Ladies who don’t lunch: Sue Round talks fund management, sentimentality and being broke

Buongiorno signora!” bellows the exuberant waiter at Bolton’s, an Italian tucked away in an unassuming corner near Leadenhall Market. “Hello, hellooo” comes the response. I know Sue Round has arrived, even before I see her.

She greets me warmly, as if we’ve known each other for years. In fact, I’ve met Sue only once before – when we shot a video interview about the fund she manages.

Today, she is a lot more relaxed. The waiter asks her what she’d like to drink. “It’s Friday afternoon and I will have a Gin and Tonic.” I follow her lead.

Sue is a rarity in a world in which fund managers with long and stable tenures, let alone female ones, are in short supply. She joined Ecclesiastical in 1984, a small asset manager that started out in 1887 as the Anglican Church’s insurer.

She was in her mid-twenties at the time. Four years later, she became manager of the Ecclesiastical Amity UK Fund (called the Amity Fund at the time). It was one of the first socially responsible retail funds, launched after the company identified a demand for ethical investments among its customers – mostly clergymen and their families.

Today, the customer base has expanded exponentially, and 27 years down the line the fund is still going strong and so is Sue, although fund management was not her initial career choice. “I never intended to come into the City. I wanted to be a fashion buyer.”

She adds wryly: “In those days I was quite sylph-like,” and laughs. She still has plenty of style, a mixture of City practicality and flair, with dangling pearl earrings, manicured nails and a paisley patterned shirt.

Sue started out as a trainee buyer on Oxford Street. It was during the height of the IRA bombing campaign. There were constant security alerts. That didn’t put her off, but the hierarchical, ‘dead-man shoes’ nature of retail did. “It was just dull.”

She started casting around for something else and applied for a junior researcher position at an investment trust company. “I knew nothing at all about investment trusts. My father, who was an accountant, gave me some questions to ask, which I guess made me sound informed. He said: ‘ask them how much they distribute.’”

She got the job. “I was the office dogsbody. There were no Bloombergs – it was just ink, paper and a calculator. I learnt how to look at balance sheets, how to value companies. It was an important part of my education. My valuebased approach came from what I did in those early days – we were looking for companies that had lots of assets but which weren’t reflected in their share price.”

The hardest part, says Sue, was working in virtual silence. “It was quite a shock – you could hear a pin drop, which I found very disconcerting. I learnt quickly that you didn’t chat.”

Without any prompt, she adds that it was quite a male-dominated environment. “I suppose… I mean… it was sexist. I just never worried about it. It was just guys being guys. I never had really overt sexist remarks – maybe there were some, I don’t recall them. I just laughed it off.”

The early 80s was a time of takeovers and investment trusts were a prime target – buying the stock at a discount to get the underlying assets on the cheap. “We lost a couple of funds, which meant the firm got smaller and eventually closed.”

So she moved to Ecclesiastical, and ended up working for the man who appointed her for almost 25 years, until he retired.

“He was a good boss – approachable, supportive, he gave space and expected people to be self-motivated. He was also infuriating to work with.”

But four years into the job, under the age of 30, and the sole manager of a mutual fund – that’s quite a meteoric rise? “Things were different back then. You were expected to have a go. You weren’t expected to be qualified, to have a…”

A CFA, I offer. Sue sniffs. “I shouldn’t say this but I will. You teach people the same approach, and you make it part of the regulated framework, and everybody just learns the same things. So why are we surprised when people behave like sheep? ”

In the early days there were just two fund managers at Ecclesiastical, and for many years they remained a small office of only 12. It was always Sue’s intention to expand the range of funds, but it took a long time to get buy-in from the bigger group.

Did she ever think of leaving? “I did, but I like a good fight. I suppose I have spent a large part of my life battling with people. Of course I always think I’m right. But I have learnt through the years that there’s more than one way to skin a cat.”

Sue is clearly a “get-on-with-it” personality, but she does have a sentimental side. She still has the handwritten ledgers in which her first trades as a fund manager were recorded.

“Why do you keep them?” I ask.

“Sentiment – it shows how far the business has come. And it keeps me grounded.”

Judging by the quick-fire service at Bolton’s and the restaurant’s proximity to Sue’s office, the venue was chosen for pragmatic purposes rather than for its cuisine or boisterous owners. Sue sticks to one G&T and declines my offer of some wine with our meal. She’s got a meeting with a client later in the day.

How has the City changed in the last 30 years, I ask? For the first time during our lunch, where the conversation has flowed as swiftly as the service, Sue goes quiet.

“It has changed completely. There are elements of change that are good but I think we have lost what is important to the customer.

“When I started we had a stock-broking community, a merchant-banking community, very English, very old school – very geared to relationships and really understanding the client. If you had a relationship with someone, you trusted them and you trusted that they would operate in your interests. You were working together.

“That changed in the 1980s when the Americans came – they were much more aggressive. Yes, we might have been fuddy-duddies in the way we did things, but you had trust and you had integrity. I am not saying that things didn’t go on then that weren’t right but I am fortunate that I have worked in an organisation where you always did what is best for the customer.”

As a money manager, Sue’s track record is stellar. She’s outperformed her benchmark over most periods. She’s also an astute businesswoman, having persevered and grown the business into a small but dynamic asset manager which punches well above its weight. But what about managing her own money?

“I have invested in my own funds and other funds. I took most of the money out before the tech bubble to buy property. That was lucky.” She then funnelled it back in later. More recently, she’s taken it out again to buy property, in Turkey.

Her husband is Turkish – she met him when she was 36 years old. “My parents were horrified and so were his. Both sets eventually realized that we had a steadying influence on each other.”

What about her pension? She’s past the official pension-fund retirement age and, come next month, new rules mean those aged 55 and over will be able to get hold of their pension savings to spend as they wish. “The rule changes are very welcome but I am fortunate enough to have a defined benefit scheme (an index-linked pension) and you would be crazy to give that up.”

Has she ever been broke? “Oh yes, in the early 1990s. I had just got a mortgage, I separated from my boyfriend at the time and interest rates shot up. I was working in a pub on evenings and weekends to pay for my cat food.

“Sure, I was comparatively better off than a lot of people at the time, but it was tight.”

It’s time to go, but I want to make sure I get my facts straight. How old was she when she started in the City? “I turned 21 in the ‘silent office’.” She adds: “That was the year Margaret Thatcher won her first term in office. It was exciting, we had gone through the winter of discontent – the whole world was dark – and then she came along and everything changed.

“It took me a really long time to understand the changes she made at the time.”

I take it she’s a fan of Thatcher? “Yes, I am. Probably more so in her earlier days. I think she went a bit crazy in the end. I mean it was radical for a woman to make that kind of change. She commanded respect on a global scale.”

I interject: “Only to be betrayed by her own Cabinet.”

“Yes but she went too far. She thought she was always right and refused to listen. As a woman she should have managed that better.”

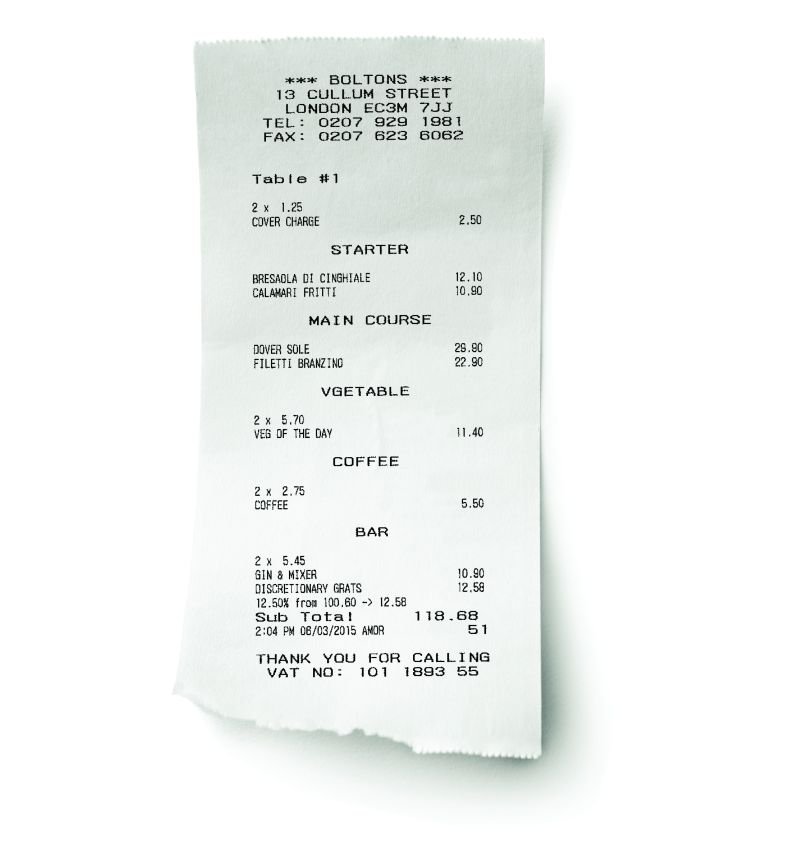

WHERE WE ATE

BOLTON’S, CULLUM STREET

LONDON, EC3M 7JJ

“Convenient for the City”

This is a simple Italian restaurant that is good value. Not very fussy. Good at understanding people are in a hurry often. Eaten here a number of times (pasta, fish, meat) and it has always been well prepared. If you want to impress or want something scenic then there are other venues.

Source: Tripadvisor

LADIES WHO DON’T LUNCH is a regular feature in which Maike Currie profiles a woman working in the City. All interviews are conducted at a restaurant table – as an exception, nothing is eaten within the proximity of a PC, with a plastic fork or out of a cardboard box.