IOG shares rise as troubled firm shelves North Sea projects

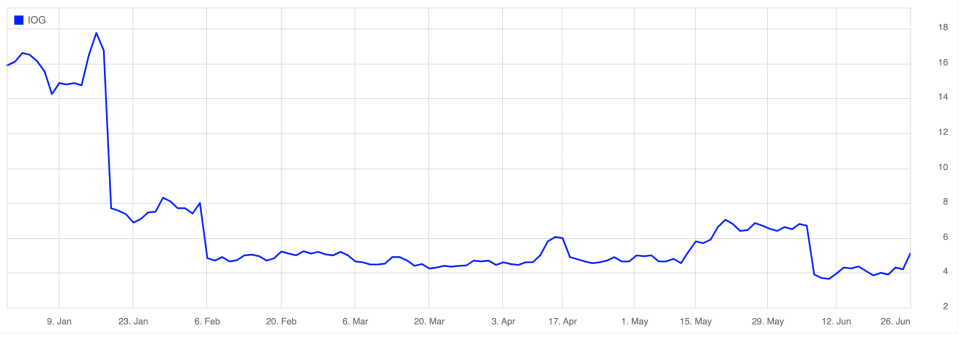

IOG has cancelled its North Sea expansion projects in a bid to boost its balance sheet, enabling its feeble share price to show slight signs of recovery.

The troubled oil and gas operator has risen 25 per cent today on the London Stock Exchange, having started the week at just 4.6p per share.

It comes after the oil company today announced it had scrapped a contract for the Shelf Drilling Perseverance jack-up rig and suspended attempts to drill at the Kelham and Goddard prospects.

Despite the uptick in shareholder sentiment, IOG remains 70 per cent down in trading compared to its position at the start of the year on the FTSE AIM All-Share.

Rupert Newall, chief executive, revealed the firm has “been assessing next steps for the business very carefully”.

“Mindful of current gas market and balance sheet risks, we have decided to pause drilling activity for now in order to maximise near-term cash flow,” he said.

IOG has not ruled out drilling the wells by next March, which are part of its Saturn Energy Hub in the North Sea and are being explored in partnership with Cal Energy Resources.

For now, however, IOG’s plan is to produce solely from its Blythe ‘H2’ field well, which came online this month.

Plummeting gas prices this year have squeezed the London-listed firm, which confirmed to investors earlier this month it was seeking a waiver after falling in breach of a €100m bond.

IOG has since secured a one-month deferral on the loan – from 20 June to 31 July.

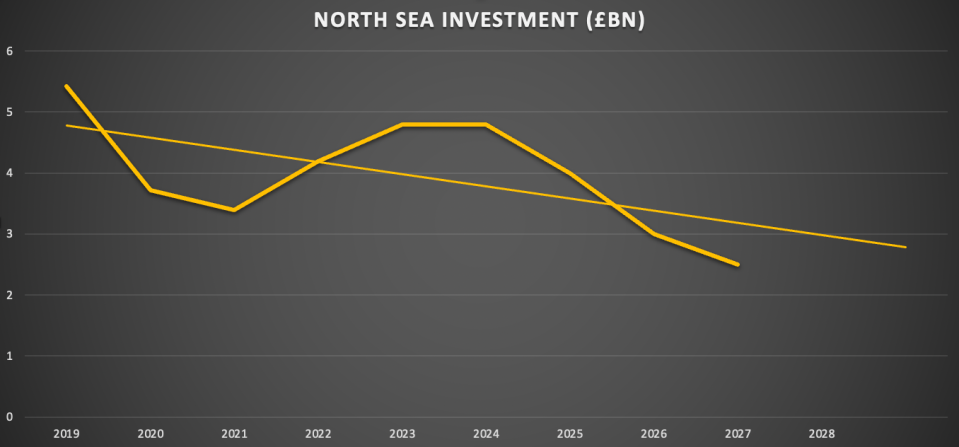

It has also been hit by a toughened investment climate after Chancellor Jeremy Hunt raised the windfall tax, expanded its timeframe and ruled out a sunset clause, which has shaken confidence in British projects.