London investor Tej Kohli on chasing the ‘second wave’ of CRISPR-Cas9

“The only thing worse than losing money on an investment is having to watch the value of something that you didn’t back grow beyond all expectations” says London-based technologist and investor Tej Kohli. Kohli is talking into a laptop with the team of experts that he has assembled to spearhead a new initiative for his Kohli Ventures investment vehicle. Staring back at Kohli are the faces of a crack team of PhD and MBA holders from the worlds of biotechnology and genetic engineering.

Tej Kohli is brimming with enthusiasm following the launch this week of his latest not-for-profit project, which will seek to cure over 300,000 people of blindness in low-and-medium income countries. The project launched at the birthplace of Buddha in Nepal just a few days prior, and already 312 patients have been cured of cataract blindness. The launch has given Kohli a renewed energy that he is eager to imbibe into his activities as an investor.

A Short History of CRISPR

The investment opportunity that Kohli is adamant not to miss is what he is calling the “second wave” of CRISPR-Cas9, a powerful gene editing tool that allows scientists to edit DNA. CRISPR started in 1987 as an accidental discovery by Japanese scientist Yoshizumi Ishino at the University of Osaka in Japan. Yoshimizu and his team were sequencing a gene from an E.Coli microbe when they discovered a unusual repetition of DNA sequences.

The ‘genetic sandwich’ that Yoshimizu had discovered only became ‘CRISPR’ in 2005 when Professor Francisco Mojica at the University of Alicante coined the name after discovering its function. When Mojica tried to publish his findings, four different scientific journals refused him. Today Mojica’s discovery is regarded as one of the most important in gene editing after Chinese American biochemist Feng Zhang published a ground-breaking paper following three years of research at the Massachusetts Institute of Technology. Zhang’s paper opened up the possibility of the application of CRISPR for genetic engineering.

Then in 2012 American biochemist Jennifer Doudna and French microbiology Professor Emmanuelle Charpentier laid down the foundation for gene editing by enabling researchers to make very specific changes to DNA sequences using ‘genetic scissors’ thanks to their discovery of CRISPR-Cas9. For that they both won the Nobel Prize in 2020.

The First Wave Of CRISPR

“I was aware of CRISPR, but my investment focus has been on genetic engineering using CAR T-cell therapies and regenerative medicine” says Tej Kohli as he closes his large laptop. “On this occasion the chance to get in early on CRISPR has gone – I missed it. But a second wave is coming. To say that the opportunity has passed would be a bit like saying that the investment opportunity of the Internet had already been exhausted by the year 2000 – the truth is that, like the Internet, the platform technology of CRISPR will change everything.”

Kohli prides himself on identifying new trends and getting in early. He says that by investing his private capital at scale more quickly than any institutional investors can act, he has been able to achieve investment returns again and again. “I make my profits when I buy” says Kohli, “there are some trajectories that are so inevitable that if you can spot and invest in them early, then the risk is very low despite the returns on offer being rather exceptional.”

In 2012 Kohli bought US-based Detraxi, a specialist in regenerative bio-synthetics, just before the scope of new applications for regenerative medicine “exploded”. In 2018 he started investing into European esports and by 2020 he had become the largest individual esports investor in Europe. Kohli has also built a “substantial” position in Bitcoin which he claims has been the most profitable investment that he has ever made, though he won’t specify how much. Even Kohli’s Zibel Real Estate empire was built upon getting in “early” by investing in tech hubs such as Berlin, Abu Dhabi and Gurgaon just before values skyrocketed.

By the time that Doudna and Emmanuelle won the Nobel Prize in 2020, CRISPR-Cas9 was already making an impact and generating a lot of hype. NASDAQ-listed CRISPR Therapeutics – one of the companies that Doudna and Charpentier launched to monetise their discovery – hit a value of $15bn in December 2020, providing a ten-fold return to any investors who bought the stock just two years earlier. In the UK, London-listed MaxCyte is licencing its platform for the development of therapeutics using CRISPR. Tej Kohli points out in his Motley Fool investment blog that investors who bought MaxCyte stock in January 2020 would have recouped a 750% profit during the twelve months that followed.

The Six D’s of CRISPR

Kohli says that a lot of the opportunities for licencing the CRISPR-Cas9 technologies are already priced into companies like CRISPR Therapeutics and MaxCyte. “There is probably still a lot of long-term upside to be gained by investing in the platforms, and I suspect that these types of companies will stay high return on invested capital companies rather than fading out as that time progresses. But just as exciting is the opportunity to invest in some of the companies that are looking to use the ‘genetic scissors’ to create new products.”

Kohli’s excitement is grounded in his embrace of ‘The Six D’s Of Exponential Organizations’ which were developed by Peter H Diamandis and Steven Kotler, and expanded upon in their award-winning book ‘Bold: How to Go Big, Create Wealth, and Impact the World’. Kohli regularly champions the Six D’s in his #TejTalks blog and has said that if someone can pitch an investment opportunity to him in terms of the Six D’s, then they are likely to get his cash.

Digitization

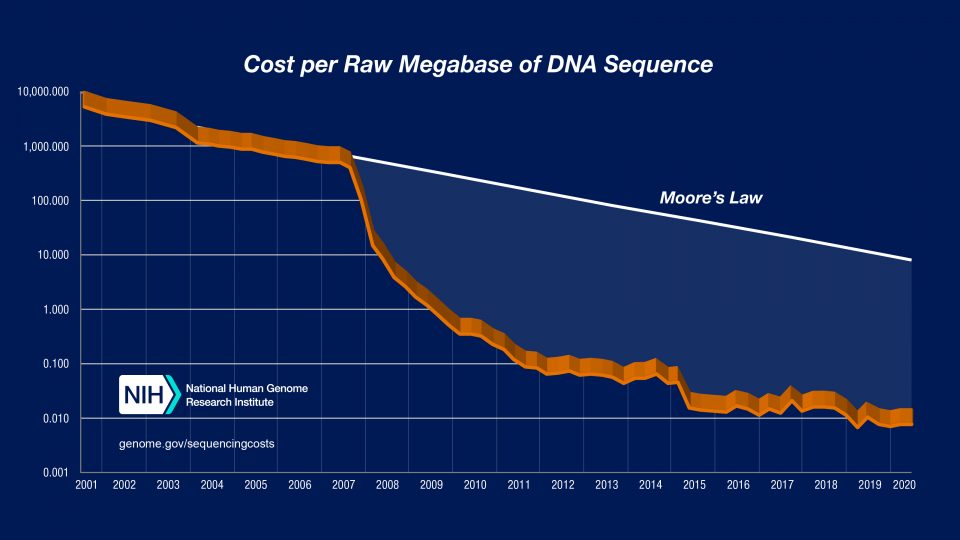

“You can easily map the trajectory of CRISPR-Cas9 directly onto the exponential growth framework for the Six D’s” says Kohli. “Each of the Six D’s is a link in a chain reaction that always leads to enormous upheaval and opportunity”. Kohli says that the first link in the CRISPR chain – ‘digitized’ – probably occurred in 2013 at around the same time that Doudna and Emmanuelle discovered their Cas-9 ‘genetic scissors’. “The cost of deciphering the human genome dropped from about $3 billion in 2001 to about $1,000 by 2013. Now that literally everything is being DNA sequenced, the opportunity to understand the genetic codes of so many different things are endless. That’s the basic process of ‘digitisation’.”

Deceptive

Kohli says that the limitation before 2013 was that even when DNA could be sequenced quickly at scale and at falling cost, the scope for taking any ‘action’ as a consequence of having easier access to this information remained small. “You’ve had CRISPR since 1987, but only in 2013 with the discovery of Cas-9 and its application as ‘genetic scissors’ did researchers attain the ability to start modifying and editing DNA with any real precision. That’s the part that historians will look back on as a key moment in human history.”

The second phase of the Six D’s is the ‘Deceptive’ stage. At this stage the initial period of growth seems small because exponential trends don’t initially seem to grow fast because they are starting from a very low base. “Doubling 0.01 only gets you 0.02, then 0.04 and so on. Exponential growth only really takes off when we get into whole numbers: 2 quickly becomes 32, which becomes 32,000 before you know it” says Tej Kohli. With the advent of Cas-9, he argues, CRISPR entered the ‘deceptive’ phase, as its popularity and awareness about its possibilities grew quickly – but from a very low initial base.

Disruptive

“The ‘disruptive’ stage of the Six D’s is where we are now” says Kohli. The ‘disruptive’ stage occurs when existing ways of doing things are outperformed by a newer, cheaper and more accessible technology. “Why buy a CD when you can stream music on your phone? Why buy a camera when you have a smartphone? Why develop treatments for inherited diseases when you can use genetic scissors to ‘cut out’ that disease altogether?” says Kohli.

According to Kohli, the ‘disruptive’ phase is when heightened public interest and hype start to drive valuations for new technologies to new levels. “We’ve seen it with the Internet and more recently we’ve seen it with cryptocurrency. This is the stage where valuations really start to soar, but they’re all based on future potential. Investors are pricing in what they expect to happen, but they tend to only back the underlying platform technology. But beyond that will be a whole ecosystem of ventures that are built upon the platform.”

Demonetisation

What investors should be looking at says Tej Kohli, are the applications of CRISPR-Cas9 as the new technology enters the next phase of the Six D’s: demonetisation. “If you could go back ten years but with the knowledge that you have today, would you invest in the Internet Service Providers who make the Internet possible, or would you invest in the FAANGS – Facebook, Amazon, Apple, Netflix and Alphabet (Google)? This is where CRISPR-Cas9 gets exciting: when you look toward investing in what could be done with the technology platform rather than the platform itself.”

Kohli believes that as more companies and organizations embrace the use of genetic scissors to create new medicines, new treatment and new products, the licensing costs will inevitably also start to fall. A licence to use the genetic scissors technology is currently thought to run into tens of millions, but as with DNA sequencing, Kohli says that the costs will likely fall very fast and become more accessible, in line with other new technologies.

Dematerialisation and Democratisation

“Eventually” says Tej Kohli, “we will see a Cambrian explosion in the use of CRISPR-Cas9 as the technology is perfected and demonetised in such a way that is becomes very easy for entrepreneurs and business leaders to intuitively ‘plug in’ to and embrace it to build new applications, much like they do the Internet. That’s when the field of exciting investment opportunities will start to get very full. But the biggest returns will be recouped by those who can get in very early, right now, before this ‘second wave’ of CRISPR grows.”

There are hints that Kohli may be right. Already in California a company called Synthetic Genomics is using CRISPR Cas-9 to remove the genes that limit the production of fats in CO2-absorbing algae, resulting in strains of algae with twice as much fat as normal. This ‘fat algae’ can be then turned into biofuel. ExxonMobil is now working with the company with a target to produce 10,000 barrels of algae-derived biofuel per day by 2025.

Another study at Imperial College London has seen researchers use CRISPR-Cas9 to develop a ‘gene drive’ tool which progressively spreads a genetic modification into the mosquito population. The modification prevents female mosquitoes from biting or laying eggs, crashing the mosquito population in just eight generations: three months. With 800,000 killed every year by Malaria, the implications for this in Malaria-ridden countries are significant.

The Second Wave of CRISPR-Cas9

Tej Kohli’s crack team of PhD’s and MBA’s have already started scoping out forward-leaning investments in ventures that intend to use CRISPR-Cas9 to disrupt marketplaces and create exponential investment growth. The Kohli Ventures investment vehicle pursues a “double bottom line” of investment return and humanitarian impact, so Tej Kohli says the first investments that he makes into ventures utilising CRISPR must be “human improving”.

In March the FDA in the United States approved the first trials that will use CRISPR to correct the genetic defect that causes sickle cell disease, which afflicts millions of people worldwide. The trial will use CRISPR to correct a mutation in the gene responsible for sickle cell. Success would be life changing for millions of people, because the only treatments currently available involve regular bloods transfusions and bone marrow transplants.

“Sickle cell is just one inherited genetic disease. It’s not so difficult to suspend your disbelief to imagine a world where we can eradicate all manner of inherited diseases using CRISPR technology. Each of the ventures who achieve this will need investor backing” says Kohli. With his extensive private capital and track record for repeatedly getting in early on the kind of new investments that have multiplied his fortune many times over since he sold a series of companies in the early 2000’s, this could be sage advice.

Tej Kohli is an investor in Rewired