JP Morgan’s digital retail bank Chase launches in UK

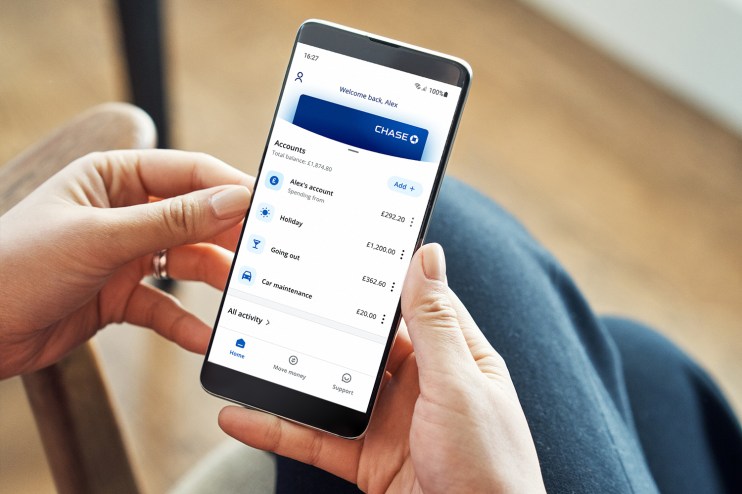

JP Morgan has today launched its new digital-only lender ‘Chase’ in the UK, as it aims to become one of the biggest banks in the country.

In its first international expansion through a retail operation in the bank’s 222-year history, JP Morgan will initially offer only current accounts through the new lender Chase, before introducing other products like savings and loans in the future.

“Having spoken extensively to consumers across the UK, we know that people want good value combined with an excellent experience, from a trusted bank,” said Sanoke Viswanathan, CEO of the newly minted bank.

It comes after three years of secret development at the bank’s Canary Wharf UK headquarters and a significant but undisclosed investment by the bank in what is one of the bank’s top three ongoing projects, Viswanathan has previously said.

And the number of employees involved with Chase exceeds that of many startups, with 400 focused on the project in London, 200 in Edinburgh and 250 more in India and the Philippines.

The bank plans to invest heavily into the UK operation and accumulate “millions of customers over time” to be viable, Viswanathan told the Times last week, before potentially expanding into other countries in Europe and Latin America.

Chase will face substantial competition in the increasingly crowded UK digital banking market, with well-established fintechs Monzo, Starling and Revolut having gained significant market share in the past few years as consumers transferred from traditional banks.

It also comes after US rival Goldman Sachs launched Marcus in the UK three years ago with more of a savings focus.

In June, JP Morgan bought UK robo-adviser Nutmeg in a £700m deal, acquiring its customer base of over 140,000 and its £3.4bn assets under management, and the bank is eyeing up further acquisitions as Chase grows.

“First impressions are that this new account will blow the competition out of the water, with an attractive cashback deal and a market-beating interest rate on its savings feature,” said Laura Suter, head of personal finance at AJ Bell.

“The fact that Chase is paying 5% interest on its round-up savings makes it very attractive. The top rate you can get from other banks paying interest on their round-up feature is 0.25%, meaning the new Chase rate leapfrogs those offerings,” she added.