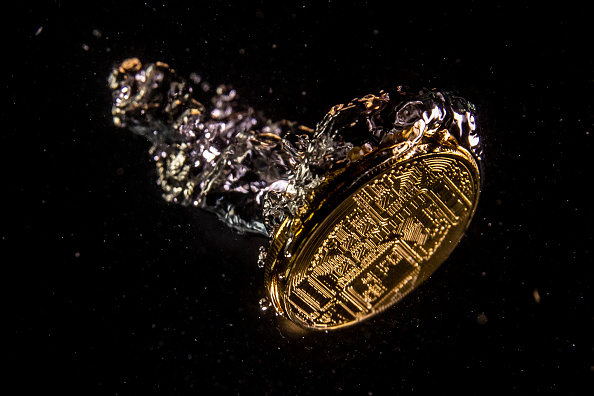

It’s been a funny old week in the world of Bitcoin

The week in review

with Jason Deane

This week can only be described as the “week of international events” for Bitcoin as news has come thick and fast from all corners of the world.

In my view, the oddest development was definitely a quiet and confusing announcement from the Central African Republic (CAR) that it had suddenly, and seemingly quite randomly, adopted Bitcoin as a national currency. So out-of-the-blue was this announcement, none of us knew what to make of it and it was several days before it was confirmed.

It was definitely done in a chaotic way with, allegedly, members of the ruling powers not even being aware of it, but happen it did. It makes sense as CAR does not have its own currency, meaning it has to rely on the management of it from another sovereign state, but it is also one of the world’s poorest countries. It has a size not dissimilar to the UK but a population of only 4.83 million, many in rural areas.

In addition, only around 11% of people have internet access and electricity is sparse, so there are many issues to overcome. Perhaps this is a chance for this struggling nation to leapfrog its neighbours and take a lead since it is now inevitable that this will attract international interest from Bitcoiners in the same way El Salvador did and continues to do.

But that wasn’t all. In the same week Panama passed a bill that gives Bitcoin, and other cryptocurrencies, legal status in the country, a move necessary to get to adoption. CAR had, in fact, gone through the same process in June this year.

Elsewhere on the same continent, Cuba announced the issuing of licences for crypto exchanges, Brazil passed a law regulating cryptocurrencies and Mexico installed another Bitcoin ATM, this time in the Mexican senate as a symbolic statement about striving for its adoption and inclusion.

Bitcoin, however, remains range bound despite all the news as the level of global uncertainty on, well, pretty much everything, continues unabated. Russia continues to shock the world with its tactics and rhetoric and inflation continues to pump through our monetary systems. Just yesterday Germany’s official rate reached 7.3%, the highest since 1981 and it’s likely we’ll see new records set in the coming weeks as energy and food prices really start to bite.

Meanwhile in the UK, some interesting research carried out by Quantum Economics via 3Gem earlier this year asked a sample of residents about various aspects of cryptocurrency including CBDCs (Central Bank Digital Currencies). Since the Bank of England has announced “looking into” the idea, would it be well received by the public?

With only 25% saying ‘yes’ it shows there’s a long way to go, but is it as simple as that? I suspect not, so I put together an article on this yesterday pulling apart the data and discussing what might be really going on behind the scenes. Top line numbers aren’t always what they seem!

Have a great weekend!

Not started your Bitcoin journey yet? Get going with £10’s worth of Bitcoin FREE from Luno*! Simply download the app, verify and enter code BPJDEANE

*18+, UK resident, new to Luno

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Yesterday’s Crypto AM Daily in association with Luno

In the markets

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/research

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1.818 trillion.

What Bitcoin did yesterday

We closed yesterday, April 27 2022, at a price of $39,241.12. The daily high yesterday was $39,397.92 and the daily low was $37,997.31.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $753.63 billion. To put it into context, the market cap of gold is $11.952 trillion and Tesla is $911.04 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $31.38 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 32.4%.

Fear and Greed Index

Market sentiment today is 24, in Extreme Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 42.02. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 49.52. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“The nature of Bitcoin is such that once version 0.1 was released, the core design was set in stone for the rest of its lifetime.”

Satoshi Nakamoto

What they said yesterday

Who’s next?

Hear, hear!

What are you waiting for?

Crypto AM: Editor’s picks

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

Meet the hackers helping people recover lost crypto assets

The cryptocurrency fundraisers behind Ukraine’s military effort

Exclusive: Fireblocks valuation climbs to $8bn in $550m funding round

Crypto crazy couple name baby after favourite digital asset

Bitcoin hashrate touches new all time high

Peter McCormack: Transforming Bedford FC into a global Bitcoin brand

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST