Klarna launches ‘pay now’ feature for UK shoppers

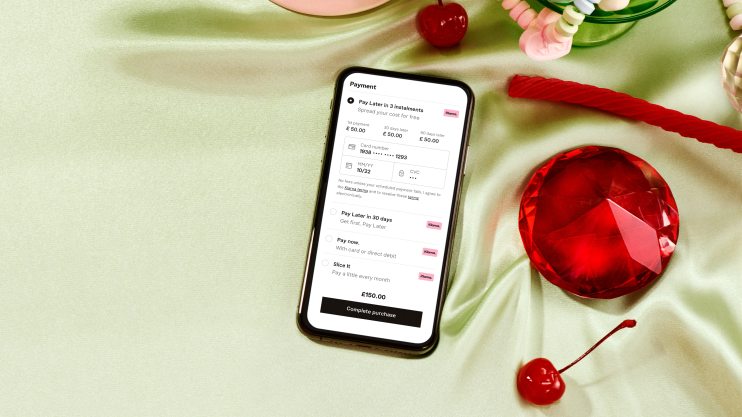

Buy now pay later (BNPL) fintech Klarna has branched out from its main service and launched a “pay now” immediate payment service in the UK.

From today onwards, British online shoppers will be able to choose to pay immediately and in full using Klarna, with the same payment experience as if they were to choose to pay later.

It’s a change that has been launched alongside more visible language at checkouts that underline that BNPL options are credit products, and its own dedicated complaints adjudicator.

“We firmly believe that most of the time, people should pay with the money they have, but there are certain times where credit makes sense,” said Sebastian Siemiatkowski, Klarna’s Co-founder and CEO.

In those cases, our BNPL products offer a sustainable and no cost healthy form of credit – and a much needed alternative to high cost credit cards

Both moves are likely a response to the criticism the sector has come under from campaigners warning that it can encourage consumers — particularly younger shoppers — to rack up debts.

Citizens Advice recently found that one in ten UK shoppers who choose to pay for products using buy now pay later have been chased by debt collectors, amid exploding demand for the services since the onset of the pandemic.

Crucially, the new research found that only 11 per cent of BNPL services warned shoppers they were taking out a credit agreement. The remaining 89 per cent included this information in small print or in the T&Cs.

BNPL enables buyers to delay payment with no incurred interest, for up to 30 days after purchase, or alternatively to spread repayment across six weeks to four month installments.

The sector is not currently regulated and relies on an exemption from consumer credit rules, though this has led to inconsistent practices.