It’s time to stop obsessing with the price of Bitcoin and look to the future

The week in review

with Jason Deane

My process for writing this Friday morning column looking at the previous seven days is a simple one.

I log key stories that occur in the week, look for trends and topical concerns and combine them all in a fashion that one hopes is interesting and educational for the reader. Since each story is logged separately, sometimes those trends aren’t actually entirely obvious until you review them together at the end of the week. This week was one of those weeks.

Looking back over my notes, this week has all been, more than ever, about price.

I know we talk about Bitcoin price a lot anyway, but even a cursory Google search on the subject for the period reveals almost every article being about dollar values and where it might go next. Collectively, we’re obsessed with it.

During a webinar I was giving this week almost all the Q&As were about price, whether we’d reached bottom and where I thought we’d go next. Those answers were long and qualifying, but in short, they stated “probably” and “upwards” (for whatever those opinions are worth).

Yet while the world obsesses over positions and portfolios, the industry builds unabated and it’s only when you step out of the office and physically join a group of focussed people who are actively working in the space that you get the sense of just how much is going on.

On Wednesday I had the pleasure of attending the Crypto AM 4th birthday event in Canary Wharf in London, even despite the dodgy trains. As always, I met some fascinating people working in different areas of the finance and crypto worlds, but they all had one thing in common – they were all excited about the projects they were working on and the future in general.

There was no focus on the Bitcoin price (except as the basis of a few self-deprecating jokes) but there was a sense of urgency that we must get this done, and done properly, as soon as possible. This, in fact, was a sentiment echoed by guest speaker Matt Hancock in a surprisingly passionate and well informed speech, a sense of which you can get from this article.

Meanwhile, the macroeconomic picture is, of course, getting worse. Discontent is running high in certain sectors and since UK inflation hit the predicted 9.1% this week, it’s clear why. There’s more to come as this author (and many others) have been predicting for some time.

Across Europe, the war in Ukraine rages on with terrible human cost as well as economic ones for millions of people. President Putin tried to put a positive spin on his country’s economic outlook this week at the St Petersburg forum, but the reality of sanctions is starting to hit the Russian people in some unexpected ways.

Russia is, economically speaking, going to be out of the picture for many, many years aside from basic commodity exports, hydrocarbon production and some heavy industry, accelerating the gap between themselves and the rest of the world just at a time when new tech development is happening at unprecedented rates. It’s hard to see any winners from that scenario.

But whether we get bogged down on Bitcoin price, war, trains, planes or how much it costs to fill the car, make no mistake. The future is being built and it’s being built by some of the most passionate and focussed people you’ll ever meet. Have a great weekend!

Want to learn more about what’s going on in our global financial system and how Bitcoin fits in to it? Come to my next free webinar on Wednesday July 20 at 6pm to find out, ask any questions, and grab some free Bitcoin*. Click here to register.

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Yesterday’s Crypto AM Daily in association with Luno

In the markets

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/research

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $937 billion.

What Bitcoin did yesterday

We closed yesterday, June 23 2022, at a price of $21,085.88. The daily high yesterday was $21,135.76 and the daily low was $19,950.12.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $401 billion. To put it into context, the market cap of gold is $11.604 trillion and Tesla is $730.6 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $26,374 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 74.5%.

Fear and Greed Index

Market sentiment today is 11, in Extreme Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 43.75. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 33.66. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“It’s about why Bitcoin exists. It’s about the money printing and policies that I think have lead to wealth disparity, and the feeling of being left behind”

Natalie Brunell, Host of Coin Stories podcast

What they said yesterday

Decentralised > centralised…

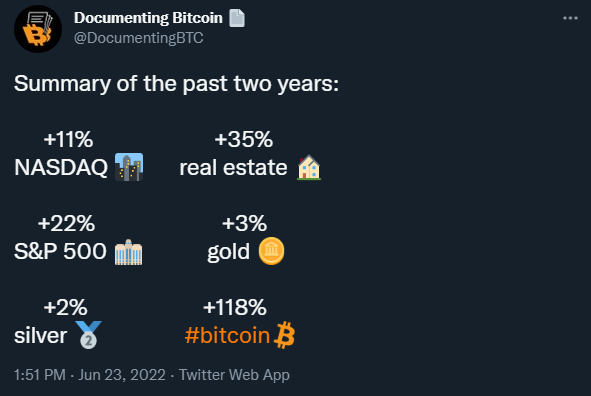

Bitcoin leading the way…

He’s got a point…

Crypto AM: Editor’s picks

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

Meet the hackers helping people recover lost crypto assets

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto crazy couple name baby after favourite digital asset

Peter McCormack: Transforming Bedford FC into a global Bitcoin brand

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST