London IPO: Darktrace shares surge 40 per cent on market debut

Shares in UK tech darling Darktrace soared on their London debut, jumping as much as 42 per cent higher than their initial listing price, in an IPO that valued the company at £1.7bn.

Darktrace this morning said shares were priced at 250p in its London IPO, the midpoint of the range.

Upon the opening bell shares traded hands at 351p, although in afternoon trading they have come back to trade at 343p – still a 37 per cent gain.

Earlier reports estimated the company’s market capitalisation could reach as high as £4bn.

The float is only around 10 per cent of the company, and existing shareholders are expected to cash in around £21m worth of stock.

Poppy Gustafsson, CEO of Darktrace, said:” Our company is deeply rooted in the UK’s tradition of scientific and mathematic research so we are especially proud to be listing on the London Stock Exchange.

“To our world-class inventors at our R&D centre in Cambridge, today is really about celebrating you. Not only have you created a fundamental technology that 4,700 organizations now rely on to help them tackle novel and advanced cyber-threats, but you remain committed to innovation, pushing the envelope and shaping the world with your ideas.”

Jefferies is acting as sole sponsor, joint global coordinator and joint bookrunner to Darktrace on its IPO, providing a market cap of approximately £1.7bn.

The successful float will be a relief for Darktrace, Jefferies, the London Stock Exchannge and investors more broadly after the bungled floats of other tech companies Deliveroo and Moonpig.

“Today is just the beginning.”

AJ Bell’s Russ Mould said the share price pop can be partially explained by the discounted offer price this morning.

“The listing valuation was nearly half that of original estimates as investors were clearly nervous about the company’s links to shareholder Mike Lynch who is fighting allegations of fraud.

“That is likely to have seen prospective institutional investors demand a heavy discount to warrant owning the shares and get the IPO off the ground.

“The surge in the share price post listing would suggest there are other investors who are more comfortable with the risks and are just focusing on Darktrace’s potential to grow fast in the cyber security space.”

Earlier this month the firm said its revenue had surged to almost $200m during the pandemic.

If momentum can stay with Darktrace it’ll mean it has helped to reinvigorate investor appetite for tech floats in the capital after Deliveroo’s disastrous debut last month.

Susannah Streeter senior investment analyst at Hargreaves Lansdown assessed this morning’s float and the prospects for Darktrace:

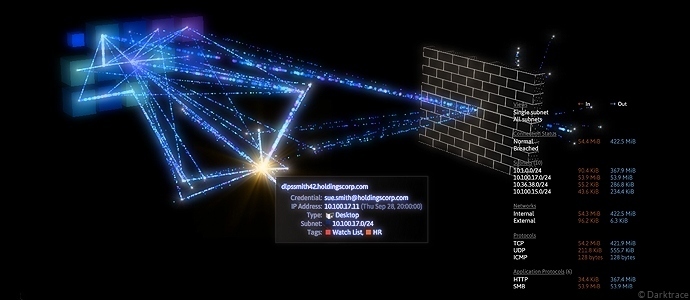

“While other recent, high-profile tech launches on the London market like Deliveroo and MoonPig could be described as superficial tech, being e-commerce platforms designed to give existing industries a digital makeover, DarkTrace has complex tech at its core.

“The global shift to digital which has accelerated during the pandemic, should open up new opportunities and markets for DarkTrace as firms scale up their operations to meet demand, whilst trying to ensure their systems stay secure.

“A successful launch will be a coup for the London market, and should help attract more fast growing tech companies to list in the UK.’’

Darktrace, founded in 2013 and led by Poppy Gustafsson, has profited from higher demand for its services due to the shift to home working throughout the Covid crisis.