Investors reach for the bottle as inflation soars

Investors might be forgiven for sipping a small glass of something to settle the nerves over the past few months.

Soaring inflation, rising interest rates and the ripples of war in Ukraine have combined to batter stocks that just last year looked like sure-fire winners, leaving even some of the most seasoned market sages nursing heavy losses. Growth firms which promised ‘jam tomorrow’ have plunged in value and punters have scrambled for steadier ground in ‘old economy’ stocks and perceived safe haven assets like gold.

And amid that scramble, reaching for the bottle has taken on a different meaning for many.

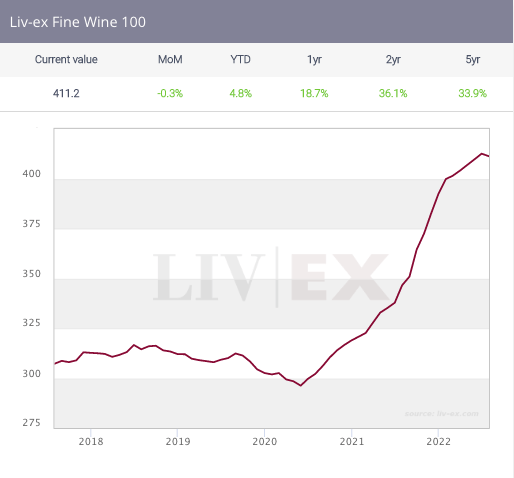

The Liv-Ex Fine Wine 100, which tracks the price movement of 100 of the most sought-after fine wines, has delivered 18.7 per cent of returns in the past 12 months.

The FTSE-100 meanwhile has climbed around 4.91 per cent in the same period, and gold – the traditional steady store of value at times of economic turmoil – is trading at near enough the same dollar value as it was a year ago, according to data from Bullion Vault.

Investors, thirsty for returns and stability, are now taking note.

“Activity on our trading platform was up about 50 per cent last year. And then in the first half of 2022, our trading platform activity was up 55 per cent versus the first half of 2021,” Matthew O’Connell, boss of wine trading platform LiveTrade tells City A.M.

“And I ascribe a very significant part of that to the hard asset, inflation-proof element [of wine].”

Wine has shown itself to be largely insulated from the wild swings in equity markets and fluctuations across bonds, gold and oil prices, and in doing so has begun to prove its worth as an inflationary hedge to investors.

The uptick in interest in the past 12 months has come from a broad base of backers across both geographies and demographics, O’Connell says, with both first time retail and aged inflation-wary investors piling in alike.

“We’ve seen people coming to us for very large portfolios, and we’ve seen a lot of activity on our trading platform with more retail-type investors creating their own portfolios,” he says.

The globalisation of fine wine as both an asset class and a consumer good has provided a more long term lift to the wine market over the past decade, as new markets pop up and cash pours in from high-net worth individuals in new markets across Asia.

Prior to the tumult that has shaken equity markets this year, fine wines were – alongside watches – the top performing ‘luxury investments’ with average growth of 16 per cent, according to Knight Frank’s Wealth report in March.

The steady growth has buoyed LiveTrade’s London-based parent company Bordeaux Index – the world’s world’s largest fine-wine trader – which yesterday reported soaring sales in the six months to June.

Revenues topped £80m in the first half of the year, up 37 per cent on last year, the majority of it driven by a 55 per cent boost in sales on LiveTrade.

Bosses said they are also now reaping the fruits of an early move into the whisky market, with 2022 delivering a raft of high profile whisky cask transactions and “ever-increasing demand for old and rare liquid” from both Scotland and Japan.

The performance has put the firm on track to beat 2021’s record revenue of £126m.

Inflation insulation

But why does wine provide such an effective inflationary hedge in times of economic strife?

In part, fine wine’s target market is one more immune to the cost of living pressures the rest of the population feel as prices rise. However, Katie Souter from wine broker Vin-X says many of its inflationary protecting characteristics are more inherent.

“It’s an interesting market and it’s driven by a number of factors. But there’s some fundamentals that are very, very simple,” she tells City A.M.

“And that is there is a finite supply of every vintage and a growing consumer base across the world as wealth grows. Because of that, there is always solid demand for the best wines.”

A report from Vin-X exploring the growth of the asset class this year notes it has outperformed even ‘safe as houses’ property investment in the year to the end of June.

In the second quarter alone, as central banks began to roll out more aggressive rate hikes and inflation began to bite, the Liv-ex 1000 notched four per cent growth where gold slumped 2.8 per cent and the FTSE-100 fell 3.74 per cent.

“The fact it is tangible and ‘real’ means it is an effective way of diversifying an investor’s portfolio, rather than becoming a complete replacement for equities,” Souter adds.

So while it might not usurp stocks as the backbone of investors’ portfolios anytime soon, wine is providing some stability and solace amid the turmoil.

And with inflation set to continue climbing this year, investors may be reaching for the bottle for some months to come.