Investors expect even higher returns from the stock market in years ahead – despite coronavirus shock

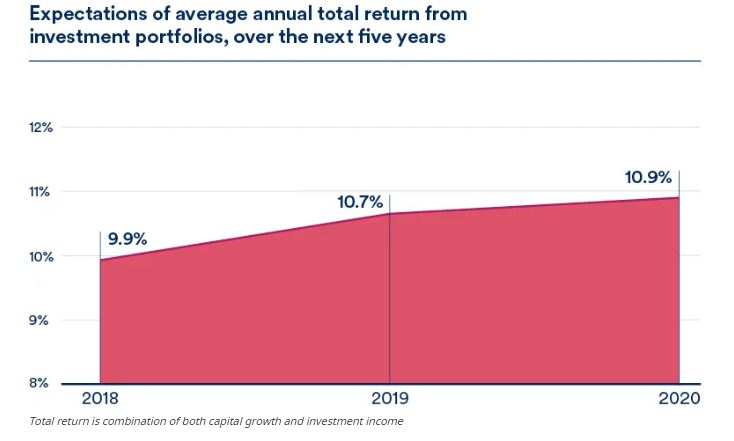

Savers predict annual returns of 10.9% from their stock market investments, even as Covid-19 halted the longest economic expansion on record and plunged the world into deep recession.

Investors continue to hope for double-digit yearly total returns from their portfolios, despite the huge blow inflicted on the global economy by the Covid-19 pandemic, according to the latest issue of Schroders’ landmark Global Investor Study.

Strong stock market performance in recent years appears to be behind investors’ continued optimism. On average, expectations for future returns are slightly higher in 2020 than in 2019. This was the third year in which investors’ forecasts of future stock market returns have increased. But it was also an extraordinary year, as investors were making their predictions in a period of extreme uncertainty. Covid-19 brought an end to the longest period of global economic expansion in history, and ushered in its place the sharpest downturn since the depression of the 1930s.

Interestingly, the market turbulence in early 2020 – as the scale of the pandemic became clear and as most of the world’s economies entered lockdown – appears not to have dented savers’ optimism.

Schroders’ independent online survey of more than 23,000 investors across 32 worldwide locations was conducted between 30 April and 15 June 2020. To put that in context, between mid-February and mid-March, world stock markets fell by over 30%*. During those weeks Germany, France, the UK and the majority of US states shut down to limit the coronavirus’s spread.

Although a recovery rally in world stock markets had begun by April – by which time some countries were re-opening aspects of business and society – markets remained considerably lower than at the start of the year.

Discover more:

– Learn: Results of Schroders Global Investor Study 2020

– Read: How did investors react to the impact of Covid-19?

– Watch: Are small and mid-cap companies weathering the US economic storm?

The desired investment returns where you live

Schroders’ research suggests that investors’ outlook for future returns is strongly guided by where they live.

-In the US, where stocks have enjoyed some of the strongest gains in recent years, investors now anticipate annual returns of over 15%. This is the highest rate of predicted future returns across all 32 countries covered in Schroders’ survey. By contrast, in markets where historic returns have been weaker, such as Japan, expectations are more moderate – at under 6%.

US expecting more than previous years…

The US is one example where investors appear to have become much more bullish over the past year. When surveyed in May 2019, US savers hoped for future annual returns of 10.3% – putting them broadly in the middle of the spectrum. In the intervening period, however, they appear to have become far more upbeat. Could this be to do with the fact that US shares had a striking run in 2019, with the S&P500 gaining by approximately 25%?**

Other geographic disparities have remained broadly consistent between 2019 and 2020. Investors in a number of emerging markets including Indonesia, Argentina, Brazil, India and Chile remain among those with the highest hopes for what their portfolios will deliver in future years – all anticipating annual returns of over 12%.

…Europe remains modest

European investors are far more moderate in their expectations, with investors in Germany, France, Italy and Switzerland anticipating the lowest future returns in 2020. This is roughly in line with their 2019 predictions.

In the UK, investors’ hopes remain middle-of-the road. Their prediction for future annual returns rose from 9.3% in 2019 to 11.1% this year.

Is there a link between investors’ predictions and past financial returns?

The year 2019 was good for world stock markets in general, and that could in part explain investors’ overall increase in optimism in this year’s survey.

However, previous research based on Schroders’ Global Investor Study findings has unearthed no clear link between past market performance and hoped-for future returns.

The year 2018, for example, was broadly disappointing in world markets. But when polled in May 2019, savers’ predictions ranged between 15.8% at the top (Argentina) and 6.5% at the bottom (Belgium). In fact in 2019 there were only three countries, out of 32, where respondents’ hoped-for future returns had been exceeded by the actual returns generated in the previous 12 months. The conclusion was that investors’ hopes were unrealistic and potentially misplaced, and that “overall return expectations for the next five years exceed stock market returns achieved in nearly all countries over the past five years.”

Although historic stock market returns may be one factor influencing investors’ forecasts, interest rates and inflation in regional economies are also likely to play a part.

In both the 2019 and 2020 surveys, investors anticipating the highest returns tended to live in economies experiencing higher inflation and interest rates. These factors generally lead to higher nominal returns on cash and other savings.

In Europe and Japan, by contrast, far lower interest rates appear to have dampened savers’ expectations over the longer-term. The latest survey puts investors in Switzerland and Japan at the bottom of the forecast rankings. Interestingly both of these countries are experiencing some of the lowest interest rates in the world, with their respective central banks having cut rates below zero more than four years ago.

Rupert Rucker, Schroders’ Head of Income, said: “The power of this unique research is that with every successive year’s findings we get a clearer picture of what investors are hoping for, and further insights into what is driving their expectations.

“It’s extremely interesting that despite the impact of Covid-19 – and all of its dramatic effects on our lives and work – investors still have confidence in generating returns from their savings. You might say that some of these expectations are unrealistic. But you could also say that perhaps investors are realising that stock market returns are not the same as economic growth.

“We strongly believe that one of the prevailing future trends will be lower long-term interest rates, and this was our view well before the pandemic. Longer-term we think there will be more disruptive forces at play in markets and that it will become harder overall to find returns. But we have seen again and again in the years since the financial crisis that certain investments can deliver returns even in challenging environments.”

*MSCI WORLD fell 34% between 12 February and 23 March. **S&P500 rose 29.7% in 2019. Source: Refinitiv

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.