Liz Truss tax cuts must be bolder to revive UK economy, Thatcherite thinks tank claims

Liz Truss must be even bolder than cancelling the corporation tax rise to unlock the UK’s full economic potential, a Thatcherite think tank has claimed today.

The prime minister’s chancellor, Kwasi Kwarteng, is expected to reverse the six percentage point corporation tax hike at this Friday’s mini-budget.

The move will generate a 1.2 per cent bump in gross domestic product (GDP), according to the Centre for Policy Studies (CPS).

But, if the government scraps taxes on all investment projects, the economy could grow 2.5 per cent quicker over the long-term, the organisation calculated.

Experts have argued taxing firms’ profits too heavily waters down investment incentives.

Capital expenditure in Britain was just over 17 per cent of GDP last year, far behind France and Germany.

Under the CPS’s plans, investment is projected to climb 4.2 per cent and wages 2.1 per cent, injecting a £10bn per cent a year boost to GDP.

Truss has stamped her authority on Whitehall by demanding officials focus on dragging growth out of the doldrums. The UK economy has effectively stalled since the 2008 financial crisis, leaving households and businesses struggling to weather the cost of living storm.

“The government now has an opportunity to radically reform the UK corporate tax system,” Tom Clougherty, head of tax at the CPS, said.

“If growth is the goal, it pays to be as bold as possible,” he added.

Kwarteng is also expected to reverse the 1.25 percentage point national insurance jump.

The government today said it will cover more than half of the cost of businesses’ energy bills for six months from 1 October.

When contacted by City A.M., the department for business, energy and industrial strategy did not confirm if the support is a grant or if businesses will repay the Treasury.

In sum, Friday’s touted tax cuts will throw the UK’s public finances on an “unsustainable path,” according to the Institute for Fiscal Studies (IFS).

If she ploughs ahead with tax cuts, Truss will miss the government’s fiscal targets – debt as a share of the economy and the deficit to be falling – as soon as January, the organisation said.

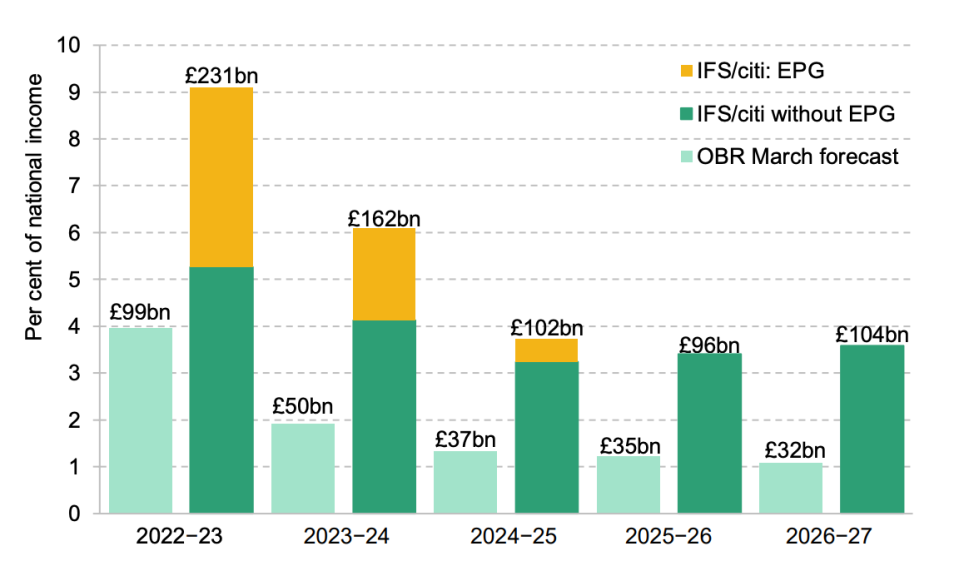

Even after household energy bills are unfrozen from £2,500 in 2024, the government will be borrowing £100bn a year, more than £60bn higher than the OBR’s March forecasts.

“Almost half of this increase in borrowing would be due to the new tax cuts,” the IFS said.

“The government is choosing to ramp up borrowing just as it becomes more expensive to do so, in a gamble on growth that may not pay off,” Carl Emmerson, deputy director at the IFS, said.

Borrowing is set to balloon to cover tax cuts

The fiscal stimulus risk keeping inflation – running at a 40-year high of 9.9 per cent – higher for longer by incentivising spending, experts warned.

“Although the immediate risk of recession over the coming winter is diminished, substantial fiscal stimulus adds to the risk of high inflation being maintained for longer – and hence the chances of, ultimately, substantially more policy tightening by the Bank of England being required,” Sandra Horsfield, economist at Investec, said.

Governor Andrew Bailey and co are likely to raise borrowing costs at least 50 points to 2.25 per cent tomorrow.