KKR seeks new talent ahead of float

Top executives at KKR, the US private equity group which is to merge with one of its funds and list in New York, said yesterday it would set aside a stake in the business to attract “new talent”.

KKR will hold 79 per cent of the new quoted company, but will allocate 20 per cent to award to new and promoted employees.

The remaining 21 per cent will belong to KKR Private Equity (KPE), but Contingent Value Interests (CVIs) attached to the deal could see KPE unit holders net a further 6 per cent, if the share value dips below $22.25.

Co-founders Henry Kravis and George Roberts yesterday stressed the difference between the listing and previous private equity flotations. They said that the interests of KKR executives and KPE shareholders would be “fully aligned” and that they would be subject to a vesting of six to eight years, although this could be waived. KPE shareholders would also be offered the chance to vote on the deal. Roberts said: “Taking this step now shows our confidence in the long term future of KKR. This is the next step in KKR’s evolution.”

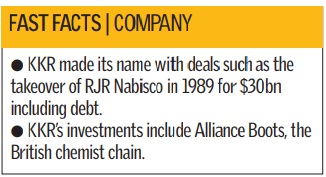

Launched by Kravis and Roberts in 1976, the leveraged buyout giant is best known for its $25.1bn purchase of RJR Nabisco. KKR has been one of the most prolific buyout shops and has worked on deals including the $45bn buyout of power firm TXU.

Its 2006 launch of KKR Private Equity Investors LP struggled, though, as the value of its holdings have declined and it has recently posted losses tied to the sale of certain assets.

KKR Private Equity’s assets declined in value by $159.7m during the year to the end of June. The company’s net assets came to $4.56bn as of 30 June.