Kentz posts rise in profits as bid battle continues

ENGINEERING and construction firm Kentz’s takeover approach from Amec reached a stalemate yesterday, after its first-half results failed to impress the larger rival’s management or shareholders, City A.M. understands.

The FTSE 250-listed firm posted a two per cent rise in revenue to $775.2m (£498.8m) and a 2.9 per cent increase in pre-tax profit to $52.7m, but Amec argues that this is mainly due to a profitable Australian contract which runs out in a year and a half.

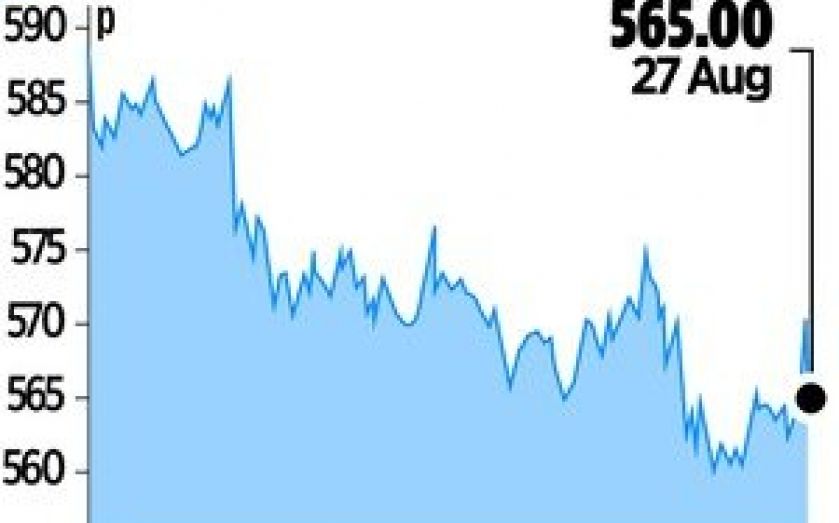

Kentz confirmed earlier this month that it had rejected indicative offers from Amec and Germany’s M+W, claiming they undervalued the firm. Amec’s offer was highest, valuing the company at 565p to 580p per share, equating to £680m. It is thought that Amec is not willing to increase its offer before the 16 September put-up-or-shut-up deadline unless Kentz can show that it can generate greater value.

Some of the FTSE 100-listed firm’s shareholders are said to have questioned why Amec would pay a higher multiple for a company with lower margins than its own.

Kentz shareholders would be open to offers of 650p to 670p per share, according to reports over the weekend.

“The board of Kentz remain confident that we can continue to deliver strong growth and returns,” said chairman Tan Sri Razali. “We are confident…that the future of Kentz will continue to be a successful one.” Kentz’s shares closed 0.4 per cent lower at 565p.