Let’s face it: Profiteering is feeding the inflation beast, not just pay rises

Inflation is a pernicious beast that is plainly bad for people and businesses.

It can ease governments’ debt burdens by (artificially) boosting tax revenues, but that can lead to severe bouts of price rises that, often, lead to societal decay.

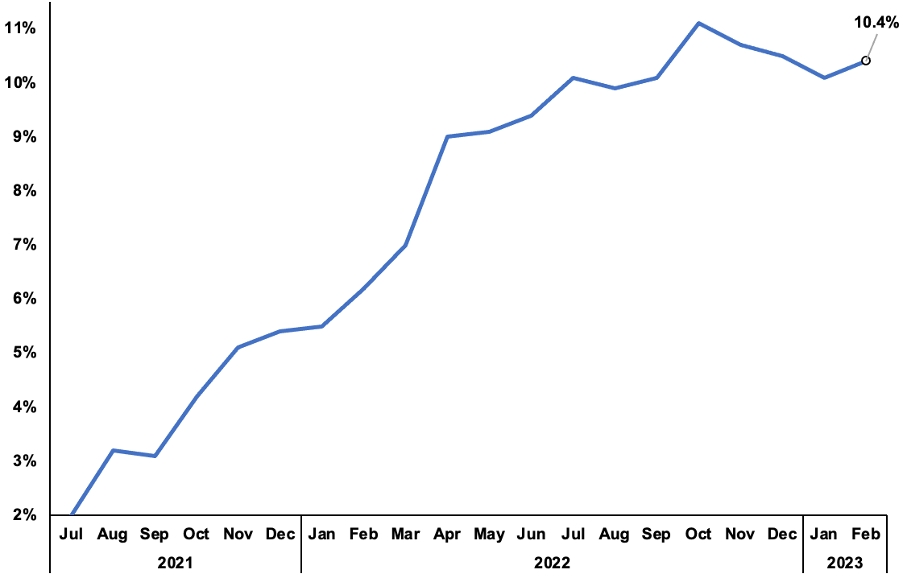

So it’s easy to see why policymakers in the UK are sweating over the rate of price increases staying in the double digits since September – it unexpectedly hopped to 10.4 per cent February, catching the City and Bank of England off guard.

Identifying what exactly is pushing inflation upwards is crucial to ensure people in charge of monetary and fiscal decisions don’t make mistakes that ultimately leave people poorer.

Doubtless Russia’s invasion of Ukraine represents the fattest wedge of the inflation surge over the last year.

This is how the typical economics textbook will breakdown how wage increases fuel inflation.

When prices begin rising quickly, workers raise their expectations for how high inflation will be in the future. That strengthens incentives for them to demand above inflation pay rises to protect their living standards.

Businesses respond by lifting prices to offset higher staffing costs, prompting staff to demand pay increases again.

A feedback loop, known as the wage/price spiral, then grips an economy.

It’s important to stress that it is inflation expectations, not real-time inflation, that can engineer that dynamic.

Current data from pollster YouGov and investment bank Citi shows Brits reckon inflation will be just under four per cent over the long run, a definite uptick from its recent trend.

Perhaps workers recognise firms will eventually pass on wage increases – running at a historic high of around seven per cent in the private sector – via higher prices.

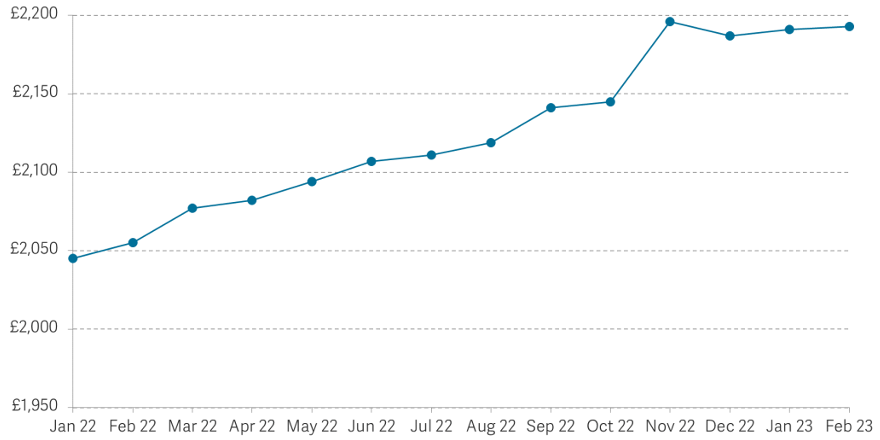

Pay growth has stalled since November

Examining more timelier data, however, indicates the role of wage increases in feeding the inflation beast has been thinning since before Christmas.

The media reports on the percentage change between the most recent level of pay compared to the same period year before.

While that stat captures changes in an economy over a year – and shows a huge uptick in private sector pay – it doesn’t measure what’s happening right now.

Actually, as pointed out by the economic think tank the Resolution Foundation, since November, the level of pay has stagnated (see graph).

“People doing PR for recruitment agencies have kept repeating that the labour market is hugely tight (and that firms need to employ their services). But signs of a cooling have actually been there for all to see,” the organisation said in a research note last month.

While monthly pay growth has stalled, monthly inflation has been creeping higher, hitting 1.1 per cent in February, clearly incompatible with the Bank of England’s two per cent annual target.

So what else could be driving inflation outside of wage increases?

A growing batch of economists have blamed certain sectors for taking advantage of the price surge by fattening up their margins above and beyond necessary.

“Even in the face of the cost of living crisis there are still a lot of people out there who are willing to pay higher prices, and firms are willing to set their prices high,” Catherine Mann, a member of the Bank’s monetary policy committee, said last month.

Samuel Tombs, chief UK economist at consultancy Pantheon Macroeconomics, highlighted in a research note recently that “supermarkets appear to have widened their margins”. Data from the ONS and British Retail Consortium show food prices are rising faster than ever recorded.

Inflation has raged for more than a year

European Central Bank officials have said they are weeding out companies who commit price gouging.

And even Bank Governor Bailey pleaded in an interview with the BBC after last month’s rate decision with firms to “understand” hiking prices steeply will hurt families.

There is evidence that companies are slipping through unfair price rises through the back door.

But it’s vital to remember that inflation is never black and white and is driven by many things.

Solely blaming steep pay increases, companies profiteering or Putin’s invasion of Ukraine is lazy.

One thing is for sure: the long living standards squeeze that has wiped £11,000 of annual real income increases from families since the financial crisis isn’t poised to let up over the coming decade.

WHAT I’M READING

Stephen King’s (not the novelist, the former chief economist at HSBC) new book traces inflation’s journey through centuries of data, drawing lessons from how not to and how to respond to price pressures. We need to talk about inflation, out later this month, is a decent economic tapestry.

YOU MIGHT HAVE MISSED

The Treasury is on track to bag just under £2bn in profit from the Help to Buy scheme. Maybe they’ll use some of that cash to launch another package to help first time buyers…