Weekend Read: Is Britain headed for a summer recession?

Britain has met the first half of the technical recession definition, meaning there is a small chance we are headed for a summer recession.

The Bank of England thinks the country will tip into the longest recession since the financial crisis in the final three months of this year.

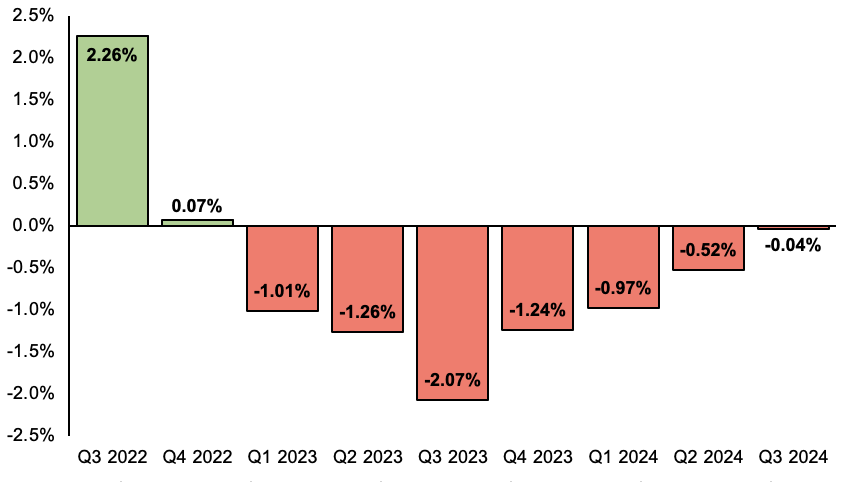

Figures published last week by the Office for National Statistics revealed the UK economy shrank 0.1 per cent in the three month to June.

Another contraction in this quarter would tip us into an earlier downturn, and there are signs this could happen.

One of the biggest drivers for the output drop was households reining in spending in response to their pay being eroded by elevated inflation and tax hikes.

The Bank of England is forecasting the longest recession since the financial crisis

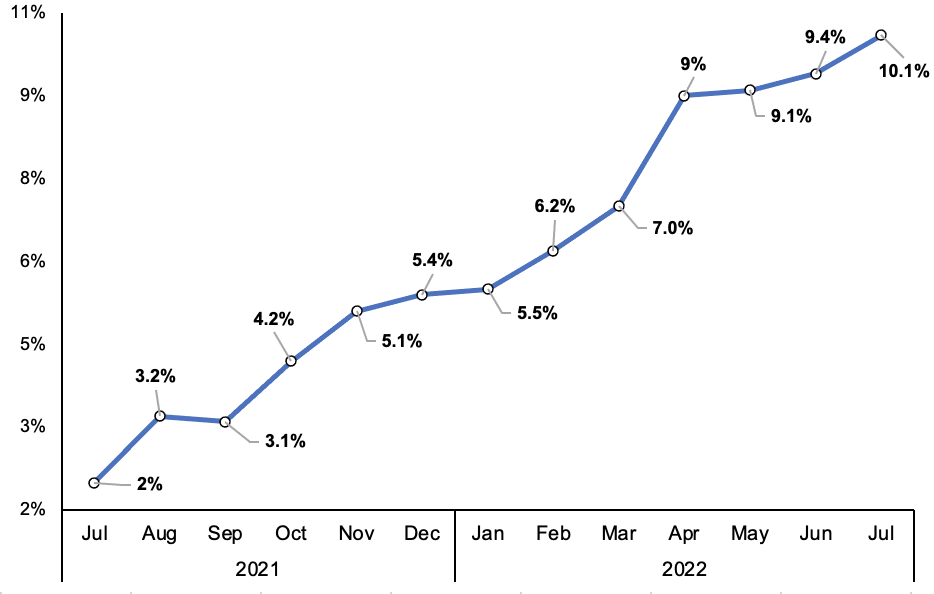

Inflation averaged over nine per cent over the period, delivering a 4.1 per cent hit to households’ spending power, the biggest since record began in 2001.

This softening in consumption comes before the huge rise in household energy bills in October.

“Cracks in the economy are appearing,” with the UK’s services industry, its economic powerhouse, stalling in the three months to June, Sanjay Raja, senior UK economist at Deutsche Bank, said.

The 1.25 percentage point national insurance was live for all of the latest quarter. The threshold at which workers start paying the tax climbed in July, putting some money back into workers’ pockets around a third of the way through the current quarter.

“Inflation is already… [in] the double digits and consumer confidence is at record lows, so headwinds from the income squeeze are already ratcheting up,” analysts at HSBC said.

The Bank of England thinks that energy bill hike will shove inflation to over 13 per cent, more than six times its two per cent target. But, that projection looks like it may be smashed after this week’s big 10.1 per cent overshoot.

Governor Andrew Bailey and co thought prices would rise 9.9 per cent in July. It is common for Threadneedle Street wonks to get their inflation forecasts wrong.

Annual CPI UK inflation

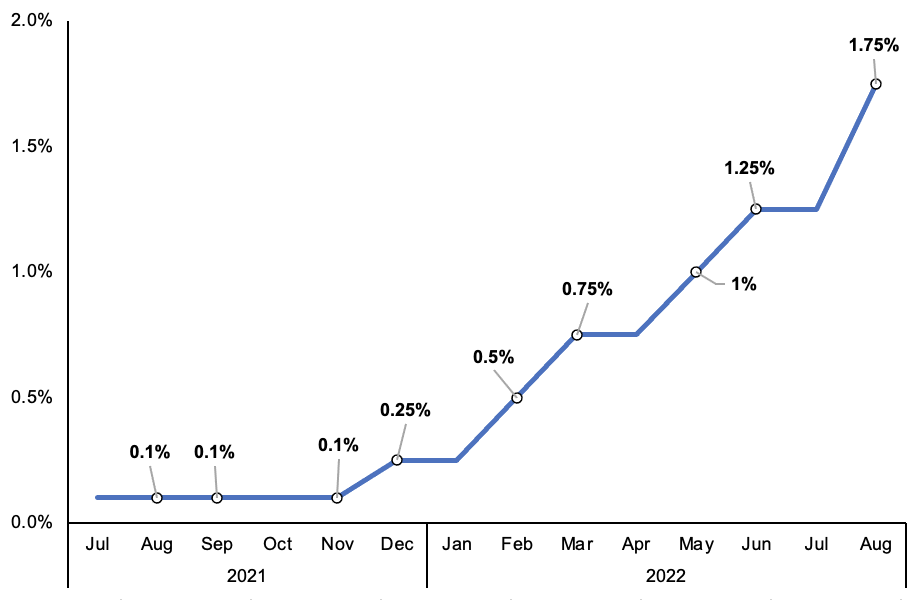

Investors expect another 50 basis point rise at the Bank’s next meeting on 15 September, taking them to 2.25 per cent. Interest rate futures point to borrowing hitting 3.75 per cent next May, intensifying the squeeze on households and businesses.

Latest figures from payroll firm XpertHR show wages are growing four per cent, so people are going to have to cut back on discretionary spending to pay their bills or take on debt to maintain usual consumption patterns.

The savings rate – the proportion of money people set aside out their paychecks – has not fallen sharply. Economists have been betting people would raid these warchests in response to higher living costs.

A persistently elevated savings rate indicates households are preparing for a tough winter by halting purchases now to keep money aside to foot elevated energy bills. If that trend continues, there is a chance GDP also drops in the current quarter.

“Given record lows in consumer confidence, and also rising interest rates… it’s possible that overall household savings will not fall by as much as we expect in our central case. If so, the outlook will get gloomier still,” HSBC added.

But, June’s month-on-month GDP was shallower than expected, suggesting the economy does have some underlying strength.

S&P Global’s purchasing managers’ indexes are still above the 50 point threshold that separates growth and contraction. But, that may be due to the survey asking firms about turnover trends instead of the quantity of goods and services sold.

One bright spot has been the jobs market. It is the economy’s biggest strength and the main factor that could prevent the country from tipping into a recession.

Hiring decisions are typically based on expectations of future demand. Vacancies are running at historically high levels, indicating firms still think adding additional workers is a profitable move.

But, ONS figures this week showed job openings dropped for the first time since August 2020.

UK interest rates

While bad for employment, this trend may ease wage pressure by forcing workers to accept jobs that offer lower pay.

Consumer confidence is also at a record low minus 44 points, according to research firm GfK, meaning job moves are likely to cool as workers prioritise keeping a steady income to pay for rising bills.

The first round of government support for the poorest landed recently.

And the higher national insurance threshold will bump pretty much all workers’ budgets, which should partly protect spending in the current quarter. Tory leadership rivals Liz Truss and Rishi Sunak have pledged more support for households over the winter.

“With fiscal support likely to be scaled up considerably by the next PM and high income households still holding substantial savings, we think that GDP will flatline through the winter, rather than fall,” Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said.

Economists have highlighted that the 0.1 per cent GDP drop last quarter was primarily driven by government spending Covid-19 measures falling off a cliff. Stripping that expenditure out, the private sector is actually doing pretty well.

But, with the virus seemingly at the back of Brits’ minds, government health spending over the current summer quarter looks set to drop even more, which will depress output and raise the likelihood of another quarter of contraction.

Economists are united in one observation: without more government cost of living support, and if inflation keeps surprising to the upside, we may be in for a bigger recession than the Bank is baking in. And, it may have already started.