Is bitcoin gearing up for an unprecedented move?

As debates on bitcoin and alternative asset classes circle the internet, all signs point towards bitcoin leap-frogging the entire cryptocurrency industry into the next paradigm – and the best part is: this is not hyperbole.

Indeed, the news that emerged this week about MicroStrategy purchasing a total of 21,454 bitcoin ($250,000,000) cannot not be taken lightly – not by any stretch of the imagination. With this move, this billion-dollar publicly traded company has now set a major precedent for industry peers to follow suit.

Additionally, the reasons for acquiring bitcoin lends credence to a narrative that has been touted since the inception of cryptocurrency; i.e. bitcoin is sound money with proven absolute digital scarcity that cannot be debased, censored or manipulated by any government or group of governments.

Briefly, MicroStrategy’s CEO Michael Saylor pointed to a topic that is frequently covered in our newsletter, which is the fact that “unprecedented government financial stimulus measures including quantitative easing… may well have a significant depreciating effect on the long-term real value of fiat currencies and many other conventional asset types”.

The CEO spoke about bitcoin fitting into the global macroeconomic picture at length.

Bitcoin, gold and silver move hand in hand

Any reasonably effective analyst will tell you that confluence is a major guide in an investor’s decision-making process. In this vein, several moving parts are rapidly coming together and are set to take this industry into the next paradigm.

Today, bitcoin is seen as a tangible inflationary hedge, and immutable store of value against infinite federal reserve and central bank money printing. When seeing bitcoin’s price-action since the covid-19 inspired sell-off against precious metals such as gold and silver, it’s hard to conclude otherwise.

Fiat currency debasement will continue

As it happens, the US Federal Reserve is now expected to fully commit to a higher inflation figure (4%) via a fresh policy that could be announced as soon as September.

For years, the Fed and other global central banks have been trying to ramp up inflation while assuming that price appreciation is healthy for a growing economy, in spite of the fact normal economic cycles preclude this from happening indefinitely. Of course, they also worry that inflation feeds on itself, keeping interest rates low as the monetary policy tool box becomes smaller and smaller over time.

In essence, the Fed is telling markets that it is fully dedicated to printing more money, and they will announce this within the coming months.

“We believe that the Fed publicly would welcome inflation in a range of 2% up to 4% as a long overdue offset to inflation running below 2% for so long in the past,” said Ed Yardeni, head of Yardeni Research.

Yardeni went on to say that the approach would be “wildly bullish” for alternative asset classes and in particular growth stocks and precious metals like gold and silver.

As is common practice with dinosaur institutions, the elephant in the room that is bitcoin is only spoken about in dark corners – away from prying eyes.

USD index slips into dangerous territory

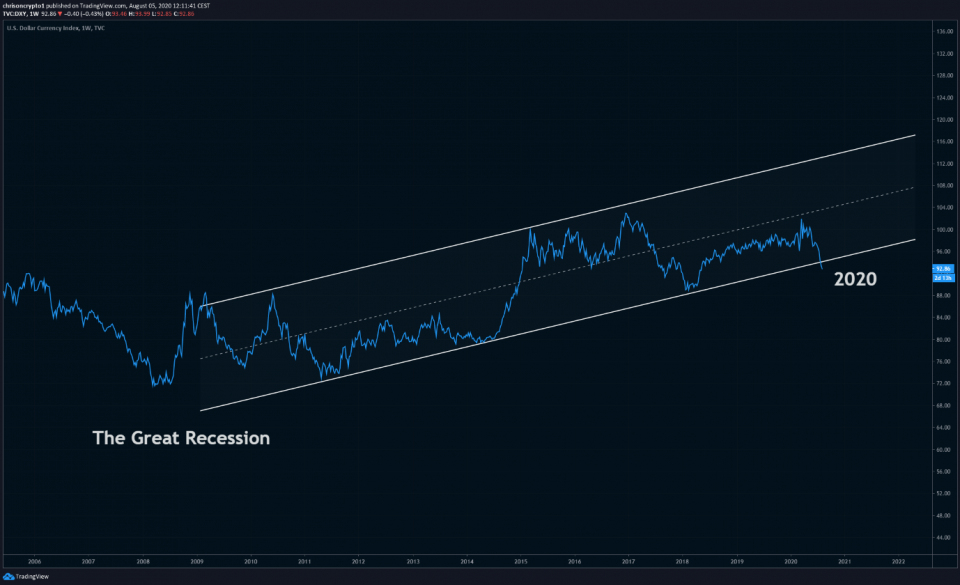

Meanwhile, the US Dollar standard is stress-testing (and arguably beaking) a major channel present since the 2008 great recession.

Provided that macro-economic factors continue to play out, and money printers continue working on over-drive, there’s only one way forward from here. Suffice it to say, any dramatic devaluation of the US Dollar would have a rippling effect on other fiat currencies while propping up alternative assets such as bitcoin and cryptocurrencies, as is already happening.

The story of fiat currency debasement isn’t a new one. In fact, on-chain analytics firm Arcane Research recently charted bitcoin’s price history against several fiat currencies since the $20,000 all-time high.

The results speak to a trend that is hard to escape: all fiat converges to its inherent value of zero given enough time.

As an analyst, it’s your job to retain a level-headed approach to all data points. However, it truly is an uphill struggle to not become optimistic on alternative assets like bitcoin and cryptocurrencies in light of universally infinite cash handouts.

The facts on the ground point towards bitcoin, and I suspect mass market will realise this sooner rather than later.

This is not financial advice.

Author Credit: Christopher Attard, journalism and content specialist who covers bitcoin and crypto markets.

Get in touch at contact@chrisoncrypto.com