London gains ground on New York in ranking of global financial centres

London has held on to the second spot in a respected ranking of global financial centres, closing the gap on New York as investors sought out the relative safety of leading finance hubs amid the coronavirus pandemic.

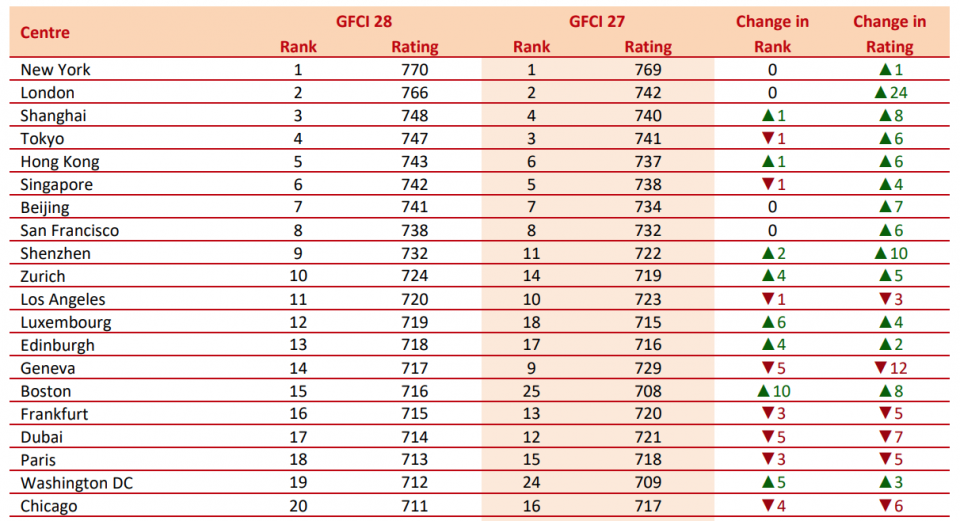

The British capital gained 24 points in the latest Global Financial Centres Index (GFCI), which measures the competitiveness of 111 financial hubs, leaving it just four points behind leader New York.

Shanghai overtook Tokyo to claim third place in the latest index, with Hong Kong and Singapore taking fifth and sixth place respectively.

The latest edition of index, which is compiled by consultancy firm Z/Yen and the China Development Institute, indicated that high levels of volatility remain as investors tackle the fallout from the Covid-19 crisis.

“Uncertainty about trade, political stability, and the economic impact of the Covid-19 pandemic has injected more volatility into the index results,” said Z/Yen executive chairman Michael Mainelli.

The average rating for financial centres ranked in the index slipped over six per cent compared to the previous edition, which was published in March.

The GFCI’s authors said the drop could indicate “a more general lack of confidence in finance during a time of continuing uncertainty around international trade, the impact of the Covid-19 pandemic on individual economies, and geopolitical and local unrest”.

This volatility appeared to benefit the top 10 centres, which all increased their ratings, while the majority of remaining hubs in the top 50 saw their rating fall.

This could indicate increased confidence in the most established financial centres as investors sought shelter in the perceived safety of the more established hubs during the crisis, the report said.

But as well as increasing volatility across financial centres, new ways of working being adopted during the pandemic are also “challenging the concept of a traditional financial centre,” Mainelli said.

“For example, the physical City of London has had an economically torrid Covid-19, while financial services in South East England have had a bumper year.”