London blue chips set for further falls

Strategist are betting on the FTSE 100 to fall further this week due to mounting concerns over the outlook for the UK economy.

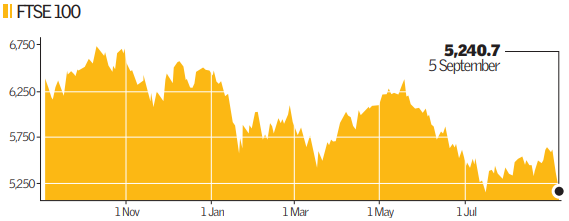

Last week marked the blue chip index’s biggest weekly fall for six years leaving it teetering on the edge of so-called bear market territory, defined as a 20 per cent fall from its most recent peak, which was 6,730 in June 2007.

The FTSE 100 closed 121.4 points lower at 5,240.7 marking a weekly loss of seven per cent – its biggest such fall since July 2002. The UK benchmark is now down 17 per cent so far this year.

Worse-than-expected employment figures from the US with the 6.1 per cent jobless rate at its highest in six years together with disappointment at the Bank of England’s decision to keep interest rates at five per cent in spite of the faltering economy are being blamed for the sharp falls. Analysts said the increasingly hawkish sounding European Central Bank’s decision to tighten its criteria for taking assets as collateral for short-term loans had also sparked concern that the Bank of England would bring in similar measures this week, when its own Special Liquidity Scheme expires.

“We are in a bear market and these are the bear rallies that we should expect. The best we can hope is for the market to continue to trade in a range between 5,200 and 5,600 which it has been doing in the last few months,” said Tim Whitehead, head of portfolio services at Redmayne-Bentley.

Teun Draaisma, strategist at investment bank Morgan Stanley, does not expect the market to pick up until the second half of next year.

Analyst Views: What is the outlook for the UK share market?

Albert Edwards (Societe Generale): “We are at a very similar point to the end of 2000, just before corporate capitulation sent reported profits and the economy diving and the equity market collapsed. Core measures of profitability are in free-fall and have now reached a tipping point, where corporate activity could easily implode. We have also reached the point where companies give up ‘manipulating’ their profits higher and admit they are actually in free-fall. A combination of economic and reported profits slumping will catalyse the next equity downleg.”

Jeremy Batstone-Carr (Charles Stanley): “The UK faces a recession. The slump in the pound is the clearest financial signal of this. The risk of a prolonged economic and credit downturn is yet to be fully discounted in corporate earnings estimates. Some positive factors are that equity valuations are low so we do not see much downside and there should be scope for a strong monetary stimulus from the MPC, at some stage.”

Mike Lenhoff (Brewin Dolphin): “It does look as if the FTSE 100 is going back to test the 5,150 level of the mid-July low. This is a critical test. If it goes back and then heads lower I expect further falls, but if goes back to this and then bounces back it will be a positive signal. We are however getting closer to both interest rate cuts and $100 a barrel oil. Both should help to stimulate the economy and eventually the market.”