JC Flowers seals Refco futures deal

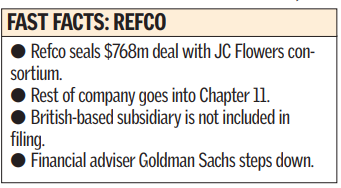

American hedge fund Refco has thrashed out a deal to sell its core futures brokerage to a consortium led by JC Flowers and has decided to put the rest of the company into Chapter 11 bankruptcy protection.

The beleaguered company agreed heads of terms for a $768m (£440m) deal to sell the division yesterday.

Also backing the sale are Silver Point Capital and the Texas Pacific Group.

The rest of the company is now in Chapter 11, except for the regulated overseas subsidiaries including British based European operation, Refco Overseas Limited.

The move will protect it from creditors. However, following changes to American bankruptcy law on Sunday it will no longer be entitled to indefinite protection.

Financial adviser Goldman Sachs, which also advised Refco on its IPO, will step in now the company has gone into Chapter 11.

However, M&A Boutique and Greenhill will continue to advise the company.

Refco’s sale follows 10 days in which the company has spiralled downward, following the discovery of a $430m black hole in the company. British-born chief executive officer Phillip Bennett was put on leave after he was implicated by others in a secret loan deal.

JC Flowers is run by ex-Goldman Sachs partner Christopher Flowers who left to form the financial services buy out firm, which currently manages around $1bn. Another former Goldman executive Mark Winkelman will be the new chairman.

Flowers said yesterday that he was interested in buying all of the group’s businesses.

He revealed yesterday that he had an option to do so and that he was “keenly interested”.

It also emerged yesterday that Bagwag, the Austrian bank, had lent Bennett more than $424m (£243m), who is now accused of fraud.

The New York Stock Exchange said yesterday that it would delist Refco’s shares which were suspended from trading last Thursday after they had plummeted 72 per cent in four days.