London offices: Bigger is better, as construction of smaller spaces in the capital dries up

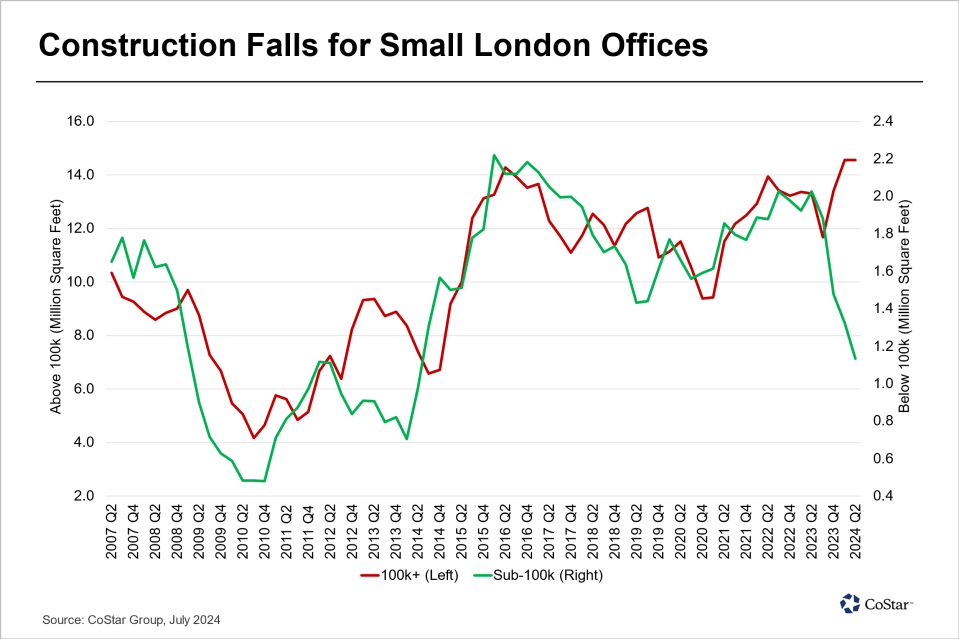

For the first time in at least two decades not a single new office scheme smaller than 100,000 square feet began construction in London in the first half of this year, despite demand for larger spaces reaching record highs.

Data from property analytics firm CoStar, shared exclusively with City A.M., has revealed there to be just 1.1m sq. ft. office space under construction in smaller buildings, the lowest for over ten years and almost 40 per cent below the 10-year average.

But the dearth of new small offices in the capital lies in stark contrast to new starts of larger working spaces, which have actually risen to an all-time high in the first six months of 2024.

Construction started on almost 15m sq. ft of new large offices between January and the end of June, which represents an increase of around 25 per cent in the last nine months.

This, CoStar said, was largely down to the commencement of building works at large schemes like 2 Finsbury Avenue, a joint venture from British Land and GIC, the Singaporean national wealth fund.

The US hedge fund Citadel pre-let 250,000 sq. ft. of the office in April.

Small office construction collapsed while larger units are built in record volumes was a departure from the historical norm.

Since 2007, new starts in large and small offices mirrored one another, until the end of last year, when volumes in smaller spaces fell off a cliff.

Patrick Scanlon, senior director in CoStar’s market analytics team, said: “The fall [in construction of small office spaces] could have several reasons: lead-in times for smaller projects are shorter, enabling developers to react to more current market conditions; also, in some cases, developers will have opted for a refurbishment project outside the planning framework to cut carbon emissions and lower capital expenditure.”

Scanlon added that the imbalance between large and small spaces could mean that space being built could not match up to demand preferences.

In addition to the large offices included in the data, around 5m sq. ft. of 4- and 5-star office space is either being built or already is already on the market; the highest on record.

This is likely to be amplified if 1 Undershaft – a skyscraper in the City of London height of the Shard – is granted planning permission in the coming months as expected.