London and south east house prices fall fastest with analysts predicting five per cent crash

House prices dropped by 0.3 per cent from June to July, the latest data suggests, with London and south east homes falling fastest in value.

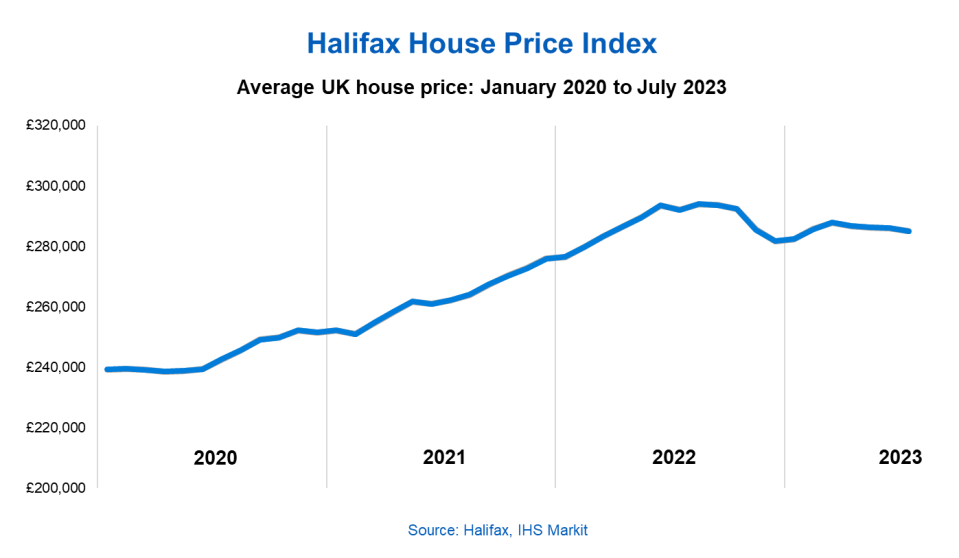

House prices fell by -2.4 per cent on an annual basis , easing from -2.6 per cent in June, the latest figures from Halifax show.

The 0.3 per cent fall was the fourth consecutive monthly decrease.

London was the region which saw one of the biggest declines in price, with average property prices down by -3.5 per cent annually in the capital. The average home now costs £531,000.

The South East of England, which includes commuter hotspots such as Surrey, remains the area where house prices are facing the most downward pressure, down -3.9 per cent on an annual basis.

Analysts believe house prices could fall by as much as 5 per cent across the year.

“We’re seeing activity amongst first-time buyers hold up relatively well, with indications some are now searching for smaller homes, to offset higher borrowing costs,” Kim Kinnaird, director at Halifax Mortgages, said.

Just over £15,500 has been taken off the value of a typical property in the region over the last year.

High Street lenders have continued to reduce the cost of their deals, despite the Bank of England raising interest rates for the 14th time last week – in a signal of hope for many prospective buyers.

“While there have been recent signs of borrowing costs stabilising or even falling, they will likely remain much higher than homeowners have become used to over the last decade,” Kinnaird added.

She said: “The continued affordability squeeze will mean constrained market activity persists, and we expect house prices to continue to fall into next year. Based on our current economic assumptions, we anticipate that being a gradual rather than a precipitous decline.

“And one that is unlikely to fully reverse the house price growth recorded over recent years, with average property prices still some £45,000 above pre-Covid levels.”

Tom Bill, head of UK residential research at Knight Frank, said: “While we expect UK prices to fall by 5% in 2023, demand should prove more resilient than expected given the shock-absorber effect of strong wage growth, lockdown savings, the availability of longer mortgage terms, forbearance from lenders and the popularity of fixed-rate deals in recent years.”