London businesses shelve hiring plans amid UK recession uncertainty

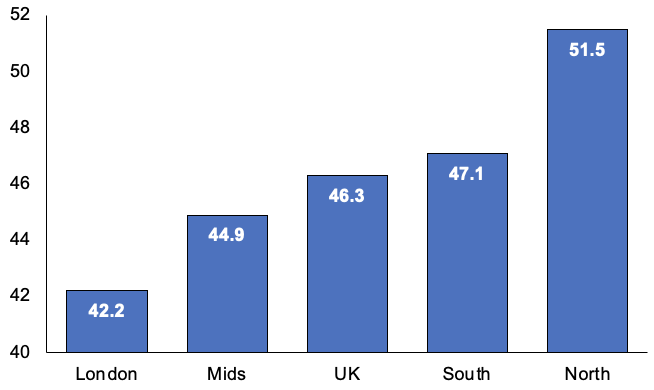

London businesses are the most reluctant to take on new staff in the UK due to uncertainty over whether the country will eventually tip into recession, a closely watched survey out today reveals.

The capital’s firms are trimming intentions to expand their workforce due to concerns over a looming drop in consumer spending amid the economic slump.

Consultancy KPMG and the Recruitment and Employment Confederation’s (REC) permanent employment index slid to its lowest level since October last year, down to 42.2 points last month, the lowest of any region in the UK.

The reading is far below the 50 point threshold that separates growth and contraction, meaning London companies are hiring permanent staff at a slower pace.

February’s reading was also a big drop from January’s 47.9 points.

Experts said the capital’s firms are taking on part-time staff to ensure they can keep running smoothly without baking in higher fixed costs that could hit them if the country does slip into recession.

“As hirers work out what variable economic forecasts might mean for their business and staff, it makes sense that we continue to see temp billings hold up so well. Temporary staffing ensures firms can continue to provide goods and services, and people can grow their careers – even when the economic outlook is unclear,” Kate Shoesmith, deputy chief executive of the REC, said.

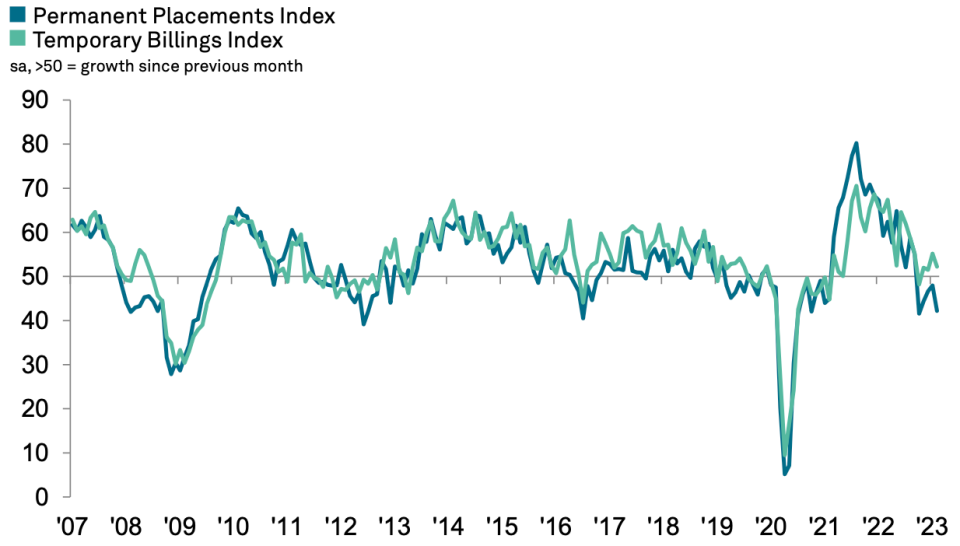

The temporary hiring index remained in expansionary territory at 52.2 points, although it fell quickly from 55.2 points.

London firms are trimming hiring plans…

A string of recent data, however, has indicated the UK economy is much stronger than first feared at the turn of the year.

This has prompted some economists to roll back their recession warnings.

London’s jobs market is softer than the rest of the UK, with the countrywide permanent hiring index hitting 46.3 points, a slight drop from 46.8 points.

Unemployment is yet to rise substantially and there is still demand for new staff despite businesses being warned to brace for a recession for months.

… at fastest pace in Britain

Typically during economic downturns, businesses shed staff to cut costs in response to a reduction in household spending.

However, there is a risk joblessness is on track to jump later in the year when the full effects of the Bank of England’s ten successive interest rate rises ricochet through the UK economy.

Permanent starting salaries rose at a faster pace last month than January at 61.3 points, up from just over 60 points, signalling the Bank could lift borrowing costs for the eleventh straight time on 23 March.

Office for National Statistics numbers still show that, despite soaring pay growth, inflation is still eroding real incomes at one of the fastest paces on record.