London floats sink again – but analysts eye buoyant times ahead

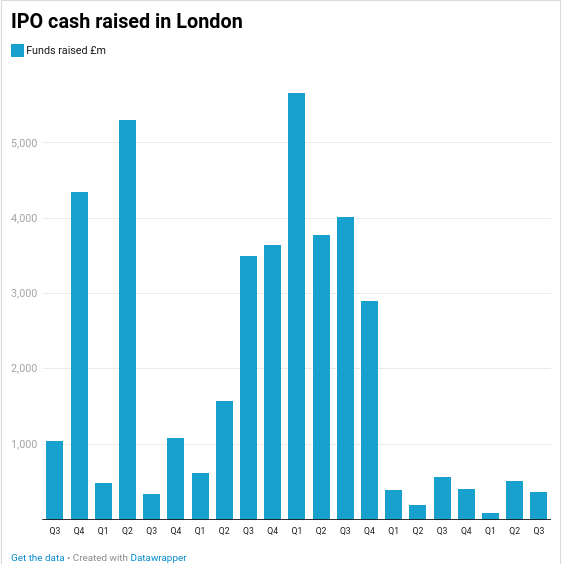

The amount of cash raised on the London Stock Exchange sank again in the past three months as the global IPO market remained hobbled by soaring inflation and roiled public markets.

Between June and September cash raised via fresh listings on London’s historic bourse fell 36 per cent to £360m as just five firms floated on the market, down from a quiet £565.5m in the same period last year, new figures from EY showed.

The main market notched two new IPOs bagging £346.5m in total, with the numbers given a boost by the £291.5m July debut of CAB Payments in July. Across the first nine months of 2023, £953m has been raised in London, down from £1.1bn last year.

The figures underscore the troubles facing the public markets this year as markets remain shaken by soaring inflation and rising interest rates.

Global IPO numbers have slumped after Russia’s invasion of Ukraine roiled markets last year and brought a sharp end to the post-pandemic IPO boom of 2021.

However, in a statement on Tuesday EY’s IPO head Scott McCubbin said there were shoots of recovery beginning to appear in the market.

“Challenging market conditions, compounded by high inflation and rising interest rates, have meant IPO activity has continued to face obstacles,” he added.

“However, there are reasons to be positive – several companies which had delayed their IPOs earlier this year are now making plans to be ‘IPO ready’ for when headwinds ease.”

Hopes have begun to grow that the IPO window could swing back open after a number of high-profile floats including chipmaker Arm and the impending listing of sandalmaker Birkenstock.

Cash raised in North America, including Canada surged 159 per cent in 2023, raising $19.3bn in total. Global IPO numbers have declined sharply however. Cash raised globally fell 32 per cent year-on-year in the third quarterto $101.2bn.

“There is an uptick in activity in the US IPO market, which normally has a positive knock-on impact in other markets, so we anticipate a rebound in activity in 2024,” McCubbin added.

Ministers and London Stock Exchange officials have pushed through a number of reforms over the past three years in the hopes of reviving the appeal of the City. The London Stock Exchange has come under fire this year as a slew of firms ditch their London listings in favour of New York.

Julia Hoggett, London Stock Exchange chief, told City A.M. last month the bourse would fight for every listing.