Is technology a new asset class?

With Covid-19 accelerating digitalisation, the question facing many companies is no longer whether technology is important, but just how important?

What percentage of their time should a bank or retailer’s top executives spend thinking about technology?

How much investment should a company make in tech?

What weighting should institutional and retail investors give the sector?

There are different ways of measuring the sector’s importance.

You could, for example, look at the quantity of goods and services produced: US tech companies’ economic output was $1.9 trillion (about £1.36 trillion), about 10 per cent of US GDP, in 2019. You could also look at tech firms employed workers.

But maybe these are the wrong metrics. They don’t show future growth and don’t reflect the sector’s enormous profitability. If only there was an algorithm that took current numbers, assigned a value to a firm or sector’s expected growth and profitability, and discounted it appropriately for risk.

There is: it’s the stock market.

Financial theory holds that every stock is the net present value of future cashflows, earnings, and dividends. And tech stocks have done well. In the US, the tech-heavy NASDAQ rose 44% during 2020, while the S&P 500 was up only 16%. But more interesting than performance are sector weightings.

1. Sector weightings (as of year-end 2020)

Sector weighting reveals a lot, reflecting all stocks in a particular sector. It also reflects the growth (or the lack thereof) in all the other sectors, providing relative context.

At the close of 2020, IT companies made up 28% of the S&P 500. So, there you have it, the answer to the question of how important tech is: CEOs should spend just over a quarter of their time thinking about the sector. But wait — tech is actually even bigger than that.

2. Tech stocks in hiding (part I)

The two largest stocks in the S&P 500 by market capitalisation, Apple and Microsoft, are both tech companies. But slot three to seven in the top 10 are a mix of ‘consumer discretionary’ and ‘communications services’ stocks. Or are they?

The stocks in question are Amazon, Facebook, Tesla and Alphabet/Google class A (one-share-one-vote) and C (no voting rights) shares.

Whatever their official classification1, many people think of these as tech companies. Moreover, beyond the top 10, Netflix, Twitter, Paypal, Electronic Arts and Activision Blizzard are also classified as communications services. But it’s no stretch to call them tech stocks either. So not only are ‘tech’ companies seven of the top 10, but also 14 of the top 20.

3. Tech stocks in hiding (part II)

The eighth-largest stock is in the ‘financials’ sector: Berkshire Hathaway. Which isn’t a tech stock. Unless you look at its 30 September ‘13F’ quarterly filing: Berkshire owned more than a billion shares of Apple among various other tech stocks. Together these tech stocks account for almost exactly half of Berkshire’s holdings.

4. Tech swallows other sectors

The 11th largest stock on the S&P 500 is that famous tech giant… Visa. For decades, Visa was part of the financials sector. Until 2018, when it was shifted to IT along with 16th-ranked Mastercard. This is nothing new: companies that aren’t tech become tech over time.

5. They’re still making tech companies

There were 480 initial public offerings (IPOs) on the US stock market in 2020, more than double the number in 2019. Most were for tech companies, and the larger tech IPOs from the class of 2020 have a combined market capitalisation of $460 billion (about £328 billion).

What was the ‘real’ tech sector weighting at the close of 2020?

IT was 28%, and communications services, which is mainly tech, was 10%. Add in Amazon (4.4%), Tesla (1.7%), and about half of Berkshire Hathaway (0.7%) and nearly 45% of the S&P 500 could be considered tech.

The global pattern may even be more pronounced. At the close of 2020, the top 10 MSCI All Countries World Index constituents are tech stocks, with Taiwan Semiconductor, Alibaba and Tencent joining the seven top 10 US-based tech companies from the S&P 500. In terms of sector weighting, IT was 22% of the index, and communication services another 9%.

6. Sector weighting historical trends

But all this is looking in the rear-view mirror. What will tech’s weighting look like in the future?

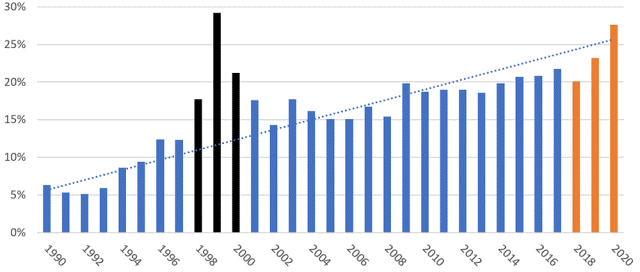

To answer that, the past is instructive. The following chart shows tech’s share of the S&P 500 from 1990 to 2017 and the IT sector’s share at year-end 2018 and 2019 and September 2020. The three black columns represent the dotcom bubble. Since the industry classifications changed in September 2018, the IT sector, represented by the orange columns, is not 100% comparable to the old tech sector. But the data are included for context.

S&P 500 Index: Tech weighting

Considering technology as an asset class

The term ‘asset class’ means something specific. Investors can reduce risk and enhance returns by investing in various asset classes — stocks, bonds, real estate, commodities, etc — especially if they are non-correlated, or don’t go up and down in value together.

Tech stocks are obviously a subset of the stock universe and mostly move in the same direction as other equities. But, as the chart shows, the tech sector weighting of the S&P 500 jumped from about 15% in 2008 to 20% in 2009: the global financial crisis hurt many market sectors, but tech outperformed and grew its weighting.

Amid the current pandemic, the IT sector weighting jumped by another five per cent, from 23% at the close of 2019 to 28% at year-end 2020.

This growing weight is real. Unlike the tech bubble of the late 1990s, tech’s current rise is not divorced from fundamentals. While other sectors have experienced anemic growth and sharp declines in revenue and profitability, many tech stocks have enjoyed double-digit revenue and earnings growth. The tech sector’s expanding weighting reflects that.

If the current trend continues and tech’s weighting grows another five percentage points from its current 45% over the next five to 10 years, investors may need to pay more attention to tech than all other sectors combined.

Investing in technology

Management teams don’t invest in stocks for their companies, but they do invest in technology in two ways.

The first is tactical. They allocate funds to purchase computers, smartphones and other tools, but they also invest in cloud migration, artificial intelligence, and so on. Most companies have budgets for tech-driven R&D, innovation and acquisitions. ‘Investing in technology’ was growing before the pandemic and Covid-19 has accelerated that growth.

Management teams’ second form of investing in tech is inherently strategic. The critical long-term task of a board is to hopefully anticipate the future.

Historically, that encompassed many variables: energy, materials, real estate, financial factors such currency moves, and technology.

Only a decade ago, management of banks, retailers and transport companies had to think about moving business online. But surging smartphone sales meant they also had to make a choice: PC-first or mobile-first. Those that got it right succeeded, while those that got it wrong are gone. And this was even before the pandemic and associated recession hit.

What does it all mean?

Our analysis leads to three main takeaways:

- Tech will not be less important in our lives post-pandemic.

- At a minimum and more than any other variable, companies’ top management need to spend more time thinking about tech, how it is changing, and investing in it.

- The smartest companies will dedicate more resources to tech than everything else put together.

1. The Global Industry Classification Standard (GICS) determines which firms are in which sector. In 2018, it revised its standards and replaced the Technology sector designation with Information Technology. It also reclassified some Technology companies as Communications Services. Due to these adjustments, it is difficult to compare pre-2018 sector weightings to later ones.

For more on how technology is a key support mechanism for sustainable investing practices, too, read the latest CFA Institute report on ‘The Future of Sustainability in Investment Management‘

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

By Duncan Stewart, CFA, director of technology, media, and telecommunications research for Deloitte Canada.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: JOSH EDELSON/AFP via Getty Images