Shell reveals LNG trade grew six per cent amid rebounding post-lockdown demand

Shell has revealed the LNG trade grew six per cent year on year in 2021 to 380m tonnes, as developed economies recovered from the COVID-19 pandemic.

This follows the US boosting Europe’s LNG supplies over Christmas, as the continent scrambled to secure supplies to avoid blackouts, and rebounding demand in Asia post-lockdowns.

China led LNG demand growth in 2021, increasing its LNG imports by 12m tonnes to 79m.

Last year Chinese LNG buyers signed long-term contracts for more than 20m tonnes a year.

Meanwhile, US exports of LNG boomed, with a year-on-year increase of 24m tonnes.

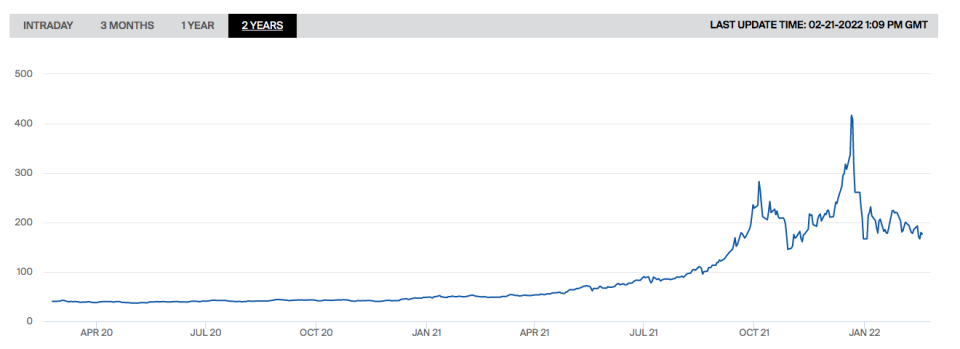

The fossil fuel giant is the world’s largest buyer and seller of liquefied natural gas (LNG), and expects the market to remain tight this year following last year’s volatility, which saw gas prices hit an all-time high.

Following the publication of its LNG market outlook, Steve Hill, executive vice president, energy marketing, explained: “The high prices we’re seeing at the moment are being driven by fundamentals, low storage levels and supply uncertainty.”

He added that the reduction of investment in LNG was further exacerbating tight market conditions.

Natural gas prices around the world soared five-fold over the course of 2021, with UK prices breaching £4 per them late last year due to a combination of tightening supplies, weaker renewable power generation and a resurgent demand in developed economies.

LNG demand is expected to almost double to 700m tonnes by 2040, according to its latest reports.

It also argued LNG has a key role to play as a back-up in the event of intermittent renewable supply.

Wael Sawan, integrated gas, renewables and energy solutions director at Shell, said: “Last year showed just how crucial gas and LNG are in providing communities around the world with energy.”

The market crisis has resulted in dozens of UK suppliers out of business while some heavy industry companies curtailed output in energy-intensive sectors.

Shell recently unveiled bumper profits in its full-year results, and has announced an $8.5bn share buyback scheme following its move to London.

German finance minister told the Financial Times that Germany needed to boost its LNG capacity, in response to the current energy crisis.

He said: . “I’m very much in favour of Germany building LNG terminals, and have been for years. If we get LNG terminals built then that would be a positive outcome of this situation.”