London house prices: Capital would be hit disproportionately by mansion tax

The extent to which London will be disproportionately hit by a new mansion tax has been revealed by new research looking into the most expensive properties in the UK

Labour has proposed a tax on properties worth over £2m, which, according to research by Knight Frank, means 2.5 per cent of properties in London would be hit.

By looking at the threshold for entering the top 2.5 per cent of houses across the country, Knight Frank showed that there was a significant price gap between elite homes in the capital and those elsewhere.

In the north east, for example, a house worth more than £343,558 would cross the 2.5 per cent boundary, despite being just over a sixth of the price of the London equivalent.

Of course, the data comes with a caveat. A mansion tax would be aimed at taxing wealth, and people in London generally command higher wages than the rest of the UK. However, research by Halifax has shown that, despite this, the price-to-earnings ratio, a measure of affordability, is higher in London than many other places.

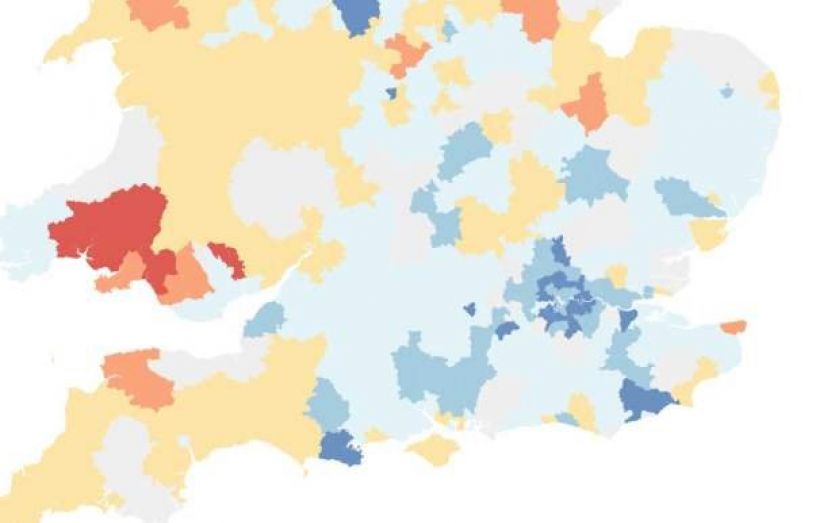

The map below compares median wages against the average cost of a square metre of floor space, based on data from Halifax.

There are more numbers to back this up. Knight Frank analysis shows 38 per cent of all £2 million-plus properties in Greater London are flats, while only 14 per cent are detached properties. Terraced houses are the second largest group at 36 per cent. Semi-detached properties make up the remaining 12 per cent.

What is more, London accounted for 42 per cent of all stamp duty revenue in England and Wales in the 2013/14 tax year, a rise from 41 per cent in the previous financial year.

Tom Bill, head of London residential research at Knight Frank, said:

The data puts the London housing market and the disproportionate impact of a mansion tax into a national context. House prices have grown more in London than other regions in recent years but this reflects high demand and constrained supply more than wage growth or any greater capacity of London homeowners to pay tax.

Furthermore, the data underlines the mismatch between the term ‘mansion’ and reality of property markets across the UK.