Jet-setting Brits ready for summer but it’s oil prices that could really take off

Airlines are finally emerging from the gloom of the global pandemic.

Having weathered record fuel prices and a sharp downturn in customers, the industry is looking forward to a surge in demand, with major airlines forecasting bumper profits for 2023.

Such resurgent demand in the world’s most developed economies across Europe and North America should lead to booming fuel consumption – which could prove to be a major tailwind for oil prices.

After all, data shared with City A.M. by analytics firm Cirium, clearly shows flights will surge this summer, with airlines rapidly closing in on pre-pandemic levels amid an uplift in departures.

The figures provide a breakdown of take-offs for the UK’s largest airlines in the third quarter, revealing that most are expecting to see a rise from 2019 levels.

Ryanair, Jet2, Virgin Atlantic and EasyJet are all predicted to see increases in departures when compared with 2019, with Jet2 expecting the highest rise to reach 119 per cent of its previous total. British Airways is forecast to hit 88 per cent of pre-pandemic levels.

Overall, UK departures are expected to reach 90 per cent of 2019 with over 49m flight seats filled, representing a near full recovery, Cirium’s figures show.

According to Lufthansa’s Director of Sales, Heinrich Lange, the travel boom can be attributed in part to “special effects” such as “pent up demand,” after years of restrictions. Other recent developments like the re-opening of travel to China and Japan have also provided a welcome boost.

“Obviously now over the past summer and for sure in summer 2023, we’re looking at an aviation market which is mostly free of restrictions, and we see this coming back into full fruition,” he said. “I think for us, it showed that people and customers still want to connect to each other and I think especially during summer.”

Lange told City A.M. that the Lufthansa Group has already added 20 per cent capacity for flights, with the company doing “a lot of preparation,” including investing in more staff for the coming months.

Deidre Fulton, an analyst at the intelligence company OAG, said that “there’s no doubt that demand is certainly strong.” Holidaymakers have remained unperturbed by the cost of living crisis, she explained, with many “still prioritising travel.”

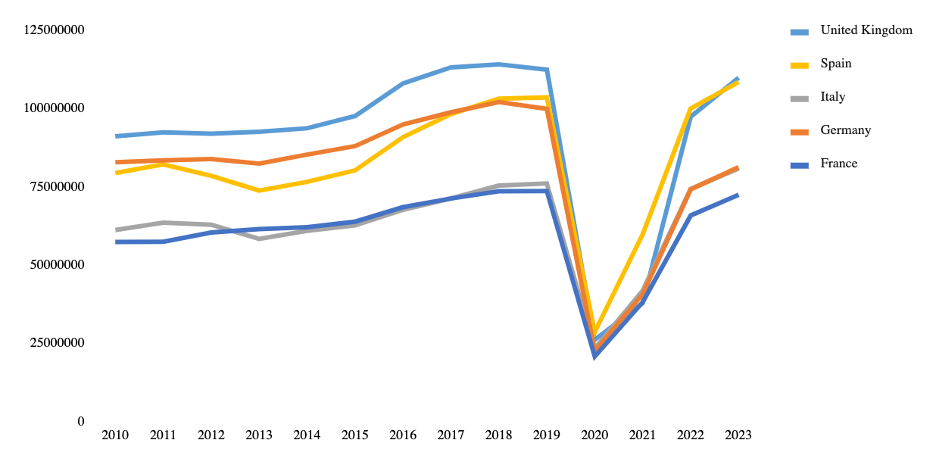

Data provided by OAG breaks down summer season capacity figures for Western European countries over the last decade. Capacity refers to the number of seats an airline plans to offer over a set period and is a good indicator of demand.

The UK has seen the sharpest recovery from pre-pandemic levels, just pipping Spain to take top spot at 109,789,521 seats this summer.

Oil markets reflect robust travel demand

This resurgent enthusiasm for air travel has helped prop up oil prices into spring, with both major benchmarks trading at around $75 per barrel – a robust valuation amid global recession fears and the contagion effect of February’s banking crisis.

The question is whether it can help drive oil prices this summer, with growing expectations of Federal Reserve hikes eating into gains made after OPEC+’s heavy cuts to oil output last month.

Callum Macpherson, head of commodities at Investec, told City A.M. that resurgent demand in jet fuel across the UK and Europe was a strong demand factor, but that it was already priced in – meaning it was unlikely to drive oil benchmarks this spring.

Instead, a revival in air travel from China, the world’s largest oil consumer, in the second half of the year was more likely to boost prices.

He said: “The key question mark is over Asian demand. There is a widely held view in the market that Asian oil demand will increase in the second half of the year and jet fuel will be an important component of that”

Craig Erlam, senior markets analyst at OANDA, also believed holiday bookings were not solely capable of driving up prices.

However, he argued the boost in tourism could suggest the UK’s wider economy was stronger than anticipated – which could be a key tailwind for oil if it leads to rising consumption across developed economies.

He said: “On its own, I don’t think holiday bookings are going to be a strong factor in the price of oil moves over the next month or two but should they prove to be indicative of overall household financial health, it could be a supportive and bullish factor, as it reflects the wider economy.”

The return of Western tourism might not be enough to cause oil prices to rise further this summer – but it could reflect a more optimistic vision for an economy teetering on the brink of a recession which could have benefits beyond oil markets.