London ‘clearly in depths of a rent crisis’ as 77 per cent of properties see price rise

A whopping 77 per cent of London’s privately rented sector has experienced a price increase in the last year, new figures show this morning.

The capital is “clearly in the depths of a crisis” one leading estate agent said, after the Office for National Statistics revealed fresh data which analyses changes in average UK private rental prices.

The ONS said prices had risen by 10 per cent or more for around one in five properties across England and Wales, but London was by far the worst hit.

Rental prices have come under severe pressure because of higher interest rates, with many landlords either raising how much they’re asking tenants to pay, in order to keep up with mortgage payments, or selling up, leading to a choke on supply.

This comes latest government figures showed more than a third of Londoners’ average pay went towards paying rent last year, as tenants face a crisis in the capital.

The figures show in London, rental prices had risen for just over three-quarters (77 per cent) of privately rented properties revisited in September 2023.

It said this “was the highest of all English regions and above the England average (63 per cent). This was up from September 2022, when prices had risen for 58 per cent of properties in London and for 53 per cent in England”.

The figures also show prices had risen by 10 per cent or more for almost one-quarter of privately rented properties in London revisited between July 2023 and September 2023.

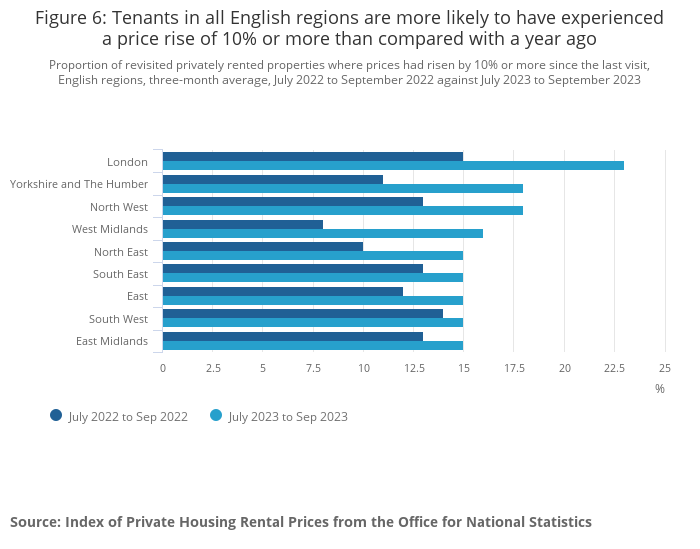

When comparing July 2023 to 2022, tenants in all English regions are more likely to have experienced a price rise of 10 per cent or more — but London is way out in front, with 23 per cent.

It said: “This was higher than the proportion of London properties revisited between July 2022 and September 2022 where prices had risen by 10 per cent or more.”

ONS Head of Housing Market Indices, Aimee North said: “Across England and Wales, around one in five properties saw their rents increase by 10 per cent or more between visits.

“Since the last visit, rental prices had risen for just over three-quarters of privately rented properties in London, the highest of all English regions and above the national average.”

Greg Tsuman, director of lettings at Martyn Gerrard Estate Agents and President of ARLA Propertymark said: “The rental market is clearly in the depths of a crisis, and it is under immense pressure from multiple fronts.”

The director continued: “The main issue, however, is that the Treasury seems to be overlooking the fact that it is eating the golden goose with the current tax structure imposed on private landlords.

“Section 24 of the Finance Act has forced landlords to pay taxes on turnover rather than just profit, meaning they are being taxed on interest payments, which have gone up from 0.1 per cent to 5.25 per cent. Whilst it will come as some relief to private landlords that the Bank of England kept the base interest rate frozen this week, rates are still high, forcing landlords to increase rents and ultimately pass on these costs to tenants.”

“But the ranks of landlords who are staying is dwindling, with many opting to sell up and leave altogether, further reducing supply of rental properties and forcing rents up even higher,” Tsuman added.

He called for the treasury to “urgently review the tax regime” in a bid to bring “landlords back to the market, not forcing them out, so that we have a competitive market that keeps rents low”.