Landlords pick a fight with the CVA

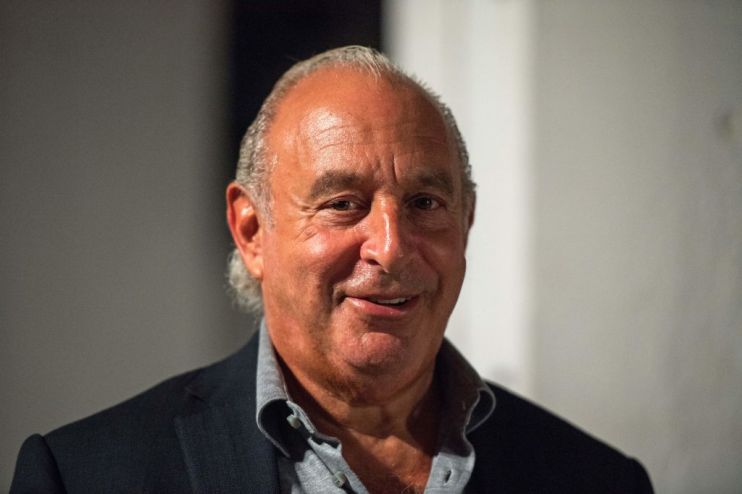

Is this the week Britain’s retail landlords fight back? After a slew of company voluntary arrangements (CVA) from the likes of Carpetright, Mothercare, Jamie’s Italian, New Look and House of Fraser, it seems there are only so many controversial rescue deals that high street property owners are willing to stomach. Today the biggest and most high profile CVA of all – that which is set to decide the fate of Sir Philip Green’s retail empire – will return to the spotlight. If the vote goes ahead, the outcome will be exceptionally tight.

Read more: Green offers landlords cash to save Arcadia rescue

Over the last seven days Green and his Arcadia directors have been frantically scrambling to shore up backing from landlords, pledging lower rent cuts at a personal cost of £9.5m to the Topshop tycoon’s family wealth. But news yesterday that embattled shopping centre owner Intu, which has the biggest single voice at today’s meeting, is planning to vote against the revised proposals means Green’s chances of winning enough support from creditors hangs by a thread. There is the very real possibility that Green could once again look to delay today’s vote, having seen he still does not have enough support, in a repeat of what happened last week. Much could depend on which way developer Land Securities chooses to vote.

In many respects, landlords face a lose-lose situation in today’s crunch meeting. If they approve the Arcadia CVA, they are agreeing to a swathe of rent cuts and potentially opening the floodgates to many of their other high street tenants demanding rent renegotiations. Yet if they block the CVA, they risk losing a tenant in their store, thereby risking vacancy and losing their rent altogether.

Elsewhere in the world of CVAs, several landlords (along with Mike Ashley) are said to be have been putting their weight behind challenges to the Debenhams restructuring plan which was passed last month.

That these retaliations are finally gaining steam is of little surprise in the context of the last 18 months: according to Colliers, nearly 900 stores covering 6m square feet have already become or are set to be vacant as a result of CVAs voted through since the start of 2018. But if the alternative to a CVA is a company administration that would likely include even more closures, then landlords looking to reject the contentious rescue plans should be careful what they wish for.