Letters: Steer clear of risky debt

[Re: Shoppers turn to buy now, pay later amid cost of living crunch, March 21]

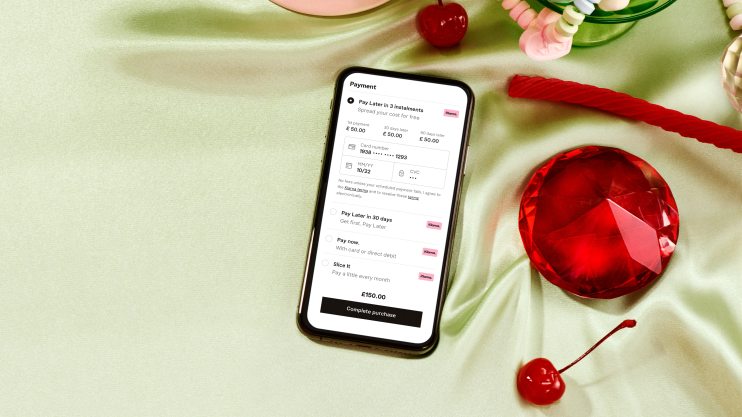

Buy now pay later is quickly changing the face of consumer finance. If used in the right way, the benefits it can bring to consumers are enormous. But – and it is a big “but” – this is no ordinary year. Prices are rising in all aspects of our daily lives. From your supermarket shopping basket; to the petrol you put in your car; to heating your home. The cost-of-living crisis will define our lives in the year ahead.

While it is true that people might need access to credit like never before, repayment schemes will only work if people can successfully repay what is owed. In research from Walnut Unlimited, over half of young people admit they are less confident at making their BNPL payments this year. At the same time, almost one in three -29 per cent – say they are “more likely” to use buy now, pay later schemes in 2022 than last year. So consumer demand is growing. Consumer need is growing. But people are going to be less and less able to make repayments.

Reputationally, the industry is on borrowed time. The cost-of-living crisis represents a very real danger for the finance providers and their users. The market needs regulation – it is coming but not quickly enough. Providers need to act now, ahead of regulation landing, to build reputation and recognition for responsible lending. We are only one slip away from disaster.

Tim Lines