As it happened: Rishi Sunak’s Spring Budget 2022

Live updates and links to all our coverage, reactions and analyses as the Chancellor of the Exchequer, Rishi Sunak, delivers the government’s Spring Budget for 2022 . Please do get in touch and let us know your opinion via news@cityam.com or @Cityam

With the cost of living crisis, rising inflation, war in Ukraine and higher interest rates, many people are feeling the pinch in their pockets.

Chancellor Rishi Sunak is under pressure to reassure working people he will “stand by” them as they feel the squeeze on wages, and higher prices threaten to eat into their savings, and profits.

In City A.M.’s live blog for the Spring Budget statement, the London news team will bring you all the key points, policy changes, opinion, analysis and much more.

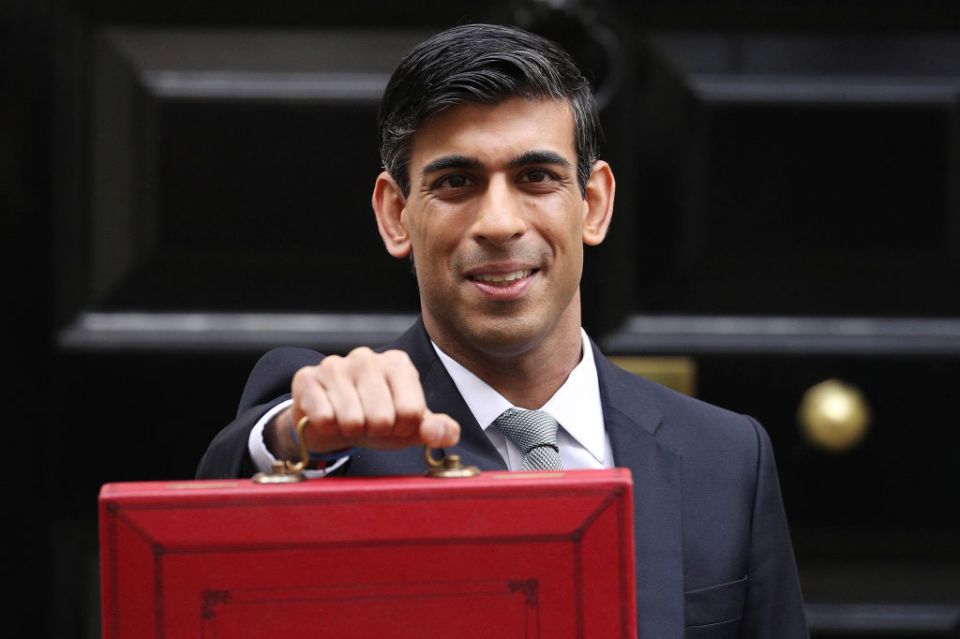

Rishi Sunak, Chancellor of the Exchequer (Photo by Dan Kitwood/Getty Images)

Reaction, opinion and analysis

Labour’s shadow chief Secretary to the Treasury, Pat McFadden, said chancellor Rishi Sunak “hasn’t got a clue.”

“He has left households and businesses to fend for themselves in the middle of a devastating cost of living crisis.

“Even after the changes today.. Britain is facing the highest tax burden in 70 years.

“Rishi Sunak is raising taxes again and again, only to offer crumbs just before an election. This is a cynical Chancellor who is asking struggling families to pay for the Tory election campaign.”

Christine Cairns, tax partner at PwC, commented that “increasing the threshold was one of the only options left to try and soften the blow for those who will feel it most.

“While it might seem curious to be effectively both increasing and cutting NI at the same time, today’s change is clearly targeted at helping those with the lowest earnings who may already be below the income tax threshold.

“The true impact of this cut, as well as of the future decrease of the basic rate tax rate, for middle income earners will need to be assessed against the impact of the freezing of the income tax bands until 2026.”

IFS director, Paul Johnson tweeted that it “drives further wedge between taxation of unearned income and earned income. Yet again benefits pensioners and those living off rents at expense of workers”.

He added, that the “big omission from this statement was anything for those subsisting on means tested benefits. They will be facing cost of living increases of probably 10% but their benefits will rise by just 3.1%. And cut compared to last year if you account for withdrawal of £20 UC uplift

Partner at HW Fisher, Gerry Myton, praised the “sensible decision from the Chancellor today to cut fuel duty” calling it a “quick and easy change to implement, and a reduction in duty at the pump will be a lifeline to those who heavily rely on their bikes, cars and vans every day for work.

“A 5p cut in the rate of duty should equate to 6p at the pumps. This is because the cost price of the goods reduces so the amount of VAT falls (net price £1.50 plus VAT at 20% (30p gets us to £1.80), the price net before VAT becomes £1.45 plus VAT becomes £1.74).”

Chief executive of National Energy Action (NEA), Adam Scorer, branded the chancellor’s Spring Statement “desperately disappointing”

“Today’s Spring Statement from Chancellor Rishi Sunak fails to address the catastrophic impact on the poorest of skyrocketing energy bills, which are set to increase next week by around 54%. Desperately disappointing. The Government must use spring and summer to come up with a real plan ahead of next winter, if we are to avoid the worst of cold homes, debt and needless deaths.”

Live Blog – as it happened

Labour’s shadow chancellor, Rachel Reeves, responds to Rishi Sunak’s Spring Budget statement

Shadow chancellor Rachel Reeves said the plans didn’t help those facing a “real-terms cut” to their income, telling the Commons: “At the weekend the Chancellor was asked about fuel poverty and he didn’t even know the numbers.

“It is shameful that he doesn’t, because when Martin Lewis predicts that 10 million people could be pushed into fuel poverty the Chancellor should sit up and listen.”

“We know that pensions and social security are not going to keep up with inflation. Pensioners and those on social security are being given a real-terms cut in their incomes.

“So, what analysis has the Chancellor done of the impact of benefits being up-rated by less than inflation? How many more children and pensioners will drift into poverty because of … this Government?”

“When I set out Labour’s plans for a windfall tax in January we estimated that it would have raised £1.2 billion, now because of the continued rise in global oil and gas prices it would today raise over £3 billion.

“That’s money that could be used to help families and pensioners and businesses with a cut to VAT, a real Brexit dividend that would help working families and pensioners across our country, and a targeted warms home discount that would see families and pensioners on the lowest and modest incomes being supported by £600.”

Reeves called for the National Crime Agency to investigate fraud, saying the Sunak had the “audacity” people to fill a “blackhole” of £11.8bn lost to fraud.

The Chancellor has been signing cheques to fraudsters, including organised criminals and drug dealers” and “has lost a staggering £11.8 billion of public money to fraud”.

“As a result of, lets face it, this jaw-dropping incompetence, the Conservatives have been funding crime instead of fighting it.

“Now the Chancellor has the audacity to come to British taxpayers asking them to pay more to fill his blackhole.”

“Let’s call in the National Crime Agency to investigate”, adding “taxpayers want their money back”.

1.31pm – UK households to be saddled with heaviest tax burden since 1940s

UK households are set to be saddled with the heaviest tax burden since the 1940s even when Chancellor Rishi Sunak’s income tax cut and national insurance tweaks are baked in.

Britain’s fiscal watchdog is forecasting the tax burden to hit 36.3 per cent in four years’ time, it said in fresh forecasts published today.

1pm – Auto Trader director criticises fuel cut

Auto Trader’s director Ian Plummer said drivers might not notice the cut in fuel tax as demand for electric vehicles soars: “In a climate of record pump prices, drivers may struggle to register the Chancellor’s giveaway, but the statement had to strike a difficult balancing act between helping families and protecting the public finances after the pandemic,” he said.

“Since Russia’s invasion nearly a month ago, we have seen a sharp rise in drivers looking at buying an electric vehicle as the cost of running a traditional petrol or diesel car soars. Last week electric vehicles accounted for more than one in five – or 20.5 per cent – of the ads clicked on by would-be buyers on our marketplace, comparted with just 6.5 per cent a year ago. Drivers are clearly being tempted by the lower running costs of EVs.”

12.55 – Sunak announces ‘three immediate measures:

” I’m announcing three immediate measures. First, I’m going to help motorists. “Today I can announce that for only the second time in 20 years, fuel duty will be cut. Not by 1, not even by 2, but by 5 pence per litre. The biggest cut to all fuel duty rates – ever. And while some have called for the cut to last until August, I have decided it will be in place until March next year – a full 12 months. Together with the freeze, it’s a tax cut this year for hard-working families and businesses worth over £5bn. And it will take effect from 6pm tonight.

“Second, as energy costs rise, we know that energy efficiency will make a big difference to bills. But if homeowners want to install energy saving materials… at the moment only some items qualify for 5% VAT relief and there are complex rules about who is eligible.

“The relief used to be more generous but from 2019 the European Courts of Justice required us to restrict its eligibility. But…thanks to Brexit…we’re no longer constrained by EU law. So today, I can announce for the next five years… …homeowners having materials like solar panels, heat pumps, or insulation installed… …will no longer pay 5% VAT– they will pay zero. We’ll also reverse the EU’s decision to take wind and water turbines out of scope – and zero rate them as well. And we’ll abolish all the red tape imposed by the EU. A family having a solar panel installed will see tax savings worth over £1,000. And savings on their energy bill of over £300 per year.

And finally, I want to do more to help our most vulnerable households with rising costs. They need targeted support. So I am also doubling the Household Support Fund to £1bn. Local Authorities are best placed to help those in need in their local areas. So they will receive this funding from April.

12.50 – OBR slashes economic growth forecasts

The UK’s fiscal watchdog, the OBR, has SLASHED its forecasts for economic growth this year driven by the Russia-Ukraine war sending inflation spiking.

12.50 – ‘We have a moral responsibility to use our economic strength to support Ukraine’

“Today’s statement builds a stronger, more secure economy for the United Kingdom. We have a moral responsibility to use our economic strength to support Ukraine” including “to impose severe costs on Putin’s regime. We are supplying military aid to help Ukraine defend its borders. Providing around £400m in economic and humanitarian aid as well as up to $0.5bn in multilateral financial guarantees. And launching the new ‘Homes for Ukraine’ scheme… …to make sure those forced to flee have a route to safety here in the UK.”

12.47pm – Fuel duty cut

“So I’m announcing three immediate measures. First, I’m going to help motorists. Today I can announce that for only the second time in 20 years, fuel duty will be cut. Not by 1, not even by 2, but by 5 pence per litre. The biggest cut to all fuel duty rates – ever.

“And while some have called for the cut to last until August, I have decided it will be in place until March next year – a full 12 months. Together with the freeze, it’s a tax cut this year for hard-working families and businesses worth over £5bn. And it will take effect from 6pm tonight.

12.43pm – Budget statement begins

Chancellor Rishi Sunak begins his Spring Statement by reflecting on women and children being “huddled in basements” in Ukraine.

“The sorrow we feel for their suffering and admiration for their bravery is only matched by the gratitude we feel for the security in which we live.”

12.41pm: MP says opponents of national insurance hike must offer an alternative

Tory politician Mark Harper says if you are against the potential National Insurance rise you must explain where you will get the additional funds for health and social care, according to Sky News

12.14pm: Sunak tells cabinet of ‘challenging’ outlook

Chancellor Rishi Sunak told Cabinet that the economic outlook was “challenging” given the “global shocks we are facing” from the Ukraine war and rising inflation, Downing Street said.

Boris Johnson said it appears to him that P&O Ferries has “broken the law” and the Government will be “taking action” and encouraging workers to do the same.

Peter Hebblethwaite, chief executive of P&O Ferries, has apologised for the impact of sacking 800 workers

“An incredibly difficult decision” but was “the only way to save the business”.

12pm – Explainer-in-brief

In 2011, then-Chancellor George Osborne cut fuel duty by 1p and froze it. It has stayed at 57.95p per litre ever since.

Now as motorists face the second petrol crisis in five months – after crucial shortages in October last year – Rishi Sunak is expected to cut fuel duty again in his spring statement.

12pm – What to expect:

Tackling the cost of living crisis: Rishi Sunak is set to vow to “stand by” British families as he is expected to outline further plans to support households facing financial hardship. We identify the key areas which are expected to be announced during the mini-budget at 12.30 on Wednesday :

- Fuel duty cut by 5p

Arguably one of the easiest ways to win over voters and support households with the cost of living crisis would be via a cut to fuel duty – and it has been suggested that Sunak is likely to take this path.

The Government has frozen the duty for 11 years, but there are now calls to reduce it – as oil prices hit highs on the back of the Ukraine conflict and prices at the pumps soar to record levels.

The Chancellor is reportedly gearing up to announce a temporary cut to the duty of up to 5p per litre in his statement.

- Raising national insurance threshold

Another option open to the Chancellor would be to hold off the planned national insurance rise previously announced – although this would represent a major U-turn from the Government.

Sunak and Prime Minister Boris Johnson have both been adamant in the past that the hike will not be delayed, with the extra cash used to fund the care sector.

- Energy bills

Sunak has already unveiled his plans to help with rising energy bills, with a £200 loan to each and every family to cut their gas and electricity payments from October – although not until the price cap jumps 54 per cent.

- VAT

There is no talk of the Government reducing VAT across the board, but Sunak could give a helping hand to the hospitality sector to ensure households can still enjoy themselves.

The Government had been due to increase VAT for hospitality firms from 12.5% to 20% from April 1 – having cut them back to 5% during the pandemic.

- Benefits

The government could also uprate benefits to put more money in the pockets of low and middle income households. The Resolution Foundation is calling for a five percentage point increase to keep pace with inflation, calling it the most effective way to support families hardest hit.