ITM Power to enter US market in blow to UK’s green hydrogen ambitions

ITM Power has announced plans to enter the US market, enticed by the vast subsidies offered under the country’s Inflation Reduction Act.

The green hydrogen firm — which specialises in making electrolysers — will now pursue a speedy entry into the US, it revealed in a statement to the London Stock Exchange, in a blow to the UK’s domestic energy aspirations.

It hopes the US could become one of its largest markets, and has confirmed it will start bidding for American projects following the standardisation of its technology, after managing to adapt its electrolysers to work in multiple territories.

The company is up 4.6 per cent on the FTSE AIM UK 50 Index in early morning trading following the announcement, rising to 72.4p per share.

In a statement to the London Stock Exchange, the company extolled the virtues of the US market, referencing the $370bn of subsidies offered in the US Inflation Reduction Act.

“The US is widely recognised as having the potential to become one of the largest markets for electrolysers,” they said.

ITM also noted that the country is targeting 10m metric tones of clean hydrogen per year by the end of the decade and 50m by 2050 as part of the country’s National Clean Hydrogen Strategy, with $9.5bn investment for clean hydrogen already pushed through via the Infrastructure Law.

For context, the International Energy Agency estimates that the current global use of grey hydrogen — produced from fossil fuels — is 95m metric tonnes per year.

Dennis Schulz, the company’s chief executive, believed this provided ITM with a “tremendous opportunity” to become a leading electrolyser provider “as the market develops over the coming years.”

Green hydrogen is produced through electrolysis in water, powered by renewable energy.

It provides reliable energy generation with effectively zero carbon emissions but remains highly expensive to produce compared to rival renewable sources such as solar and wind.

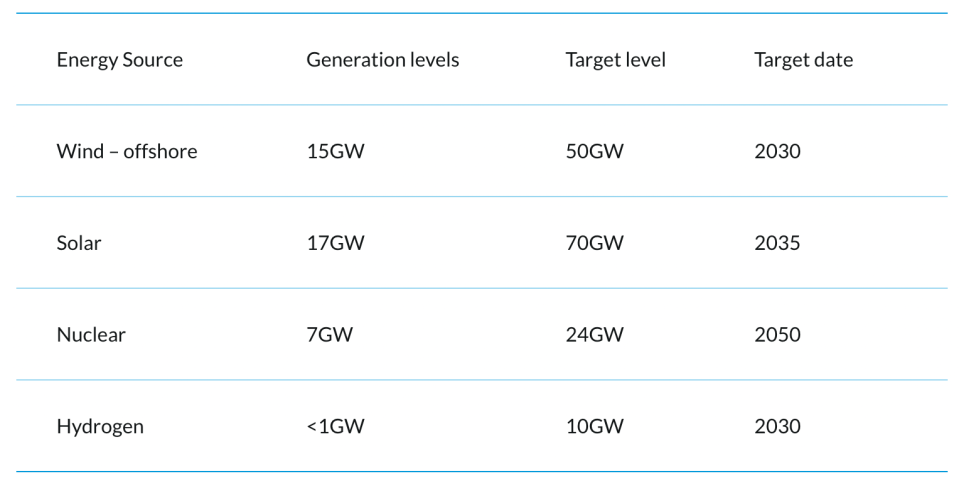

ITM’s decision to shift its focus to US markets is a blow to the UK — which has adopted its own 10GW target of hydrogen generation over the current decade.

The Sheffield-based company is one of many emerging renewable firms to previously warn the UK about its lack of sufficient funding to rival the investment climate emerging in the US and Europe.

This includes other hydrogen players such as AMTE Power and investment fund Hydrogen One.

It has also suffered an avalanche in its share price amid rising debts and production difficulties, having struggled to convince investors of its turnaround plans.

Schulz, who joined late last year, has committed the company to a 12-month improvement plan.

ITM Power told City A.M. it remains “committed to UK opportunities,” but that the announcement recognises the scale and ambition of the US government’s Inflation Reduction Act.”

A spokesperson said that while the UK was well-positioned to develop new projects, more needs to be done to boost products internationally.

“Compared to state support given for similar manufacturing companies in Europe the government should invest in manufacturing hubs that bring an international supply chains together,” they said.

Analysts welcomed today’s news, with Peel Hunt maintaining a buy recommendation with a target price of 200p per share.

Peel Hunt’s Nick Walker said: “This is an important milestone for ITM, as it can use one production process and supply chain, simplifying operations and enabling economies of scale.”

Investec also kept its stance at buy with a target price of 170p per share.

“Momentum in the US continues; last week President Biden announced $7bn in federal grants across 16 states to develop seven regional hydrogen hubs, advancing a key pillar of US decarbonisation plans with an aim to jump-start clean hydrogen production growth through investment in production and importantly the infrastructure to facilitate clean hydrogen production across the US,” said Alex Smith, equity research analyst at Investec.

When approached for comment, a Department for Energy Security and Net Zero spokesperson said: “The UK has already overperformed against our previous targets and we’ve cut emissions faster than any other G7 country. We have attracted £200bn in low carbon investment since 2010 – and our global leadership in clean technologies is expected to attract a further £100bn in private investment by 2030, helping to support up to 480,000 skilled jobs across the country.

“We are adopting a fairer and more pragmatic approach to meeting net zero that eases the burdens on working people while remaining completely committed to our Net Zero commitments, set out in law. Our targets keep us on track to meet that legal commitment, and to meet international commitments including those under the Paris Agreement.”