L&G rises despite fall in first half profit

Legal & General saw its first-half profits plummet after stock market volatility wiped out the value of its investments, but the group’s shares climbed as it grew new business by 8 per cent.

Under European Embedded Value accounting rules, first half post-tax profits fell from £672m to £56m, taking into account the fall in L&G’s stock market investments.

Under International Financial Reporting Standards, this resulted in a £27m net loss, compared to a profit of £312 the previous year.

However L&G, which is the biggest pension fund manager and the third largest insurer in the UK, posted a 6 per cent rise in first half operating

profit to £626m, which came in at the higher end of analysts’ forecasts as annuity sales offset the impact of a weakening economy on protection and savings growth.

L&G, which expects sales to jump to £10bn across the market in 2008, said it wrote £1.4bn pounds in policies in the first half, up from £400m.

New business grew by 8 per cent globally to £806m while its institutional funds management division gained an extra £17.6bn in new funds.

L&G said it was pressing ahead with a £1bn share buyback programme, due to complete later this year, and confirmed its 7.5 per cent dividend growth rate.

The better-than-expected results came in at the top end of City analysts’ forecasts.

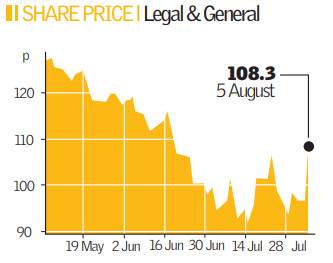

“Weaker equity markets inevitably create adverse investment variances which affect our reported after tax profits: these impacts can be expected to smooth out over time. We are confident of our ability to continue growing profitably,” said group chief executive Tim Breedon in a statement. L&G shares climbed more than 12 per cent to 108.9p, making it one of the biggest gainers in the FTSE 100 yesterday.