Is Bitcoin on track to take pole position as the wheels come off US banks?

The week in Review

with Jason Deane

Good morning from Croft racing circuit!

Yes, the Bitcoin Racing Team is out in force this weekend with no less than six cars in three championships at two major UK tracks.

Seb Melrose will be representing in the Porsche Carrera Cup at Brands Hatch as will Jordan Kerridge (aka That Martini Guy on Twitter) in the Vertu Mini Challenge while my fellow drivers and myself will be flying the flag at Croft Racing Circuit in the Nankang Tyre CityCup Challenge, supported by our new sponsors Monochrome.

In short, it’ll be hard to miss the Bitcoin logo at any major racing meet over the next few days as we go through testing, qualifying and racing in our respective classes.

Our goal, as ever, is to bring Bitcoin to the masses as much as we can, mainly by just getting the millions of people who watch these races around the world to ask the question “what is this Bitcoin thing anyway?”.

This question is becoming ever more relevant as the traditional financial world continues to show signs of strain.

Just this week, yet another bank ran into serious trouble. The Federal Deposition Insurance Corporation (FDIC) was once again called in to support First Republic Bank, which, to my mind, sounds like something out of the Star Wars franchise. However, since JPMorgan Chase now own that “asset” the name is likely to be less important than it ever was.

This is the third major US bank failure this year and it is yet another public signal of what is really bubbling under out of sight of most people who are mostly focused on trying to earn enough to beat inflation.

One of the best alternatives, of course, is Bitcoin, but just as the US is positioning itself quite beautifully as the leading hashrate producer in the world, the Biden administration proposed a bill to tax Bitcoin miners to the tune of 30% on all power used in a badly thought-out piece of legislation that is clearly politically driven and has nothing to do with any actual facts. It’s a subject I am very passionate about given my extensive mining background and I was pleased to discuss it in some detail with CityAM earlier this week.

READ MORE: Biden’s crypto mining tax simply wouldn’t work in the UK… or the US, for that matter

Meanwhile, the price of Bitcoin bounced around a little on the news that MicroStrategy was rumoured to be selling some of its Bitcoin to cover debts, something that wasn’t quite as black and white as some commentators were making out, especially given Michael Saylor’s stance on this very point.

Finally, I feel it would be remiss of me to complete this week’s roundup without mentioning the bizarre attack on the Kremlin on Wednesday night, allegedly by Ukraine who were looking to assassinate President Putin – at least according to the Russians anyway. In reality, this was most likely a “false flag” attack by the Russian state itself in an attempt to drive support for what will almost certainly be another recruitment drive to support the failing army in its disastrous campaign to invade its neighbour.

While it may be sometime before the truth is ever known, I think we can safely say it’s another nail in the coffin of Russia’s credibility and the ongoing macroeconomic effects of the country’s actions will be felt for sometime yet.

Meanwhile, here in the UK, as the Bitcoin Racing Team heads off to work this weekend, we’ll be swearing in a new monarch for the first time in well over half a century bringing joy – and controversy – to the country in equal measure.

Have a great weekend!

New to Bitcoin? Learn all about it here with the Bitcoin Pioneers!

Yesterday’s Crypto AM Daily

In the Markets

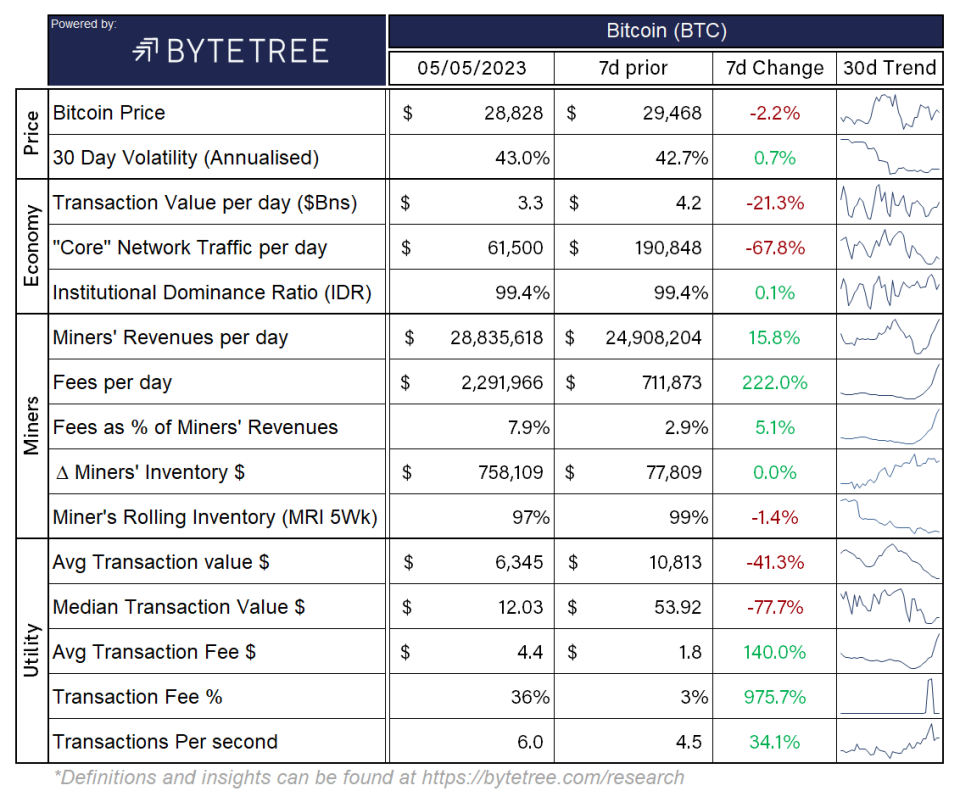

The Bitcoin Economy

*Data can be found at https://terminal.bytetree.com/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market this morning was $1.194 billion.

What Bitcoin did yesterday

We closed yesterday, May 4, at a price of $28,847. The daily high yesterday was $29,353, and the daily low was $28,694.

Bitcoin market capitalisation

Bitcoin’s market capitalisation this morning was $563.633 billion. To put it into context, the market cap of gold is $13.531 trillion and Tesla is $510.92 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $16.639 billion.

Fear and Greed Index

Market sentiment today is 61, in Greed.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 48.54. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 50.89. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Soundbite of the day

But just as all authentication of ownership (such as a house deed) isn’t a means of creative expression, not all NFTs are connected to art. This technology can take form in an endless list of use cases ranging from proof of attendance, exclusive access, reputation, brand marketing and more.

John Gilbert and John Lee Quigley for Blockworks

What they said yesterday

🔨

🌿

🤔

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Crypto AM: Editor’s picks

ChatGPT urges crypto conference panel not to become over-reliant on AI

Mt. Gox customers will have to wait until November to recover lost Bitcoin funds

Sam Bankman-Fried: A tissue of lies soaked with fake tears?

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.