Let the good times roll: EY Item Club forecasts strong growth for UK financial services

The financial services industry can expect decent growth over the next few years, a group of forecasters have said today.

Mortgage lending, business borrowing and consumer credit are all set to grow at healthy rates over the coming years, as the UK economy shrugs off recent severe stock market declines.

However, the EY Item Club said financial services firms will be looking for an interest rate hike over the next year to help close the gap between lending and saving interest rates.

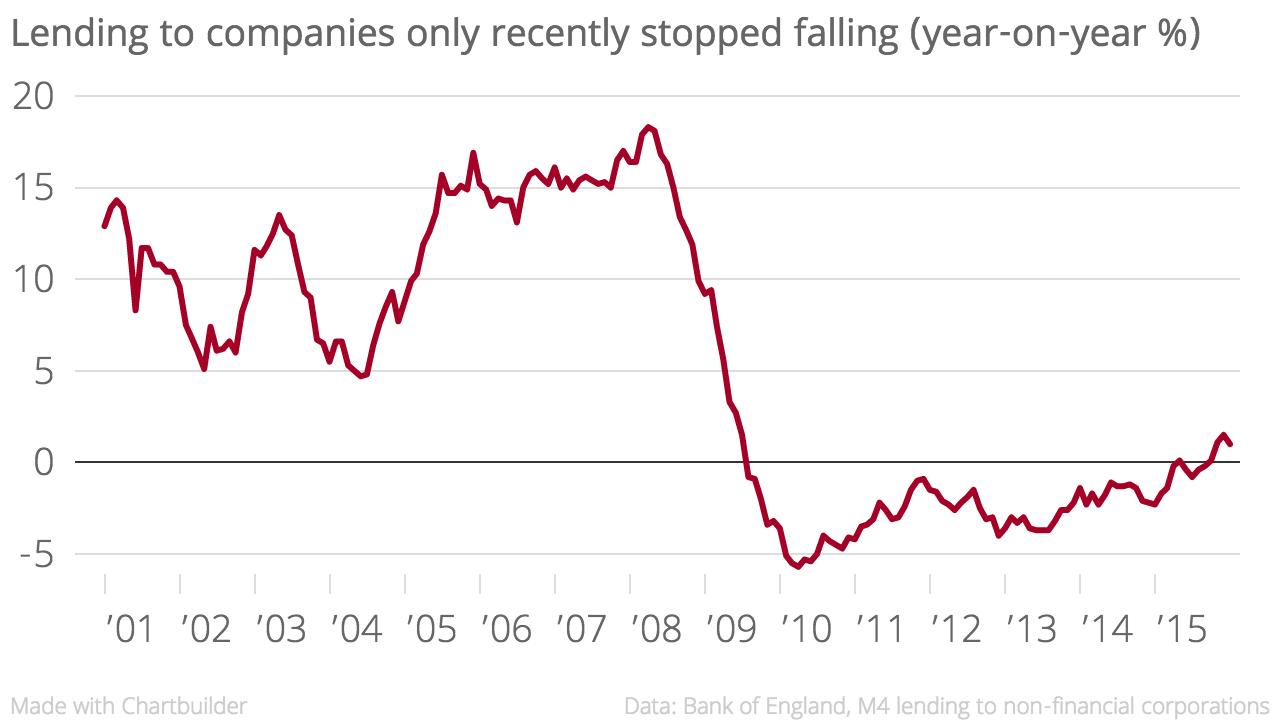

Business investment growth and low borrowing costs will help boost businesses’ demand for loans this year. The EY Item Club believes net lending to business will growth by an average of five per cent a year over the next four years. It compares with the average decline of six per cent per year from 2009 to 2014.

Last year’s boom in consumer credit is expected to taper off to a moderate annual growth rate of 5.7 per cent this year and four per cent in the three years to 2019. Most of last year’s rapid growth in consumer credit was due to the release of pent up demand for cars, with a record number of new car registrations in 2015.

Steady gains in house prices and household incomes are expected to fuel more mortgage lending. The UK’s total stock of mortgage debt is expected to grow 3.4 per cent this year, the fastest since 2007, but still below pre-recession levels.

Omar Ali, UK financial services managing partner at EY, said: “2015 was the first year for some time that the underlying economic fundamentals were good enough to support an across-the-board return to growth in borrowing by consumers, home buyers and firms.”

“If we can plot a course through the policy and politics, 2016 looks set to be a better good year.”

“However, the delay in any UK interest rate rise is causing some concern. Until rates rise, banks are going to struggle to increase the gap between lending and savings rates, and the prospect of higher returns for asset managers and insurers is pushed even further out.”