London house prices: Housing market cools in capital with July sales drop and slower growth forecast

London house sales dropped last month as the market cooled, calming fears of a housing bubble in the capital- a trend that’s expected to continue over the next 12 months.

The data from the Royal Institution of Chartered Surveyors suggest the market is “going into reverse”, as sales fell for the third month in a row in July.

London's housing market was dampened by issues of affordability, a potential rise in interest rates and warnings from the Bank of England, experts warned.

“In the capital, enquiries and sales are now falling, instructions are rising sharply and price momentum, whilst positive, is fading rapidly,” said the institute’s chief economist Simon Rubinsohn.

Over the next year, property experts expect London house prices to rise by 1.9 per cent – a significant drop from a high of expectations of 6.7 per cent back in January.

Growth predictions have also become less bullish in the long term, falling from a high of 9.3 per cent in March, to 4.6 per cent in July.

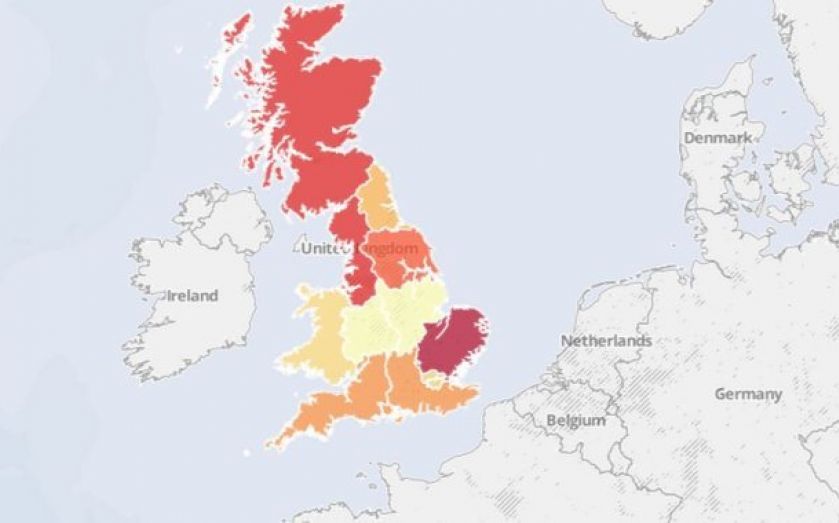

London has fallen behind the rest of the country, with average growth predictions of 1.9 per cent behind the average of 2.6 per cent across England and Wales.

What the surveyors say

“Lending restrictions and concerns about imminent interest rate rises brought seller/buyer balance to the market for us this month with enquiries down, listings up and certainly realistic offers. So we’re hoping for sustainable activity from now on.”

“A rebalancing of the London sales market has taken place over the past quarter. Now with over ambitious sales prices coming down, the market is once again starting to move.”

“I think that the market is in a strong position, without the insanity of sealed bids etc., allied with prudent lending, but still with strong buyer demand. Some pockets are still very sought-after.”

“The market has suddenly become a little patchy. School holidays, the Commonwealth Games, the referendum and likely interest rate rises may be to blame. It will be interesting to see how the autumn market performs.”