capital with the highest amount of available funding at nearly £204 billion, as well as 4,326 investors and 46 fintech unicorns – more than every other.

New York ranks in second place and actually beats San Francisco when it comes to the number of FinTech companies, with 1,515 registered. However, its total funding amount of £122 billion, 3,521 investors and 35 unicorns fall just short of the top spot.

London takes third, boasting the greatest number of FinTech companies at 1,866 – with 25 of them being unicorns. The capital also has more funding available than New York at just shy of £140 billion, making it second only to San Francisco.

London edges both, though, when it comes to FinTech events. New York hosts 49 a year, San Francisco 41, but London stages 52 major events.

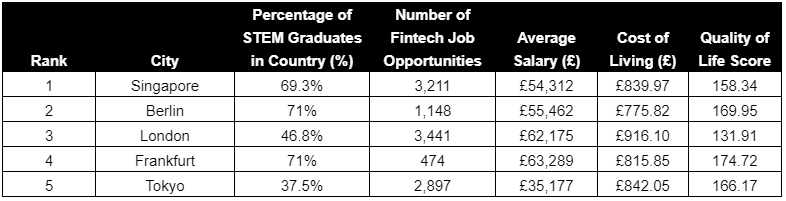

While Singapore came fourth on Fluro’s list of FinTech hubs, it has been crowned the best city for those looking to launch a career in the industry. There are 3,211 FinTech job opportunities at an annual salary of £54,312 on average, and the cost of living (before rent) is an estimated £840 per month.

London still has the highest number of job opportunities at 3,441, but scores lower on account of the cost of living.

Berlin places a surprise second, with a slightly higher average salary of £55,462, as well as a lower cost of living (£776) and better quality of life score (169.95 vs 158.34 in Singapore). And there is plenty of talent to fill the 1,148 fintech job opportunities available in Berlin, with Germany having the highest percentage of STEM graduates – 71 per cent.

READ MORE: UK is now the largest crypto economy in Europe

“The growth of the fintech market has accelerated over the past 10 years, largely due to technological breakthroughs, and it’s great to see hubs of expertise emerge across the globe for both businesses and individuals looking to work in this industry,” said Fluro CEO Nick Harding.

“Fintech companies have filled the gap left by traditional institutions which struggled to keep up with changing consumer behaviour. Efficient, timely and personalised services are more important than ever in the financial services space to secure a positive customer experience.

“As the industry continues to grow across the globe, now might be the time for businesses, consumers and future talent to get on board with digital finance.”

Full research here: https://www.fluro.co.uk/blog/the-fintech-capitals-of-the-world.

Methodology and sources

Fluro analysed a seed list of the top 50 financial cities, looking at the number of fintech companies, total funding amount, number of investors, as well as the number of fintech events sourced from Crunchbase. The number of unicorns was collected from CB Insights. The cost of living and quality of life scores were collected from Numbeo. Job opportunities and average salaries were collected from Indeed. The percentage of STEM graduates by country was taken from the World Bank. Data was collected, and currency conversions were made, between September 20 2022 and September 21 2022.