KPMG set to run Caliber liquidation

Caliber Global Investment, the LSE listed mortgage-bond fund run by the hedge fund group Cambridge Place Investment Management, is seeking shareholder approval to appoint KPMG, the accountancy firm, to oversee its liquidation.

Caliber is unwinding holdings of US and European mortgage-backed debt, which totalled $908m in March 2007, after taking losses on subprime mortgages. The fund will ask shareholders to approve the voluntary liquidation at an extraordinary general meeting held in Guernsey on 26 September.

Cambridge Place, a London-based hedge fund manager, will continue to advise the company after a liquidator is appointed, but will waive its management fees, a spokesman for the group said last night.

The appointment of a liquidator has been on the cards since last year when the fund said it would change its strategy from investing in mortgage-backed securities to returning capital to shareholders.

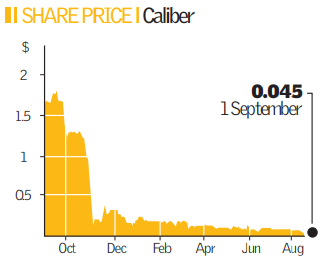

Shares in Caliber have fallen from around $1.7 last October to $0.045 yesterday as its prospects in the mortgage-backed securities market have been undermined by a lack of liquidity. Caliber managed $176m of securities directly, and through companies it created to buy bonds by borrowing, at the end of March this year, according to a company statement in June.

The company has assets of $9.9m, excluding those held by other companies it manages, it said in a 13 August statement. Cambridge Place was founded by former Goldman Sachs bankers Martin Finegold and Robert Kramer in 2002.

“Shareholders should get something back from this but not a lot,” a spokesman said yesterday. Cambridge Place is a specialist global institutional investment manager. KPMG declined to comment.