Letters: Keeping the branches up

[Re: Four new UK banking hubs planned following sector-wide deal, Nov 2]

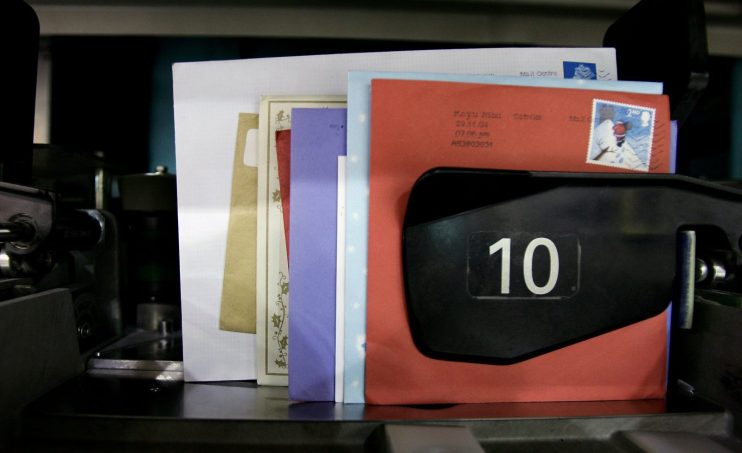

Four new UK banking hubs is a great result but it will take years to provide enough to replace the existing branch network – we must innovate now to find complementary solutions.

We’ve seen great strides in digital banking adoption, but 22.5 million people still intend to use bank branches.

As the cost-of-living crisis bites, access to in person advice will likely increase – without it people are at risk of being left behind.

Where banking hubs are not currently in existence there must be a push for other ways to offer physical banking experiences. Each interaction is an opportunity to help upskill customers who may require additional support in adopting technology, and to better understand barriers to use.

Physical services could be offered through the wider roll-out of mobile branches, visiting different communities on different days, or increasing accessible banking kiosks (for all banking brands), set up in shopping centres or high street locations.

Struggling branches should consider whether there are opportunities to offer non-banking services to help fund that branch, such as setting up a coffee shop or other services communities may want to use.

Jason Hill