Jury out for interest rate

Analysts were divided yesterday on what the unexpected leap in inflation would mean for the direction of interest rates.

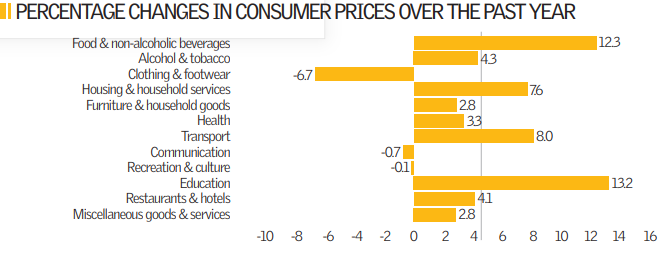

The 4.4 per cent annual inflation rate is more than double the Bank of England’s two per cent target. Normally such a sharp increase would lead to an automatic rise in official rates, but with the economy teetering on the brink of recession its hands are tied.

Bank of England policymakers had already seen the inflation figures at their meeting last week when they left rates unchanged at five per cent.

After the official data was released, interest rates futures markets attached around a 15 per cent chance the central bank would cut rates to 4.75 per cent in December, and a more than 50-50 probability rates would be cut in February.

“A cut within the next couple of months looks well off the agenda. Indeed, a rate rise is still a possibility,” said Vicky Redwood, at Capital Economics. But Howard Archer, economist at Global Insight expected interest rates to remain on hold in the belief inflation would retreat.

Analysts Views: Where do you see inflation peaking?

George Buckley (Deutsche Bank): “Our preliminary forecast is for inflation to reach 4.7 per cent in August. This looks set to rise further as the remaining energy providers raise their prices. We continue to believe, however, that this will not lead to higher interest rates, but rather that the slowing in growth will prompt rate cuts by early next year, once the peak in inflation, probably around 5 per cent before the end of the year, has passed.”

Michael Saunders (Citigroup): “We expect CPI inflation to rise to about 4.7 per cent year-on-year in August as household energy prices rise, reaching about 5 per cent year-on-year around the year end. Thereafter, even with the recent drop in global commodity prices, and the likelihood that the UK economy is in recession, we expect CPI inflation to stay above the 3 per cent letter-writing level until quarter three next year, staying also above the 2 per cent target throughout 2009 and 2010.”

Richard McGuire (RBC): “We see inflation peaking at 4.8 per cent in September this year, up from yesterday’s 4.4 per cent print, with this further increase driven by rising utilities tariffs. While the risk of CPI inflation touching 5 per cent in the coming months is not insignificant, the recent pronounced drop in energy prices informs our modestly more benign outlook. We see CPI inflation remaining above 4 per cent until the turn of the year but to then decline rapidly to fall comfortably below the BoE’s target of 2 per cent in the latter half of 2009.”