Investment slump amid higher interest rates risks finally sparking UK recession

A mix of factors are buffeting the UK economy right now. Spending power is being crushed by high inflation eroding family finances.

House prices are coming off their heady heights as sellers drop prices to source buyers amid higher mortgage rates.

External demand is thinning in response to weak consumer confidence amid a global cost of living crunch.

One area that’s yet to sag sharply is business investment, which may surprise many people – after all, it’s the area that lots of experts have tagged as a weak point of the British economy especially post-Brexit.

That uptick is all the more unexpected given the dire predictions about where economic growth was headed this year. Remember the Bank of England thought this year we’d slump into the longest recession in a century last November.

Yet, the early 2023 investment jump is a bit of a wolf in sheep’s clothing. It’s been driven by temporary factors that have endowed it with an artificial gloss.

Prime Minister Rishi Sunak’s super deduction – which allowed businesses to take off 130 per cent of the value of certain investments from their corporation tax liabilities – finished in March.

As analysts at Pantheon Macroeconomics put it: “The breakdown of the business investment data for Q1 suggests that investment was artificially boosted by businesses bringing forward planned spending in order to take advantage of the government’s super-deduction policy.”

A front-loading effect happened. Lots of firms scrambled to bag that tax break. You’d expect they won’t need to invest much more this quarter.

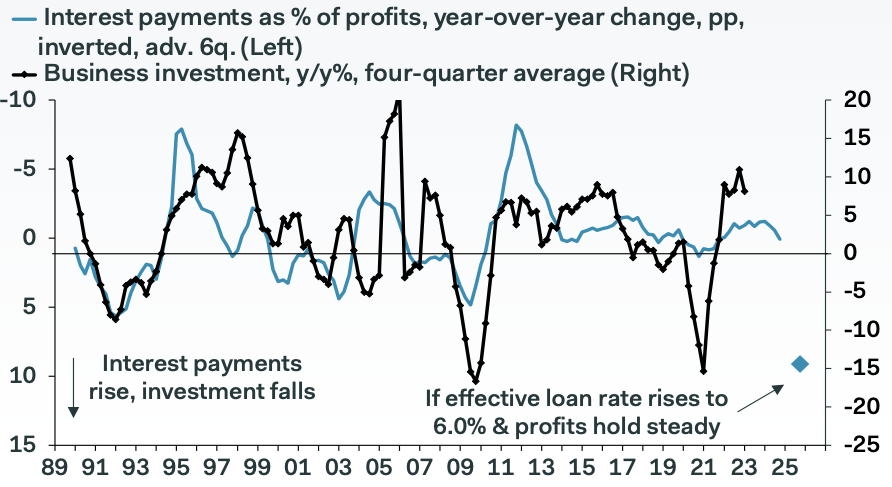

Business investment is highly sensitive to interest rate changes…

Chancellor Jeremy Hunt rightly recognised this cliff edge and tried to smooth it out by launching a less generous successor to the super-deduction.

From now on till April 2026, businesses can offset 100 per cent of certain capital spending from their profit tax bill.

That’s good policy as it uses the tax system to nudge businesses into behaviours that yield a greater benefit to the economy’s long-run health instead of prioritising short-term gain.

Whether it’ll be enough to prevent a big drop in investment spending is murky.

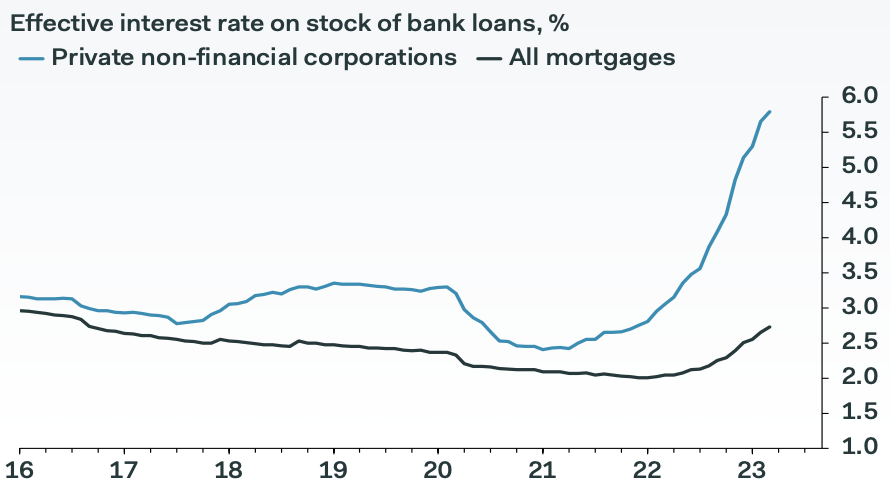

Higher interest rates are an absolute killer for business investment, especially when firms’ debts are structured around spot rates instead of being fixed and locked in over a long period. A huge chunk of corporate debt – about £8 in every £10 – in the UK operates this way.

That’ll make a lot of potential investment opportunities unviable, unless there’s a productivity miracle, which is a dead rubber in the UK’s case.

Yes, Britain is now tipped by the IMF to dodge a recession, though that call came before markets ratcheted up their peak interest rate expectations.

… and firms are grappling with big upward swings

The threat of a deeper slump is very much back on the table if Bank Governor Andrew Bailey and co meet market expectations, which would amplify businesses’ caution over how they manage their finances.

Repaying debt with any excess cash may be a greater priority than buying new IT equipment or moving to a new office.

Certain sectors are set to trim capital expenditure more than others. Real estate and manufacturing are highly sensitive to rate changes due to their end customers typically borrowing to fund spending.

Much has been made of the UK’s low growth problem since the 2008 financial crisis, and there is now a consensus behind its root cause: low productivity improvements primarily fuelled by poor private and public investment. For economy-wide investment, we rank second bottom in the OECD.

For the country to turn its fortunes around and aim for better growth and living standards, investment must turn on a pinhead and get motoring upwards. The chances of that happening any time soon though are slim.

Hunt’s decision to lay down full capital expensing will keep investment higher than it otherwise would’ve been.

But until inflation is finally killed, freeing the Bank to slash borrowing costs, business will probably tread water.

WHAT I’M READING

Recession seemingly all round for the world’s most advanced economies, according to a fresh set of forecasts out from investment bank Deutsche Bank to kick off this week. The global economic slowdown will be spearheaded by the US finally succumbing to the Federal Reserve’s aggressive interest rate hikes. The globe’s largest economy is on course for the first central bank-engineered recession in four decades, Deutsche Bank reckon. They’ve also cut German GDP growth this year to minus 0.3 per cent.

YOU MIGHT HAVE MISSED

Inflationary pressures are still hiding in the UK economy. Latest purchasing managers’ indexes from S&P Global and the Chartered Institute of Procurement and Supply have signalled costs keep on rising for services firms, mainly driven by higher wages, the pair say. Wage growth is still lagging inflation, mind.