A defence of buy now, pay later: a new retail landscape needs new payment systems

After a tumultuous year for retail, there finally looks to be light at the end of the tunnel as the vaccine roll out paves the way for stores to return to trading this spring. As the UK economy begins to reopen, retail will play a critical role in driving its recovery however, it won’t quite be “back to normal”.

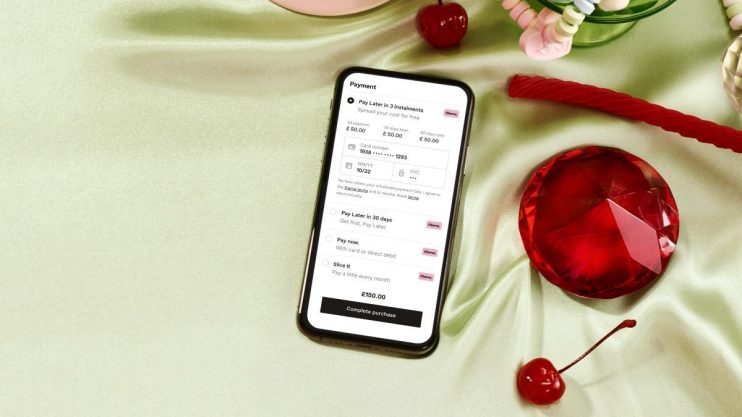

Consumer trends have changed drastically over the past year. We have changed the way we shop, the way we engage with brands and the way we pay. The growth of “buy now, pay later” (BNPL) solutions have been at the core of this.

A new report, ‘BNPL and The New Economic Landscape’, was launched this week by independent economic consultancy firm Capital Economics. It gave a detailed analysis of BNPL as a payment method, including why consumers and retailers are using it, the challenges the sector faces and the role it can play in driving economic growth.

For Klarna, the findings around the growth of the sector come as little surprise. The pandemic has accelerated underlying market trends, particularly when it comes to embracing online shopping and new ways to pay.

In 2020 online transactions leapt from 20% to 30% of overall retail sales and household savings increased to £300 billion compared to £100 billion in 2019. Those fortunate enough to have weathered the economic impact of the pandemic will be critical to the UK’s recovery, but they’ll also be more cautious and looking for payment methods that cut upfront costs and boost flexibility.

It is this demand that has driven a marked shift away from credit and towards debit and where BNPL has risen to the challenge of a new type of consumer.

Last year, more than 10 million adults used deferred payment schemes.

And yet, as the report makes clear, BNPL is still only at the beginning of its growth trajectory, equal to a little less than 2% of all credit card purchases.

Traditional business models, where the rich gain interest free benefits, loyalty points and other perks, subsidies by interest and late payments, disproportionately from those with lower incomes, are broken. Yet, there are rich opportunities to fix it.

Using BNPL instead of credit cards, UK consumers were able to save over £75million in interest payments last year. As more consumers choose BNPL and it continues to grow and gain share, the potential for savings on interest payments will also increase.

But BNPL solutions aren’t simply a substitute for credit cards.

According to the analysis from Capital Economics, a third of those who purchased something using BNPL last year said that if it wasn’t an option, they would have used their debit card instead. That suggests that other benefits like flexibility and convenience of handling returns were driving their decision to use deferred payments.

However, as the BNPL sector continues to grow we need to step back and look at the challenges it faces.

As with any high-growth market, an influx of new players, established incumbents and widely varying models means there’s ample room for confusion.

Collectively the industry must ensure it provides consumers with the information they need to make appropriate choices whilst protecting them should anything go wrong. This is one reason why we have long been calling for regulation of the sector and we look forward to working together with the government, the FCA and the wider sector to build a modern regulatory and supervisory framework that delivers the best outcomes for customers.

Like many of you, I’ve been looking forward to getting back to exploring the high street again – but it’s becoming increasingly clear that the future of retail will be drastically different from the past. Let’s all use this opportunity to reset and establish a consumer finance industry which is fairer, more transparent and has the best interest of consumers at its heart.