Is London rebounding better than New York? That’s what the numbers say.

While many have been downbeat about the City in recent months, with New York seen as the place to be for many listed firms.

Away from the stock market however it’s a very different picture – with London sitting pretty on a number of post-pandemic rebound stats, according to research from the London Property Alliance.

City A.M. breaks down three areas where London is ahead of the Big Apple and examines whether it will be able to hold its lead in these areas.

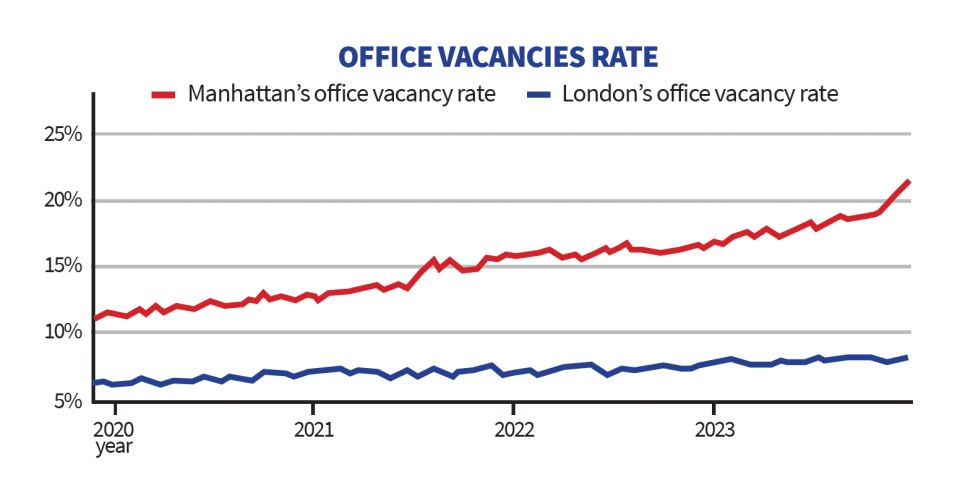

Office vacancies

Hybrid-working has dampened demand for offices the world over, but London’s office property market seems to be in much better shape than New York’s.

Over the past three years, Manhattan’s office vacancy rate, which currently sits at 22.4 per cent, has steadily continued trending upwards over the last few years, doubling from 11 per cent at the beginning of 2020.

Whereas London’s office vacancy rate of 7.5 per cent has only increased marginally by 1.5 per cent in the same period.

LPA’s research observes that New York’s commercial property sector is experiencing a “perfect storm” of weaker aggregate demand, rising interest rates, mid-tier bank instability and an excess of non-prime quality.

London’s latest prime office rental growth data, 10.6 per cent in the West End and 6.9 per cent in the City of London, also outstrips Manhattan’s Midtown district of 1.4 per cent.

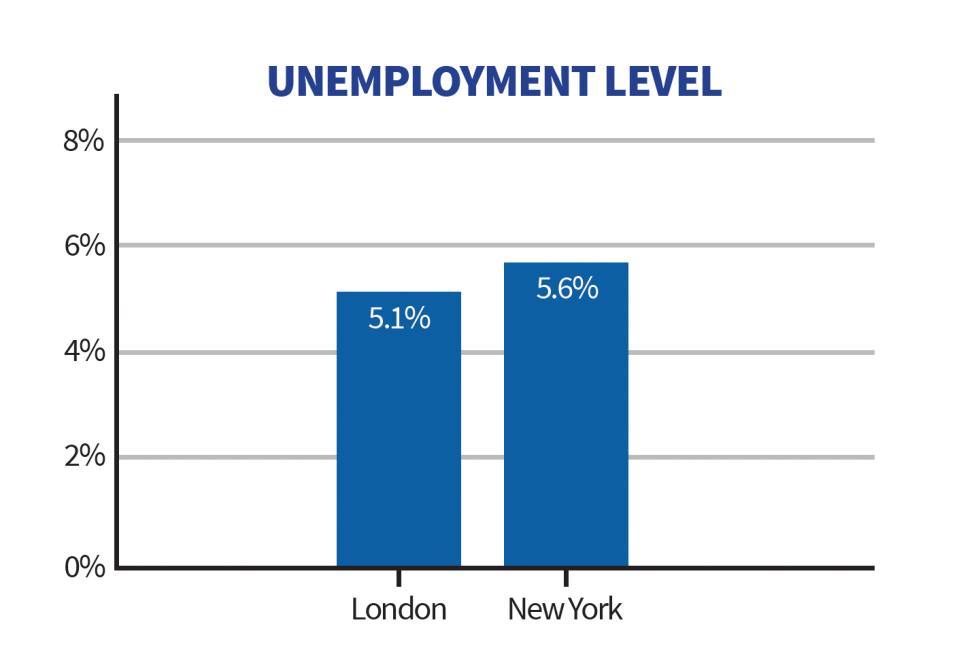

Unemployment

London’s unemployment level of 5.1 per cent is slightly lower than New York’s 5.6 per cent.

Employment rates as a percentage of pre-covid levels is slightly ahead for London, with the UK capital currently sitting at 101.7 per cent versus the Big Apple’s 100.5 per cent.

A contributing factor to this is London’s position nationally and in the context of continental Europe – which leads on to the third area of which London outperforms New York.

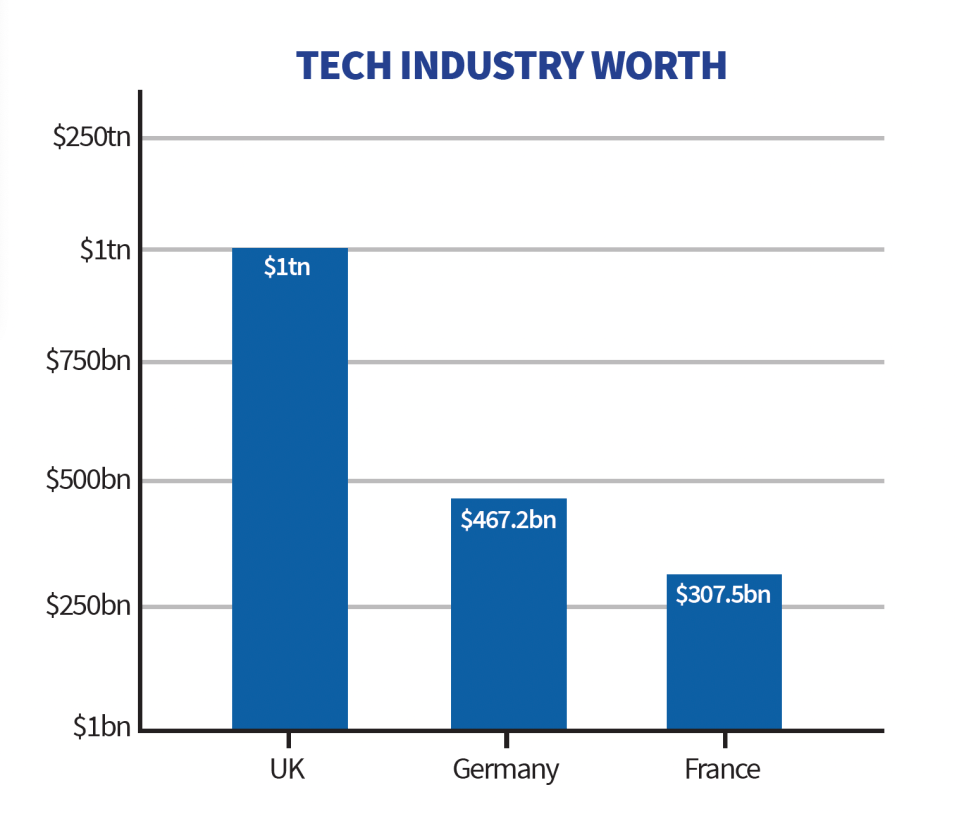

Tech (yep, really)

London is arguably Europe’s biggest technology hub, while New York city has, for many years, been second to San Francisco Bay Area.

The UK tops the poll for more high-growth companies than its European counterparts, with a tech industry worth more than double that of Germany or France at $1 trillion.

The UK’s tech industry is worth more than double that of Germany ($467.2bn) and three times that of France ($307.5bn).

Neil Ross, associate director for Policy, TechUK said: “The tech sector is one of the UK’s modern economic success stories. The UK digital sector’s contribution to the economy rose by over 25 per cent between 2010 and 2019 and now adds over £150bn to the UK economy a year. This makes it one of the country’s most valuable economic assets and the leading tech sector in Europe.”

“London has been a key hub of this work, however in our recent UK Tech Plan, TechUK highlighted the risk of the UK resting on its laurels when it comes to tech, especially as global competition heats up.

“The Government needs to work with the tech sector to tackle the major challenges to our continued growth, such as skills and adoption, scale-up finance, attracting major investments, public procurement and access to data.”