King’s shares crushed on first day trading

Candy Crush maker’s shares slump 15.6 per cent in first day of New York trading

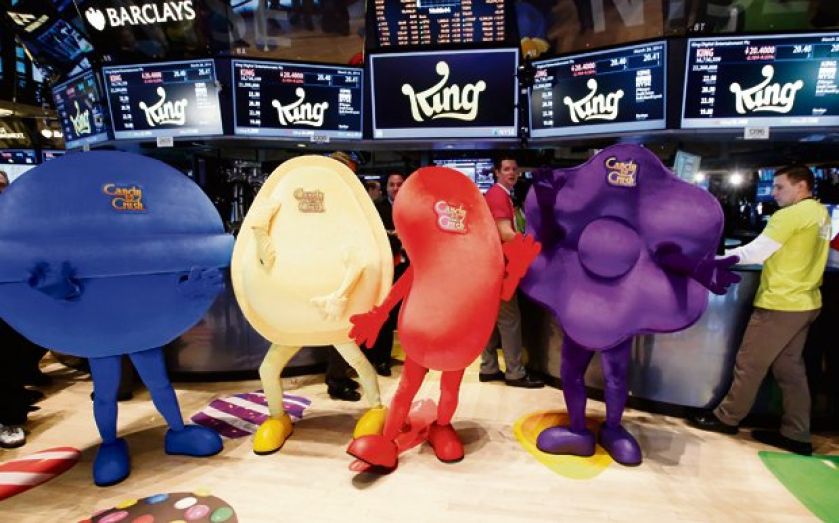

KING, the British game developer behind hit mobile game Candy Crush Saga, was bloodied yesterday during its debut on the New York Stock Exchange, with nearly $1bn (£600m) wiped off its market valuation.

Shares in King, which had been priced before the float at $22.50, dived 15 per cent to $19.08 just moments after chief executive Ricardo Zacconi rung the New York Stock Exchange’s opening bell.

The lacklustre opening underscores concerns that the company could turn out to be a one-hit wonder built around Candy Crush Saga, 2013’s most popular app on iPhone and Android devices.

Zacconi described the disappointing debut – that left the firm with a valuation of $5.9bn, below an expected $7bn – as the start of a marathon for the company, adding: “I think the opportunity [for King] is great.”

Yesterday’s float marks the biggest initial public offering from a European technology firm since Russian search giant Yandex’s $1.4bn listing in May 2011, but is now seen as a disappointment by analysts.

“This was mispriced,” said Arvind Bhatia, a senior research analyst at Sterne Agee.

“There are a lot of initial public offerings in the pipeline so investors are not starving… and are being picky. Today’s action also says investors are not going to ignore fundamentals.”

King offers over 180 games but its two-year-old Candy Crush Saga, which is free to download and offers paid-for extras, accounted for around three-quarters of the company’s revenue for the last three months of 2013.

King’s float comes in an industry that is highly susceptible to shifting trends. The boom of Facebook gaming in 2011 buoyed Farmville-maker Zynga from a valuation comparable to King’s up to $12bn in early 2012, but its market capitalisation has since shrunk to just $4.2bn. Twitter floated last year with a value of $14bn, having never turned a profit.

King made profits of $567m on revenues of $1.88bn last year and says it is confident that its games are more than just a passing fad. In its prospectus to investors, King said: “We believe we have a repeatable and scalable game development process that is unparalleled in our industry.”

But King’s reliance on a single game – Candy Crush Saga accounts for 78 per cent of King’s total bookings – is likely to come under increasing scrutiny.

“The market is so concentrated with very few titles at the top, and King has been a beneficiary of that with Candy Crush Saga, but the real challenge is being able to repeat that success and we haven’t seen many companies that have had that repeat success with titles,” IHS gaming analyst Jack Kent told City A.M.

Zacconi, who founded the firm in 2003, told CNBC yesterday: “What we want to achieve is not to find another Candy Crush. That’s not what we are here for.

“What we are here for is to build a portfolio of games. We want to build a network of players, of loyal players, who play our portfolio of games,” he added.

King’s dismal debut dragged down other gaming stocks yesterday. Zynga shares fell 4.1 per cent, while smaller player Glu Mobile slipped 4.5 per cent. King’s shares closed down 15.6 per cent at $19.00 following the disappointing opening day.

JP Morgan, Credit Suisse and Bank of America Merrill Lynch were the lead underwriters for the offering.