Jeremy Hunt is at sharp end of economic consensus on childcare revolution

It’s rare for consensus to emerge in economics.

Quibbles about the role of the state in society, the level of taxation and where to spend taxpayers’ money often turn into heated arguments thrashed out in just a handful of words on social media.

But for once people interested in policymaking are behind around one area that’s in need to change: childcare support.

Even former Prime Minister Liz Truss made stepping up help for young families a pillar of her strategy to fortify the UK economy, though her proposals (like nearly everything else) were ditched.

The thread that joins these respective recommendations is a realisation that Britain is forgoing missed output by allowing families to fend for themselves.

At a time when experts at the Bank of England have warned the UK over the long run can produce less than one per cent of economic growth each year without stoking inflation, we need all the supply side improvements we can get.

So, what can parents claim from the government at the moment?

Some 30 hours per week of free childcare for most of the year for children aged three and four if they are working and mostly during term time. It’s 15 hours for everyone.

Most can also get up to £2,000 of tax-free childcare per child.

Support is targeted at children aged three and four, probably due to the assumption parents can leave from work during a child’s very early years to care for them.

This current set up has its benefits. It incentivises people into work so they can claim the full-fat support.

Experts reckon we can do much, much better, though, and they may have reason to think so.

Britain presently spends around 0.1 per cent of GDP on childcare, the second lowest in the OECD, the group of rich countries.

Perhaps most worrying is that loads of allotted spending is going unused.

“Tax free childcare… has seen terrible rates of take up. Of an estimated 1.3m eligible families in the UK, only 282,000 families were using it in spring 2021,” according to the Resolution Foundation.

Exceedingly low take up indicates the system is way too complicated for people to navigate and identify the most cost-effective support to tap.

Those deciding to use universal credit to fund childcare often have “no support… for the initial upfront costs of childcare” due to cash being paid monthly, “a clear barrier to entering work,” the Foundation said.

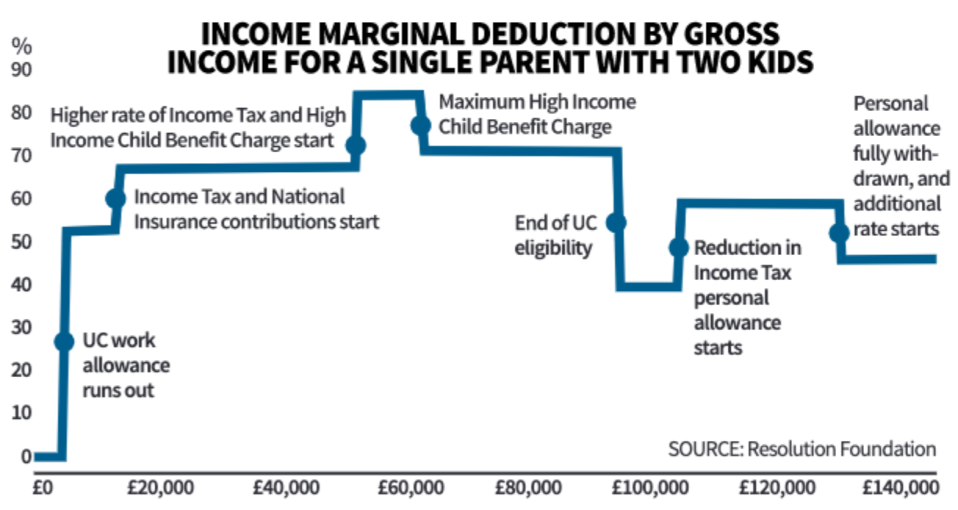

Among the stupidest policy designs – and one which has been overlooked – over the last decade has been the level at which families see their child benefit removed.

A household with one child that has an earner on between £50,000 and £60,000 will be subjected to child benefits eroding the more they earn.

That threshold has been frozen since the measure was introduced around a decade ago.

Some families in that situation can have 60p in every additional £1 they earn taken away, an eye watering marginal tax rate.

A simple solution to that mishap is to just raise the level at which the taper kicks in, something that should’ve happened, if not yearly, every other year since its inception.

Under the current regime, that group are disincentivised from working more or harder to bag a pay rise. That means lost output for the economy and income for the Treasury from foregone wages.

“For some people with young children, the financial rewards from working (or working more hours) may not be worth it, once personal taxes and childcare costs are taken into account,” former Bank of England rate setter Michael Saunders and now senior adviser at Oxford Economics said earlier this month.

As has been well documented recently, Britain stands out as the only rich country to be suffering from an acute and possibly structural workforce participation problem, with around 900,000 fewer people out of the labour market since the start of Covid-19. Getting people back into work by taking some of the strain of childcare off of them would help tackle that.

The Treasury hasn’t batted away the batch of calls from business groups to step up childcare support, signalling Chancellor Jeremy Hunt is readying something at the 15 March budget.

Firms would round behind such a move.

As former director general of the CBI Tony Danker put it last week: “The UK needs a childcare revolution. We simply can no longer trail other countries in enabling parents to work.”

WHAT I’M READING

The value of Brits’ savings that initially swelled during the Covid-19 crisis and have since kept rising has been eroded by rampant inflation, signalling economists’ bets on spending holding could be a bit overcooked. That’s according to Capital Economics, who reckon “from now on, real consumer spending will have to evolve in line with real incomes”. Remember experts have warned we’re in for a huge real income shock this year.

YOU MIGHT HAVE MISSED

All the upbeat data of late has had economics journalists in a pickle. Britain might actually avoid a recession this year. Eggs on faces all round if we do.