Liontrust and Ashmore feel the squeeze as volatility rocks London’s asset managers

London’s asset managers have been rocked by a “complete lack of investor confidence” over the summer as soaring inflation and market turmoil chokes off the flow of cash into firms like Liontrust and Ashmore, analysts have said.

London-listed investment platforms and fund managers have revealed a slump in flows in the three months to September, with asset managers in particular reporting outflows of three per cent on average, analysis by investment bank Peel Hunt shows.

The bank has slashed its outlook for the amount of cash under management across the broad money management and retail investment sector by an average of 15 per cent from the full year figure last year.

However, Peel Hunt said there had been a “clear divergence” between firms that offer hands-on wealth management to investors, like St James’s Place and unlisted Evelyn Partners, and asset managers.

“[Recent market statements] all highlighted how difficult market conditions have been, characterised by a complete lack of investor confidence and increased outflows given cost-of-living pressures and the more attractive returns now on offer from cash,” Peel Hunt said.

“Although the wealth managers and platforms proved more robust, the asset managers saw net outflows averaging three per cent of opening AUM.”

Fund management groups Man and Tatton have been among “few bright spots” for the asset management industry, they added.

| Asset manager | net flows |

| Ashmore | -2.9% |

| Jupiter | -1.0% |

| Liontrust | -1.6% |

| Premier Miton | -0.7% |

| Man Group | 0.7% |

| Tatton | 0.9% |

Flows at wealth managers have been more robust, with cash into funds dipping by just 0.1 per cent on average. The standout performer has been unlisted Evelyn, where annualised net inflows are running at close to four per cent.

The sharp slump for asset managers underscores the troubles facing money managers after a bruising 18 months in which investors have fled volatility shaking the market.

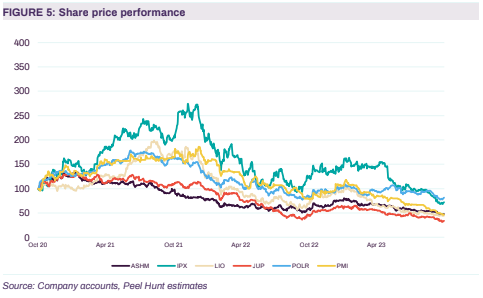

Share prices at London’s listed asset managers have fallen sharply. Liontrust and Premier Miton have fallen by over 50 per cent this year, while Jupiter is trading down around 36 per cent and Polar Capital by 10. Ashmore is trading gown nearly 30 per cent.

“After more than a decade of significant growth for Liontrust, the past year or so has been more challenging,” Liontrust boss John Ions said in a recent statement when it announced its results.

Emerging markets specialist Ashmore said in recent update that after three quarters of positive returns, a “period of consolidation within a longer recovery cycle is normal”.