Is a major dip on the cards for Bitcoin as a record $6bn of options expirations loom large today?

Crypto at a glance

It’s been another week of mixed fortunes in the crypto markets, though things do seem to be somewhat looking up as we head into the weekend.

Bitcoin yesterday tested support at $50,000 for the first time in two weeks, dipping to as low as $50,856.57 before rebounding back to over $53,000, where it’s currently changing hands.

Bitcoin still hasn’t traded below $50,000 since March 8. The last two weekends have seen the Bitcoin price push for new all-time highs, will we see another repeat this weekend?

The latest rebound means that Bitcoin’s market cap is once again back over $1 trillion. This important psychological landmark will be reassuring given that (Tesla news aside) the general news this week has been largely bearish for Bitcoin.

First, the US dollar has strengthened recently to new highs in foreign exchange markets, with Bitcoin still showing signs of being inversely correlated with the greenback.

Then there’s been the looming record $6 billion contract expiration, which is due today. Analysts have warned the ‘max pain’ point would occur if the price plunged to around $44,000. The max pain point is where buyers have the most to lose and sellers the most to gain and the thinking goes that the market will gravitate toward the pain point while heading into the expiry.

If the price holds though, it could drive another price run. Historically, April has been a bullish month for Bitcoin, posting a green candle in eight out of the last 10 years. Will history repeat itself this year?

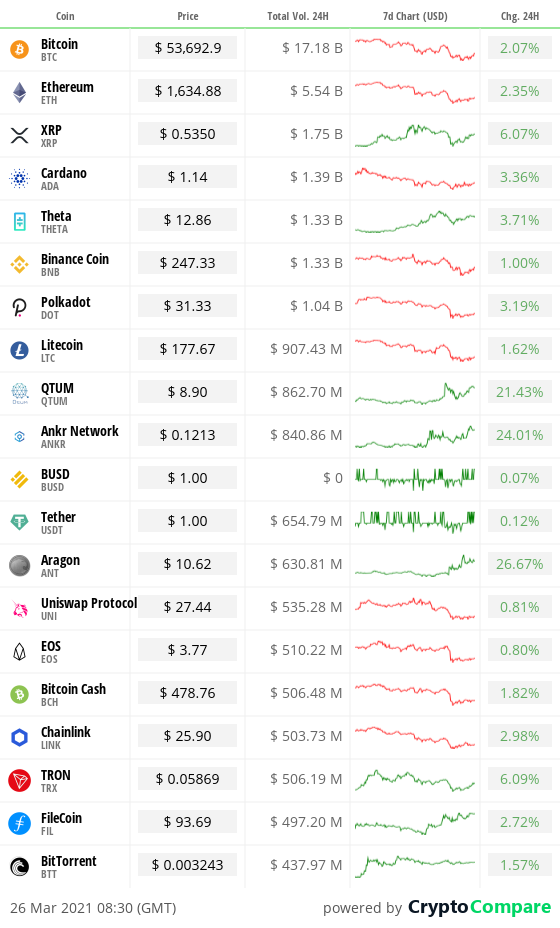

Looking down the market, Ethereum and other larger caps still seem largely in lockstep with Bitcoin. It’s a sea of green over the last 24 hours, albeit mostly just recouping yesterday’s losses. Tether is back at third by market cap, leapfrogging Cardano (ADA) and Binance Coin (BnB). XRP also continues to show strength – could it force its way back into the conversation at the top of the table?

Theta also continues to look strong, holding its position in the top 10 for a third consecutive day. Can it hold?

Please note our new look ‘In the markets’ data chart below supplied by our friends at CryptoCompare. All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??.

Start your investment journey into crypto with Luno with £10 on us!

If you’ve not started your crypto journey yet, we’ve joined forces with Luno to offer you £10 absolutely free. Click on the graphic below and simply use the code CITYAM10 when you sign up.

In the markets

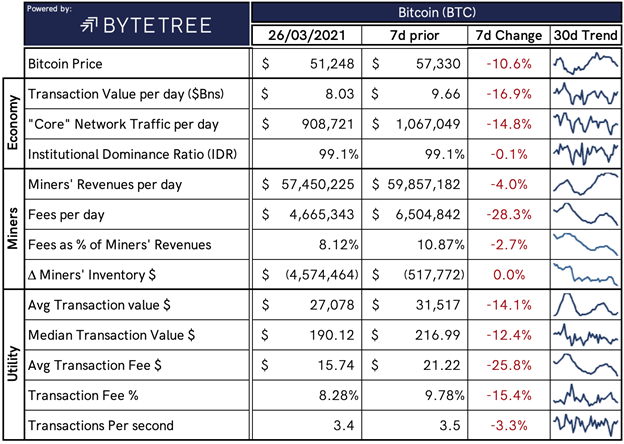

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is $1,684,291,807,617, down from $1,639,413,732,517 at this time yesterday.

What Bitcoin did yesterday

We closed yesterday, March 25 2021, at a price of $51,704.16 – down from $52,774.26 the day before. It’s now 19 days in a row that the price has closed above $50,000.

The daily high yesterday was $53,392.39 and the daily low was $50,856.57.

This time last year, the price of Bitcoin closed the day at $6,681.06. In 2019, it closed at $3,963.07.

Bitcoin market capitalisation

Bitcoin’s market capitalisation is just above one trillion dollars at time of writing. To put that into context, the market cap of gold is $10.952 trillion and Alphabet (Google) is $1.374 trillion.

Bitcoin volume

The total total spot trading volume reported by all exchanges over the last 24 hours was $63,483,606,319 at time of writing, down from $77,598,575,761yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 62.79%.

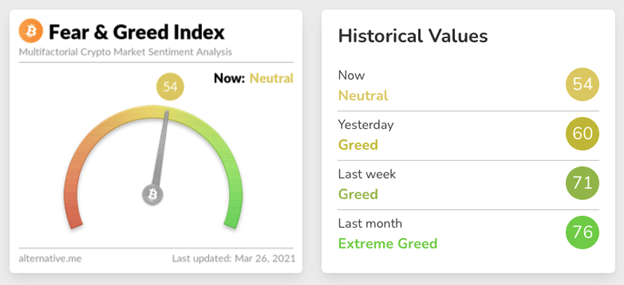

Fear and Greed Index

Market sentiment is down to neutral at 54. That’s the lowest it’s been since 1 March.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 61.16. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 50. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Shareholder value creation comes from holding an appreciating asset $BTC over a long period of time. It is logical for every firm (both public & private) in the #Bitcoin industry to do the same thing Tesla is doing. Corporate treasuries should #hodl bitcoin.”

– Michael Saylor, poet

What they said yesterday

Time flies…

Fair coverage?

Jack makes a statement…

? or ?

Crypto AM Editor writes

General Motors could be the next big car manufacturer to accept Bitcoin

Binance announces two more major appointments

Elon Musk: you can now buy a Tesla with Bitcoin

Sophia the robot to become next NFT sensation

Bitcoin falters as $60,000 starts to feel like a distant memory

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with Zumo

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special Five Part Series

March 2021

Day Five

Day Four

Day Three

Day Two

Day One

Crypto AM: Recommended Events

CC Forum

Global Investment in Sustainable Development

March 31 to April 1 2021 – Dubai

Global Technology Governance Summit

April 6 to 7 2021 – Tokyo

https://www.weforum.org/events/global-technology-governance-summit-2021

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.