Investors toast dividend hike at Galliford Try

GALLIFORD Try has hiked its dividend by almost 50 per cent as a recovery in its construction business and buoyant demand for new homes helped to boost sales and profits.

Pre-tax profits rose 12 per cent to £42.5m in the first half of the year to 31 December compared with the same period last year, while revenue was up 35 per cent at £1.1bn. The group said it would raise its interim dividend 47 per cent to 22p per share.

Galliford’s outgoing chairman Greg Fitzgerald, who will retire at the end of the year, said its partnerships business which builds affordable homes was enjoying “exceptional demand” across the UK after growing revenues by 56 per cent to £157.6m.

In September, it won its largest ever contract with the Greater London Authority to deliver 1,100 homes in Canning Town, worth around £360m. It has also begun work on an £81m, 350-home scheme in east London for Notting Hill Housing.

Its larger housebuilding division, Linden Homes, was also buoyed by strong consumer demand, with revenues up five per cent to £346.1m.

“Housing market conditions remain good and we are optimistic about the prospects for a number of recent and forthcoming sales outlets,” Fitzgerald said.

Galliford’s construction arm had a record order book of £3.25bn after the acquisition last year of Miller Construction. It is targeting £1.5bn of sales by 2018 from £1.25bn previously.

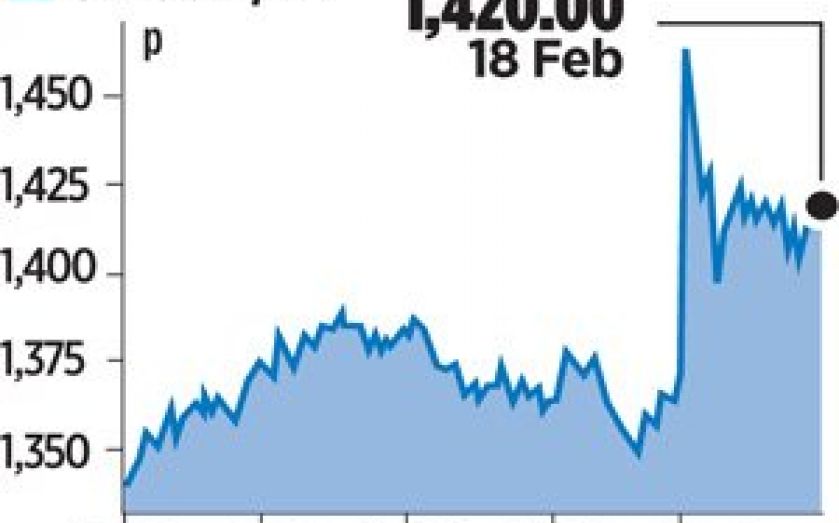

Shares rose 3.65 per cent to 1,420p.