Johanna Kyrklund: Time to slow down (but not too much)

In my family I am often mocked for being a cautious and slow driver. So it was ironic and a source of great amusement to them that I recently received a speeding ticket and had to attend a speed awareness course.

One of the main messages from the course was that as a driver you should not only observe the speed limit, but also the conditions around you. Just because you can drive at 60 miles-per-hour, doesn’t mean you should.

I thought there was a parallel to be drawn with investing; you have to watch valuations, but also the broader market environment around you.

Right now, equity valuations suggest it’s time to slow down in markets, but you can’t take your foot too far off the gas due to the dearth of more defensive options.

It’s a predicament that reminds me of the 1994 blockbuster movie Speed.

For those of you unfamiliar with Keanu Reeves’ oeuvre, in Speed he and co-star Sandra Bullock are in a bus which must keep above 50 miles per hour. If the speedometer dips below that level, the bus will explode.

While investors are not facing a literal fireball, those who drive too cautiously may be figuratively setting fire to potential investment returns.

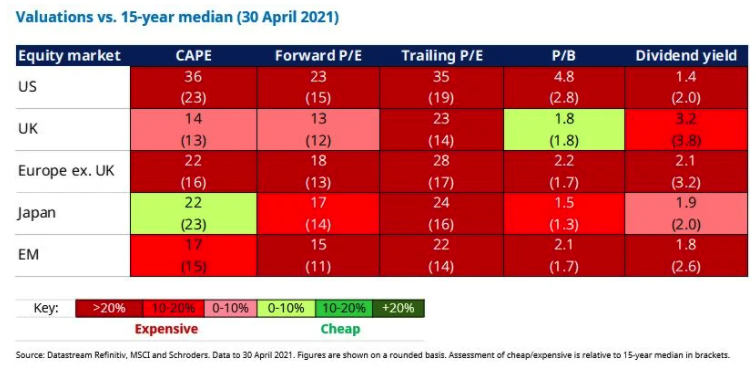

There’s no denying that equity markets are expensive. Just look at the sea of red in the table below, which shows how the valuations of major equity markets around the world compare to their 15-year medians.

The darker the red, the more expensive compared to history (according to a variety of measures, which are explained at the foot of this article).

But it’s clear there isn’t an abundance of defensive assets around to head for. Cash yields virtually zero. Government bonds are not much better – the days of getting 5% from US Treasuries or gilts seem like a distant memory.

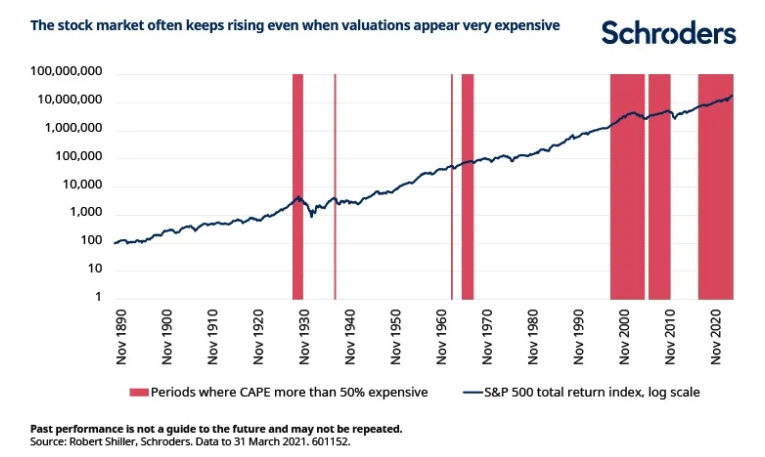

What’s more, just because market valuations are expensive, it doesn’t mean they can’t keep rising, as the table below shows. Trying to time the top of the market is not only impossible, but can be very expensive.

It may not be time to sell equities, but it’s probably time to curb your enthusiasm somewhat as it’s getting late in the game.

To continue the driving analogy, we’re off the motorway now and a more skilled driver is probably needed. Rather than being all in on equities, a more dynamic – and dare I say, multi-asset – approach may be needed.

Discover more from Schroders:

– Learn: The pros and cons behind the SPACs craze sweeping the market

– Read: The equity sectors best at combating higher inflation

If there is a lack of alternatives to equities currently, then you might ask what good a multi-asset approach is. Well, the advantage of such an approach is the ability to respond quickly and tactically as circumstances change.

Should bonds sell off, for example, there may suddenly be interesting opportunities, or should there be unexpected bad news on the Covid front, you may need to act fast.

We don’t have a crystal ball as to what’s around the corner, but as investors we just need to assess the range of probabilities. And it’s clear that there has been a shift in the balance of probabilities compared to when the positive vaccine news emerged in November.

Since then, both the MSCI World and S&P 500 have risen around 20%. So the potential upside remaining has probably shrunk, while the potential downside has grown.

The odds aren’t as attractive now, but it’s too early to be overly defensive. There is no recession on the horizon; you need to stay invested and you can’t sit in cash.

In my recent updates since the vaccine news of November I have singled out value, banks and Japan as the areas I favour in equity markets. The first of these two have worked out well and are positions I still like, but Japan hasn’t worked out so well as Covid-19 has re-taken hold in a way we didn’t expect.

In general the “reopening” trades have played out to a large extent now and markets have become more nuanced. Markets are getting more volatile, which is a sign that this current cycle is getting long in the tooth.

At such a time, rather than taking drastic measures like Keanu and Sandra did in Speed, it’s best to just drive more carefully.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.